Get the free Letter of Indemnity for Packing Loan - The Bank of East Asia

Show details

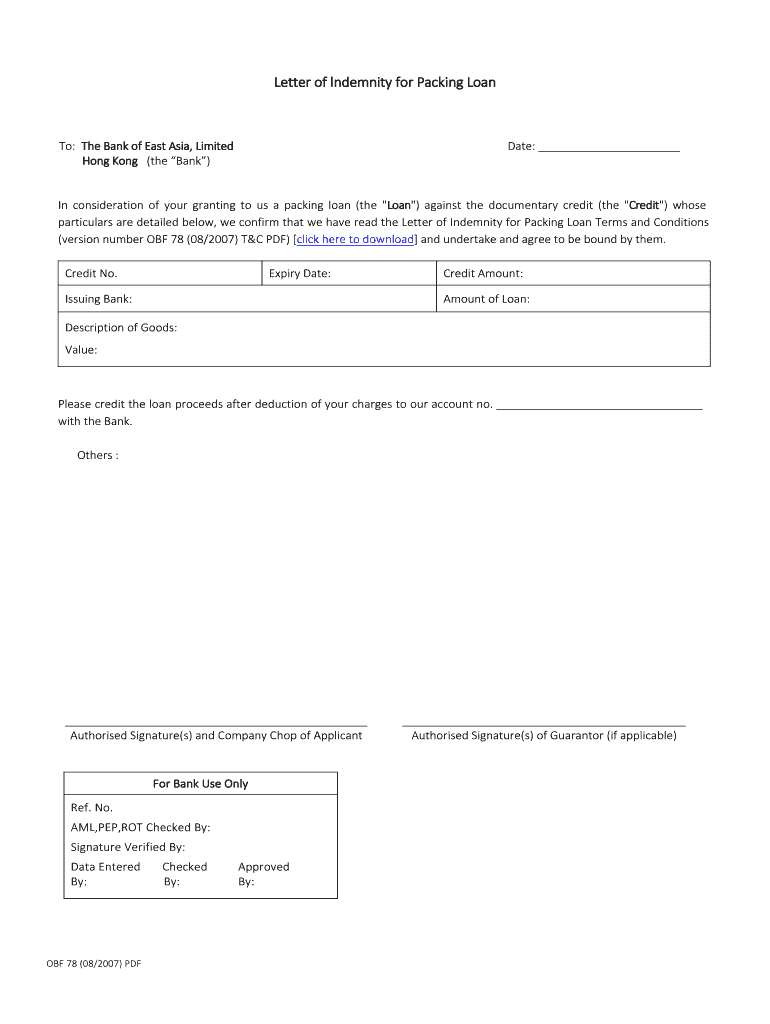

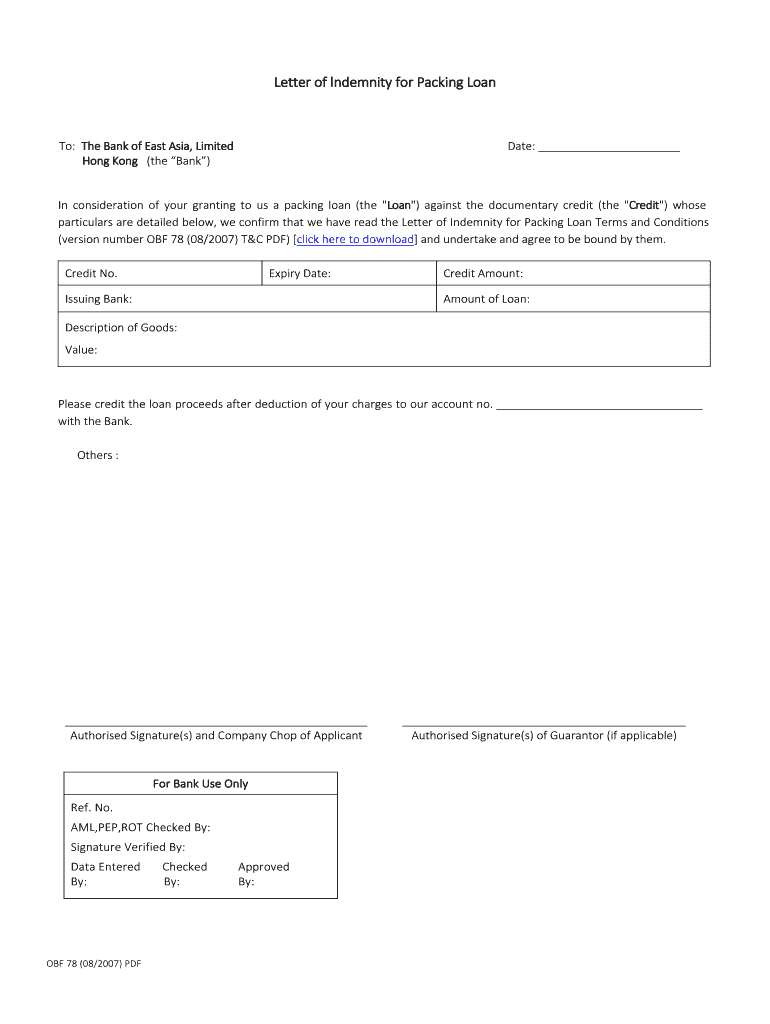

Letter of indemnity for Packing Loan To: The Bank of East Asia, Limited Hong Kong (the Bank) Date: In consideration of your granting to us a packing loan (the Loan “) against the documentary credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letter of indemnity for

Edit your letter of indemnity for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letter of indemnity for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing letter of indemnity for online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit letter of indemnity for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letter of indemnity for

How to Fill Out a Letter of Indemnity:

01

Begin by writing the date at the top right corner of the letter.

02

Include your full name, address, and contact information as the sender of the letter. This information should be placed below the date.

03

Next, write the recipient's name, address, and contact information on the left side of the page below your information.

04

Add a subject line that clearly states the purpose of the letter, such as "Letter of Indemnity."

05

Start the body of the letter by addressing the recipient formally, using their title and last name.

06

Introduce yourself and provide any necessary background information to create context for the letter.

07

Clearly state the reason for issuing the letter of indemnity and explain the specific circumstances under which the indemnity is being provided.

08

Outline any terms and conditions related to the indemnity, including specific actions or responsibilities that the recipient should undertake to ensure compliance.

09

Mention any supporting documents or evidence that are being included in the letter, if applicable.

10

Specify the duration or validity period of the indemnity, if there is one.

11

Offer to provide further assistance or clarification if needed and include your contact information again.

12

Close the letter by thanking the recipient for their attention and consideration.

13

Use a professional closing, such as "Sincerely" or "Best regards," followed by your full name and signature.

14

Make copies of the letter for your own records and send the original to the recipient via certified mail or another secure method.

Who Needs a Letter of Indemnity?

01

Companies or individuals engaging in potentially risky activities or transactions may require a letter of indemnity.

02

Businesses entering into contracts or agreements with other parties may request a letter of indemnity to protect themselves from potential losses or liabilities.

