Get the free Duty stamp not needed - unibz

Show details

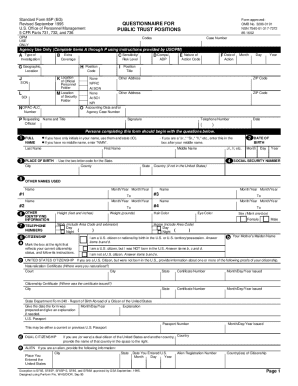

Duty stamp not needed (Authorized by Tax Office Local Head office A Dozen/Bolzano No. 2012/84597 of 20.12.2012) APPLICATION FOR THE RECOGNITION OF A FOREIGN ACADEMIC QUALIFICATION TO THE RECTOR OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign duty stamp not needed

Edit your duty stamp not needed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your duty stamp not needed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit duty stamp not needed online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit duty stamp not needed. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out duty stamp not needed

How to Fill Out Duty Stamp Not Needed:

01

Determine if duty stamp is required: Before filling out the duty stamp, check whether it is necessary for your specific situation. This may depend on the nature of the document or transaction you are dealing with.

02

Consult relevant regulations or authorities: If you are unsure whether the duty stamp is needed or not, refer to the applicable regulations or authorities. They will provide detailed instructions on when a duty stamp is required and when it is not.

03

Verify exemption criteria: In some cases, certain individuals or entities may be exempted from using duty stamps. Familiarize yourself with the exemption criteria and ensure that you meet the necessary requirements. If you qualify for an exemption, proceed with filling out the document accordingly.

04

Obtain the necessary form or document: If duty stamp is not required, you may still need to fill out a specific form or document to indicate that the stamp is not needed. Obtain the appropriate form from the relevant authority or organization.

05

Provide accurate information: When filling out the form or document, ensure that all the required information is accurately provided. This may include personal or business details, transaction information, and any relevant supporting documents.

Who Needs Duty Stamp Not Needed:

01

Individuals exempted by law: Some individuals may be exempted from using a duty stamp based on certain legal provisions. This could include government officials, diplomats, or specific categories of individuals as determined by the law.

02

Non-profit organizations: In certain jurisdictions, non-profit organizations or charities may be eligible for exemption from duty stamp obligations. This allows them to carry out their activities without the burden of additional fees or paperwork.

03

Government entities: Government entities, departments, or agencies may be exempted from using a duty stamp for internal transactions or official documentations. This is typically done to streamline processes and reduce administrative burdens.

04

Specific types of transactions: Certain types of transactions may be exempted from duty stamp requirements based on their nature or purpose. For example, if a transaction involves an inheritance, gift, or transfer of ownership within the family, a duty stamp may not be needed.

05

Other exceptions: Depending on the jurisdiction, there may be additional exceptions or specific situations where a duty stamp is not required. These exceptions are typically outlined in the relevant laws or regulations governing duty stamp obligations. It is important to consult the specific laws of your jurisdiction to determine if you fall under any exemptions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is duty stamp not needed?

Duty stamp not needed is a declaration that certain goods do not require a duty stamp to be affixed before they can be imported or exported.

Who is required to file duty stamp not needed?

Importers or exporters who have goods that are exempt from duty stamp requirements.

How to fill out duty stamp not needed?

The importer or exporter must complete a form declaring that the goods in question do not require a duty stamp.

What is the purpose of duty stamp not needed?

The purpose of duty stamp not needed is to provide a streamlined process for goods that are exempt from duty stamp requirements.

What information must be reported on duty stamp not needed?

The form for duty stamp not needed must include details about the goods being imported or exported, the reason they are exempt from duty stamp requirements, and the signature of the importer or exporter.

How can I modify duty stamp not needed without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including duty stamp not needed, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete duty stamp not needed online?

Filling out and eSigning duty stamp not needed is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out duty stamp not needed on an Android device?

Use the pdfFiller mobile app to complete your duty stamp not needed on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your duty stamp not needed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Duty Stamp Not Needed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.