Get the free ACOM160 Fidelity Guarantee Insurance Proposal ACOM160 Fidelity Guarantee Insurance P...

Show details

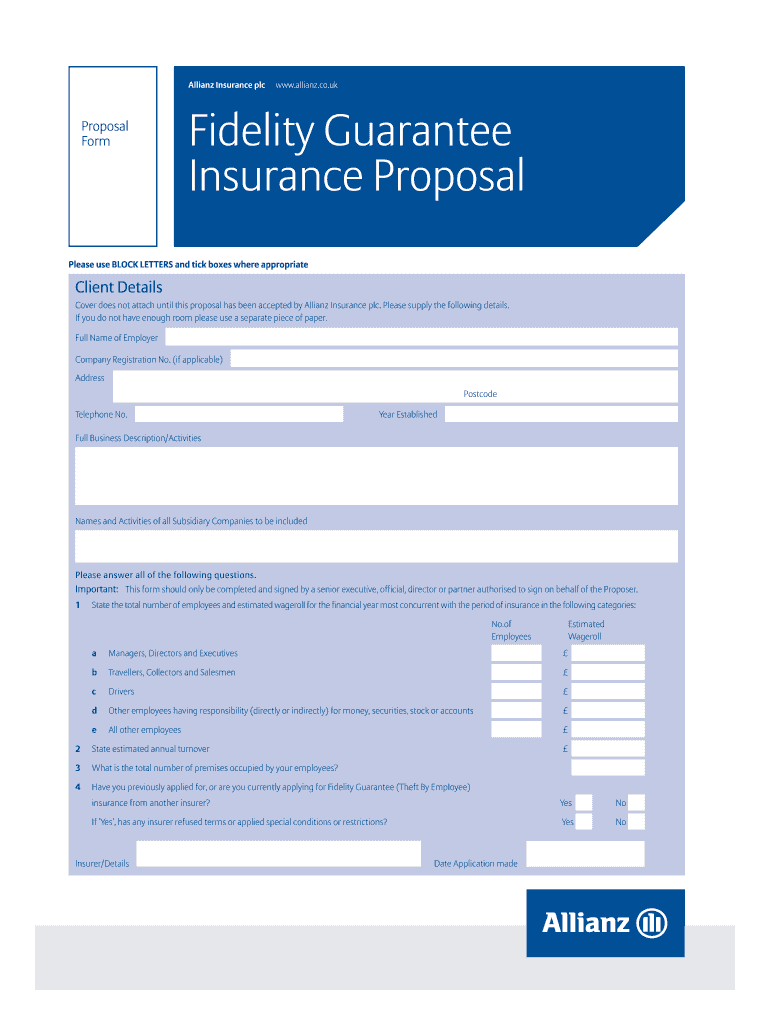

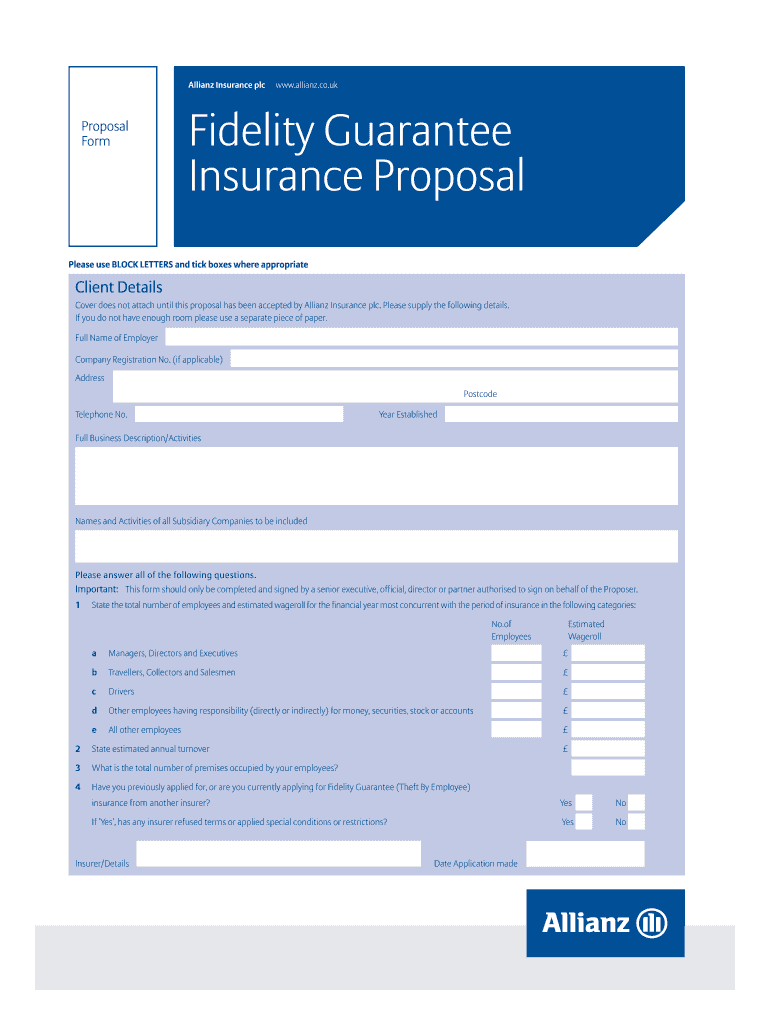

ACOM1606 FidelityGaPro Layout 1 07/11/2013 13:36-Page 1 Allianz Insurance plc Proposal Form www.allianz.co.uk Fidelity Guarantee Insurance Proposal Please use BLOCK LETTERS and tick boxes where appropriate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign acom160 fidelity guarantee insurance

Edit your acom160 fidelity guarantee insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your acom160 fidelity guarantee insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit acom160 fidelity guarantee insurance online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit acom160 fidelity guarantee insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out acom160 fidelity guarantee insurance

How to fill out acom160 fidelity guarantee insurance:

01

Begin by gathering all the necessary information about your business, such as its name, address, and contact details. You will also need to provide details about the nature of your business operations.

02

Carefully read through the acom160 fidelity guarantee insurance application form. Make sure you understand all the terms and conditions mentioned in the policy.

03

Provide accurate and complete information about your employees, including their names, positions, and roles within the company. This is crucial as the fidelity guarantee insurance covers any losses caused by dishonest actions of your employees.

04

Determine the coverage amount you require based on your business's financial activities and potential exposure to risks. The coverage amount should be sufficient to cover any potential losses.

05

Fill out the application form by providing the required information, ensuring that all the details are accurate and up-to-date. Double-check your entries to avoid any mistakes that could invalidate the insurance coverage.

06

Review the completed application form to ensure all the necessary sections have been filled out correctly. If you have any doubts or questions, don't hesitate to reach out to the insurance provider for clarification.

07

Once you are satisfied with the accuracy and completeness of the application form, sign and date it. Make a copy of the filled-out form for your records.

08

Submit the completed application form along with any required supporting documents to the insurance provider. Follow the designated submission process specified by the provider, whether it be online or through physical mail.

09

Pay the applicable premium for the fidelity guarantee insurance policy. The premium amount will depend on various factors, including the coverage amount, nature of your business, and the level of risk associated with your operations.

10

Keep a copy of the policy document and other relevant documents in a safe place for future reference.

Who needs acom160 fidelity guarantee insurance?

01