03

Shipping companies often require a letter of indemnity to ensure that they will not be held responsible for any damages or losses that may occur during transit.

04

Lenders may ask borrowers for a letter of indemnity to provide additional assurance that the loan will be repaid, especially in cases where collateral is involved.

05

Insurance companies may issue letters of indemnity to policyholders to outline the terms and conditions under which claims will be paid out.

Overall, a letter of indemnity is an important legal document that helps protect parties from potential losses or liabilities in various situations. By following the steps mentioned above, you can ensure that the letter is properly filled out and serves its intended purpose.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is letter of indemnity for?

The letter of indemnity is a legal document that ensures one party will be financially compensated for any losses or damages incurred by another party.

Who is required to file letter of indemnity for?

The letter of indemnity may be required to be filed by parties involved in a transaction where there is a risk of financial loss.

How to fill out letter of indemnity for?

The letter of indemnity should be filled out with specific details of the transaction and signed by all relevant parties.

What is the purpose of letter of indemnity for?

The purpose of the letter of indemnity is to provide financial protection in case of any unforeseen events that result in financial loss.

What information must be reported on letter of indemnity for?

The letter of indemnity should include details of the transaction, the parties involved, the amount of financial protection required, and any other relevant information.

What is the penalty for late filing of letter of indemnity for?

The penalty for the late filing of the letter of indemnity may vary depending on the terms of the agreement, but it could result in financial consequences or legal action.

How can I modify letter of indemnity for without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your letter of indemnity for into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute letter of indemnity for online?

pdfFiller has made it simple to fill out and eSign letter of indemnity for. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit letter of indemnity for on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing letter of indemnity for right away.

Fill out your letter of indemnity for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letter Of Indemnity For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.