Get the free Insurance Premium Finance Application - disb - The District of ... - disb dc

Show details

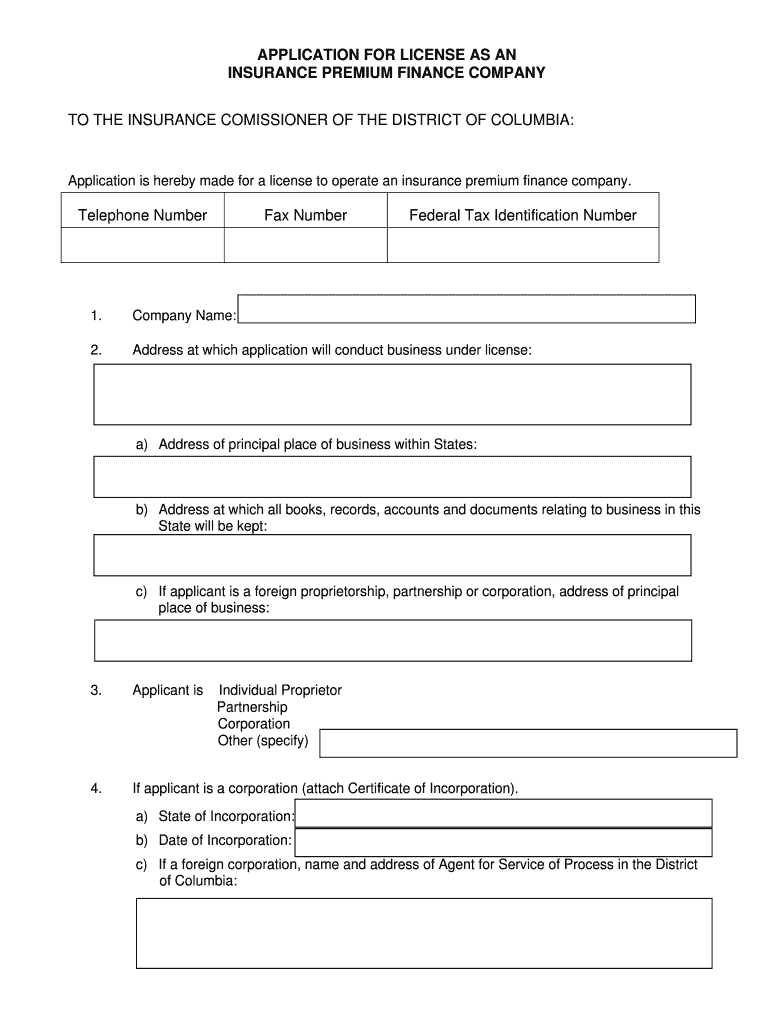

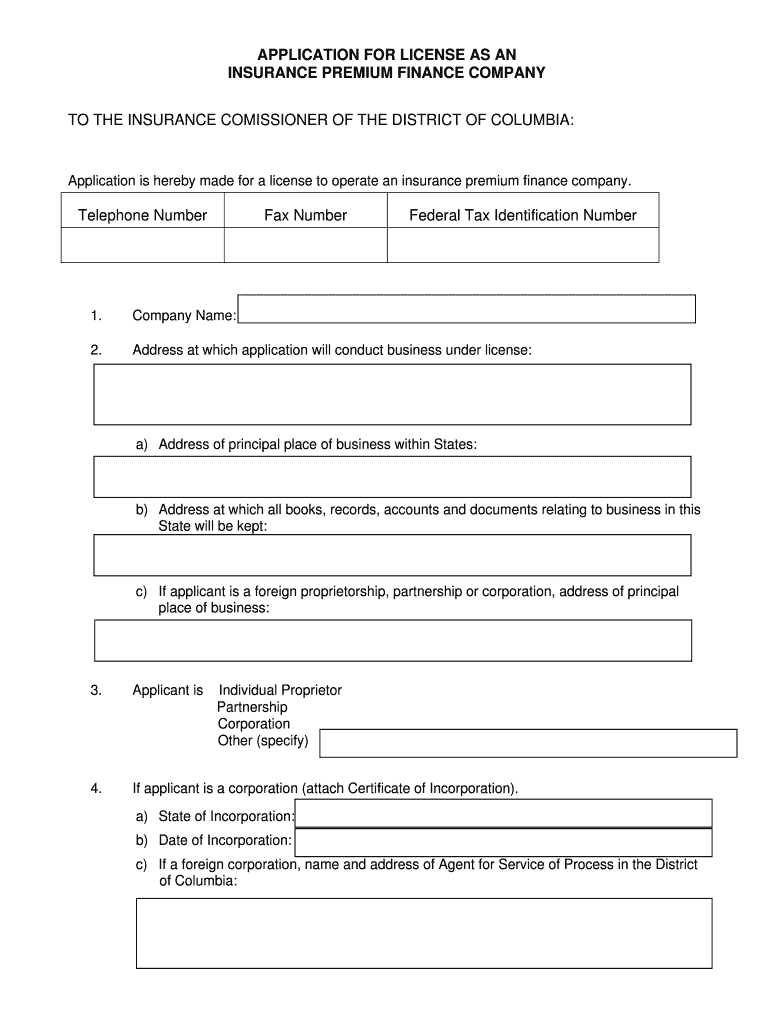

Government of the District of Columbia Department of Insurance, Securities and Banking Premium Finance Company License Instructions Complete and return the license application form with the required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance premium finance application

Edit your insurance premium finance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance premium finance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance premium finance application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit insurance premium finance application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance premium finance application

How to fill out an insurance premium finance application:

01

Begin by gathering all necessary information. This may include your personal details such as name, address, contact information, and social security number. You will also need information about the insurance policy you wish to finance, such as the policy number, coverage details, and premium amount.

02

Carefully read through the application form. Understand the questions asked and the information required for each section. Make sure to provide accurate and complete information to avoid any delays or complications in the financing process.

03

Start filling out the application form systematically. Begin with your personal details, providing the requested information accurately. Ensure that you double-check the details before moving on to the next section.

04

Proceed to input the details regarding the insurance policy you want to finance. Enter the policy number, the name of the insurance company, and other relevant insurance information as required. Additionally, provide the premium amount you wish to finance and the desired payment terms.

05

If there are any co-applicants or additional insured parties, provide their information as requested in the application form. This may include their personal details, relationship to the main applicant, and any additional documentation that may be required.

06

Carefully review the completed application form for any errors or missing information. It is crucial to ensure all sections are properly filled out to avoid delays or potential rejection of the financing application.

Who needs insurance premium finance application:

01

Individuals who want to manage cash flow: Insurance premium finance allows individuals to spread out the cost of insurance premiums over time. This is particularly useful for those who prefer to manage their cash flow more efficiently, as they can avoid paying the entire premium amount upfront.

02

Small business owners: Small businesses often face budget constraints and fluctuations in cash flow. Opting for premium financing can help alleviate the financial burden by allowing business owners to pay their insurance premiums in installments rather than a lump sum. This can contribute to better cash flow management and allow businesses to allocate funds for other essential needs.

