Get the free Reinstatement Directions Foreign Entities

Show details

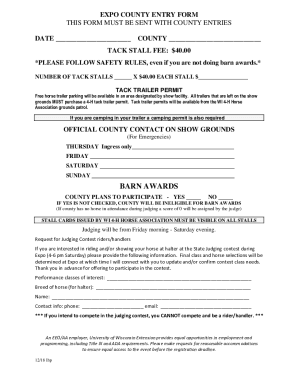

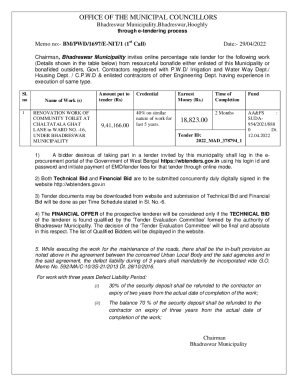

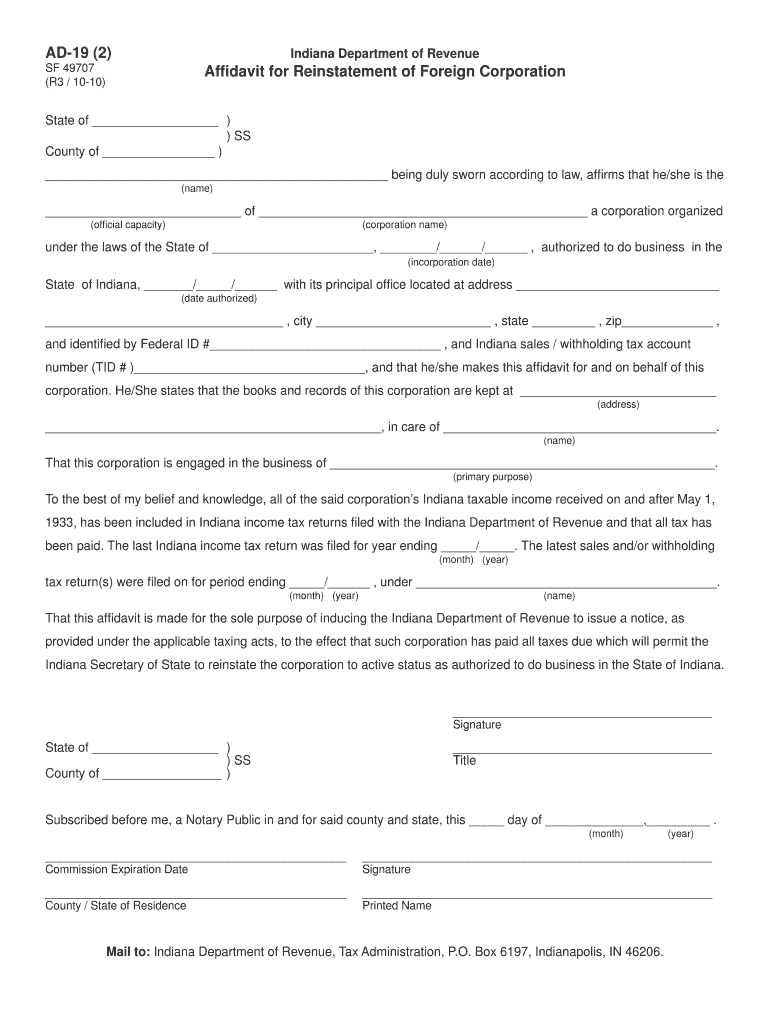

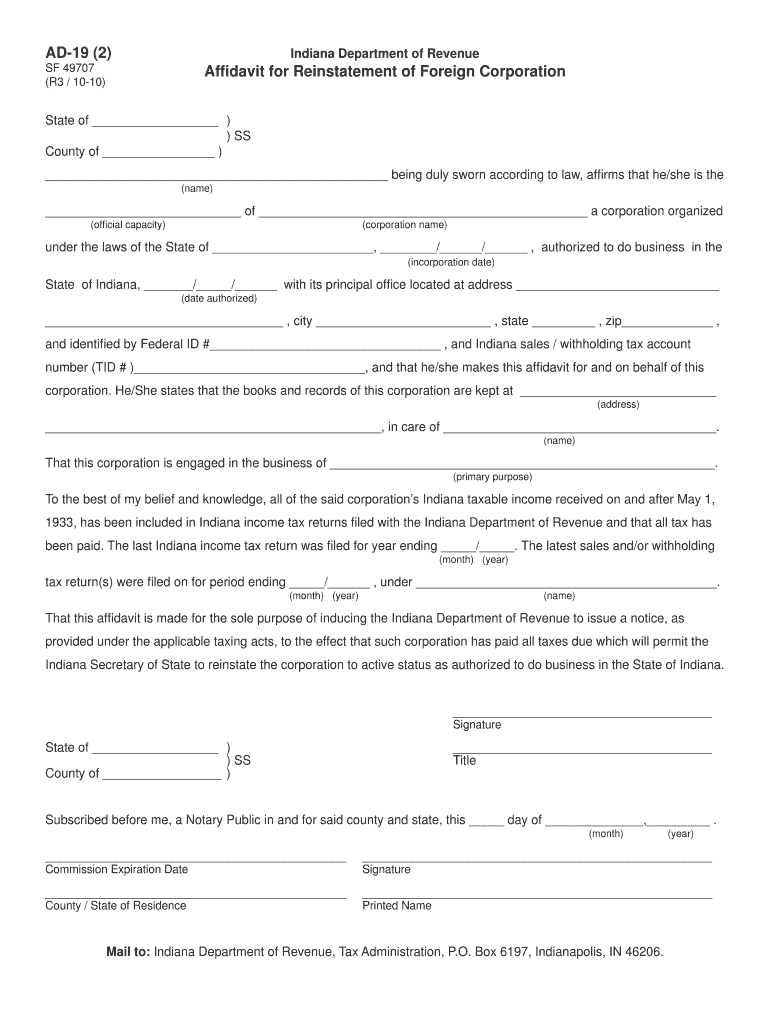

Reset Form REINSTATEMENT DIRECTIONS FOREIGN ENTITIES The following steps must be taken to reinstate your corporation or limited liability company when it has been revoked* Please direct any questions to our information line at 317 232-6576 or visit our website at www. IN*gov/sos. STEP 1 Obtain a Certificate of Clearance from the Indiana Department of Revenue by completing the AD19 Reinstatement Affidavit and ROC-1 Responsible Officer Information forms. This must be completed before anything...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reinstatement directions foreign entities

Edit your reinstatement directions foreign entities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reinstatement directions foreign entities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reinstatement directions foreign entities online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit reinstatement directions foreign entities. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reinstatement directions foreign entities

How to fill out Reinstatement Directions Foreign Entities

01

Gather all necessary documentation related to the foreign entity's registration.

02

Obtain the Reinstatement Directions form from the relevant government authority or their website.

03

Fill out the entity's details including the name, registration number, and jurisdiction.

04

Provide reasons for reinstatement if required by the form.

05

Include any supporting documents that may be necessary for the reinstatement process.

06

Pay any required fees associated with the filing of the reinstatement application.

07

Review the completed form for accuracy and completeness.

08

Submit the completed form and documentation to the appropriate government office.

Who needs Reinstatement Directions Foreign Entities?

01

Foreign entities that have been administratively dissolved or revoked and wish to resume business operations.

02

Companies seeking to restore their good standing in the jurisdiction they were initially registered.

Fill

form

: Try Risk Free

People Also Ask about

How do I reinstate my LLC in Indiana?

Obtaining a Certificate of Clearance Submit an Affidavit for Reinstatement (AD-19) and a Responsible Officer Information form (ROC-1) to the. Indiana Department of Revenue. Wait for the Certificate of Clearance to be mailed to you by the Department of Revenue. Process an Application for Reinstatement through INBiz.

Can you reactivate an inactive LLC?

LLC reinstatement refers to the process of reactivating a dissolved or inactive limited liability company. The process commonly consists of submitting forms and fees to the state. Reactivating the entity brings its business into action, maintains its legal status, and protects its assets from personal liability.

Should I reinstate my LLC or start a new one?

Assets and Liabilities Does your old LLC has valuable assets or liabilities that you want to either retain or address? Then reinstating the LLC may be the better option. Starting a new LLC would mean leaving behind any assets or liabilities associated with the old one.