Businesses that handle large amounts of cash transactions, such as banks, financial institutions, and retail stores, may benefit from acom160 fidelity guarantee insurance. It provides protection against losses caused by dishonest acts committed by employees.

02

Companies that employ individuals in positions of trust, such as accountants, bookkeepers, or cashiers, should consider obtaining acom160 fidelity guarantee insurance. This coverage helps safeguard against any financial loss resulting from fraudulent actions performed by these trusted employees.

03

Organizations that deal with valuable assets, sensitive information, or confidential data, such as data centers, warehouses, or security firms, can also benefit from acom160 fidelity guarantee insurance. It offers protection in the event of theft or misappropriation of assets by employees.

04

Any business, regardless of its size or industry, that wants to mitigate the financial risks associated with employee dishonesty should consider obtaining acom160 fidelity guarantee insurance. It provides an added layer of financial protection and peace of mind for business owners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is acom160 fidelity guarantee insurance?

acom160 fidelity guarantee insurance is a type of insurance that protects a company from financial losses due to dishonest acts committed by its employees.

Who is required to file acom160 fidelity guarantee insurance?

Companies or businesses that want to protect themselves from losses caused by employee fraud or dishonesty are required to file acom160 fidelity guarantee insurance.

How to fill out acom160 fidelity guarantee insurance?

To fill out acom160 fidelity guarantee insurance, the company must provide information about the coverage needed, the number of employees to be covered, and any relevant financial details.

What is the purpose of acom160 fidelity guarantee insurance?

The purpose of acom160 fidelity guarantee insurance is to protect companies from financial losses caused by fraudulent or dishonest acts committed by their employees.

What information must be reported on acom160 fidelity guarantee insurance?

Information such as the company's name, address, number of employees, coverage amount, premiums paid, and any previous claims must be reported on acom160 fidelity guarantee insurance.

How can I get acom160 fidelity guarantee insurance?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the acom160 fidelity guarantee insurance in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the acom160 fidelity guarantee insurance in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your acom160 fidelity guarantee insurance and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit acom160 fidelity guarantee insurance on an iOS device?

Create, modify, and share acom160 fidelity guarantee insurance using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your acom160 fidelity guarantee insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

acom160 Fidelity Guarantee Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.