Get the free Buying a mutual fund is a lot like going in on a group gift or joining a co-op--with...

Show details

What is a Mutual Fund? Buying a mutual fund is a lot like going in on a group gift or joining a coop with people you'll never meet. Mutual funds allow a group of investors to combine their cash and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign buying a mutual fund

Edit your buying a mutual fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your buying a mutual fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing buying a mutual fund online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit buying a mutual fund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

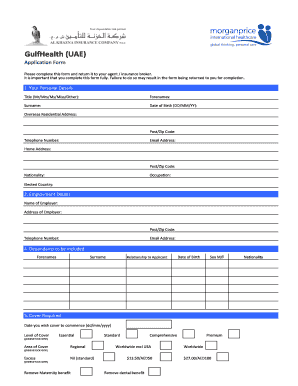

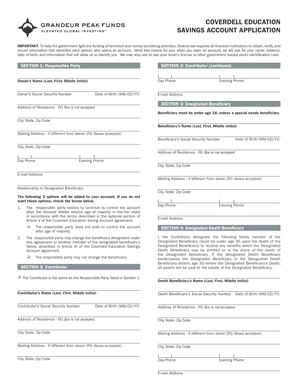

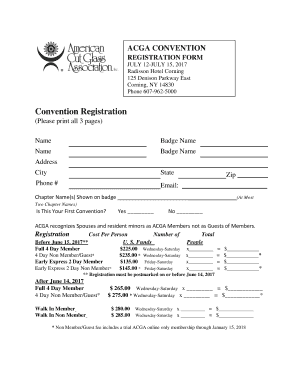

How to fill out buying a mutual fund

How to fill out buying a mutual fund?

01

Research and understand mutual funds: Start by educating yourself about mutual funds. Learn about the different types, risks, and potential returns associated with mutual funds. This will help you make an informed decision while filling out the application.

02

Define your investment goals: Before filling out the application, clearly define your investment goals. Determine your risk tolerance, time horizon, and desired outcome. This will help you select the right mutual fund that aligns with your objectives.

03

Choose a mutual fund: Explore different mutual fund options available to you. Look at factors such as past performance, fees, investment strategy, and the fund manager's track record. Select a mutual fund that suits your investment goals and preferences.

04

Gather necessary information: When filling out the application, you will need certain information like your social security number, contact details, and financial information such as your employment and income details. Ensure you have all the necessary information and documents handy.

05

Fill out the application form: Carefully read the application form and provide accurate information. Double-check all the details before submitting the form to avoid any errors or delays in the buying process.

06

Choose the investment amount: Decide how much money you want to invest in the mutual fund. You may have to provide information on the investment amount or deposit with the application. Consider your financial situation and investment goals while determining the investment amount.

07

Select the purchase method: Determine how you would like to purchase the mutual fund – whether it's through a financial advisor, an online brokerage account, or directly from the mutual fund company. Each option may have its own requirements and processes.

Who needs buying a mutual fund?

01

Investors seeking diversification: Mutual funds provide investors with access to a diversified portfolio of assets. By pooling money from various investors, mutual funds invest in a wide range of securities, offering diversification benefits and reducing the risk associated with investing in a single security.

02

Individuals looking for professional management: Mutual funds are managed by professional fund managers who conduct research, make investment decisions, and monitor the fund's performance. This is beneficial for individuals who do not have the time, expertise, or desire to manage their own investments actively.

03

Investors with different risk profiles: Mutual funds come in various types, catering to different risk profiles. From conservative bond funds to aggressive growth funds, there is a mutual fund available for every investor's risk tolerance. This makes it suitable for both conservative and aggressive investors alike.

04

Individuals seeking convenience: Buying a mutual fund is relatively straightforward, with the option of automatic investments and reinvestments. Once you have selected a mutual fund, you can set up recurring investments or opt for automatic reinvestment of dividends, making it a convenient investment option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send buying a mutual fund for eSignature?

Once your buying a mutual fund is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit buying a mutual fund on an iOS device?

You certainly can. You can quickly edit, distribute, and sign buying a mutual fund on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete buying a mutual fund on an Android device?

Use the pdfFiller app for Android to finish your buying a mutual fund. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is buying a mutual fund?

Buying a mutual fund involves purchasing shares in a professionally managed investment fund that pools money from multiple investors to invest in stocks, bonds, or other securities.

Who is required to file buying a mutual fund?

Individuals or entities that purchase shares in a mutual fund are required to report the purchase when filing their taxes.

How to fill out buying a mutual fund?

To fill out buying a mutual fund on your taxes, you will typically need to report the amount invested, any dividends or capital gains received, and any sales of shares during the tax year.

What is the purpose of buying a mutual fund?

The purpose of buying a mutual fund is to provide diversification, professional management, and convenience for individual investors who may not have the time or expertise to manage a portfolio of individual securities.

What information must be reported on buying a mutual fund?

When buying a mutual fund, you must report the amount invested, any dividends or capital gains received, and any sales of shares during the tax year.

Fill out your buying a mutual fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Buying A Mutual Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.