03

Individuals and businesses with multiple insurance policies: Managing and paying for multiple insurance policies simultaneously can be challenging. Premium financing provides a convenient solution by consolidating the payments into a single monthly installment, making it easier to keep track of and manage insurance expenses.

04

Those seeking flexibility in payment terms: Insurance premium financing offers flexibility in choosing the payment terms that best suit individual or business needs. Depending on the provider, applicants can select from a range of payment options, such as monthly, quarterly, or semi-annually, to personalize their repayment schedule.

05

People with large insurance premiums: Some insurance policies, such as life insurance policies with significant coverage, may come with high premium amounts. For individuals who may not have the immediate cash resources to cover these costs, premium financing can provide a practical solution to spread out the payments over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is insurance premium finance application?

Insurance premium finance application is a process of financing insurance premiums through a third-party lender.

Who is required to file insurance premium finance application?

Insurance policyholders who are looking to finance their insurance premiums.

How to fill out insurance premium finance application?

To fill out an insurance premium finance application, the policyholder needs to provide personal and financial information, details about the insurance policy, and agree to the terms of the financing agreement.

What is the purpose of insurance premium finance application?

The purpose of insurance premium finance application is to help policyholders spread out the cost of their insurance premiums over a period of time by securing a loan from a financing company.

What information must be reported on insurance premium finance application?

The information required on an insurance premium finance application includes personal details, financial information, insurance policy details, and agreement to the terms of the financing agreement.

How can I modify insurance premium finance application without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your insurance premium finance application into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the insurance premium finance application electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your insurance premium finance application.

How can I edit insurance premium finance application on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing insurance premium finance application, you can start right away.

Fill out your insurance premium finance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Premium Finance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.