What does reinstatement mean in business?

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority. Reinstatement is the action taken that restores an administratively dissolved business entity's rights, powers, and authority.

How to reinstate a dissolved LLC in Indiana?

Obtaining a Certificate of Clearance Submit an Affidavit for Reinstatement (AD-19) and a Responsible Officer Information form (ROC-1) to the. Indiana Department of Revenue. Wait for the Certificate of Clearance to be mailed to you by the Department of Revenue. Process an Application for Reinstatement through INBiz.

What does it mean to reinstate an LLC?

Reinstating a business or nonprofit restores the entity to good standing. Reinstating an entity begins with resolving the underlying reason(s) the state deems the entity not in "good standing". The most common reasons are failing to file a Secretary of State annual report and failing to pay taxes.

How much does it cost to reinstate an LLC in Indiana?

Filing fees – The filing fees consists of all fees owed for Business Entity Reports plus the reinstatement fee of $30.00. For help determining the correct fees, call the information line at (317) 232-6576.

What is the yearly fee for an LLC in Indiana?

Initial and Annual Fees for LLCs StateFiling FeeAnnual Fee Indiana LLC $100 $50 Iowa LLC $50 $45 paper, $30 online, Kansas LLC $165 paper, $160 online $110 paper, $100 online Kentucky LLC $40 $1549 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Reinstatement Directions Foreign Entities?

Reinstatement Directions Foreign Entities refers to the process by which foreign entities that have previously been dissolved or forfeited can restore their status to active standing within a jurisdiction by complying with specific legal requirements.

Who is required to file Reinstatement Directions Foreign Entities?

Foreign entities that have been dissolved or forfeited in a jurisdiction and wish to resume their business operations in that jurisdiction are required to file Reinstatement Directions Foreign Entities.

How to fill out Reinstatement Directions Foreign Entities?

To fill out Reinstatement Directions Foreign Entities, a representative of the foreign entity must complete the necessary forms specified by the jurisdiction, providing required information such as the entity's name, the reason for reinstatement, and any outstanding fees or taxes owed.

What is the purpose of Reinstatement Directions Foreign Entities?

The purpose of Reinstatement Directions Foreign Entities is to allow foreign entities to legally reestablish their status and continue business operations after being dissolved or forfeited, ensuring compliance with state laws and regulations.

What information must be reported on Reinstatement Directions Foreign Entities?

The information that must be reported includes the foreign entity's name, registration number, the reason for reinstatement, contact information for the entity, and any outstanding obligations such as unpaid fees or taxes.

Fill out your reinstatement directions foreign entities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reinstatement Directions Foreign Entities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.