Get the free Recurring Deposits Plan - HDFC

Show details

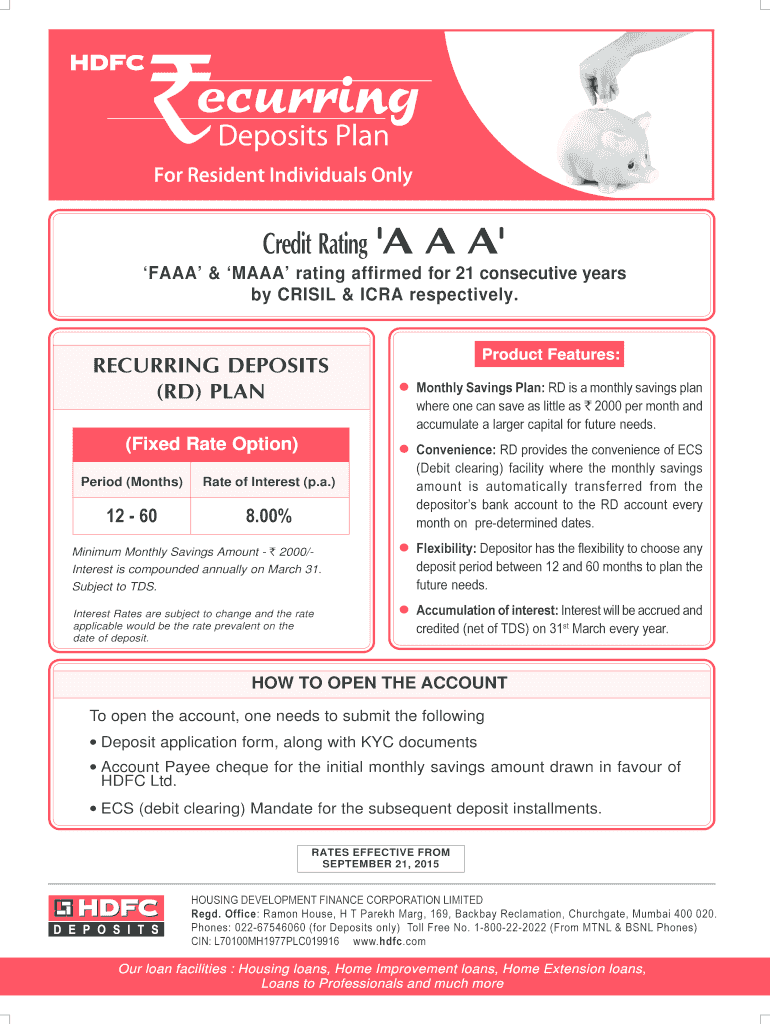

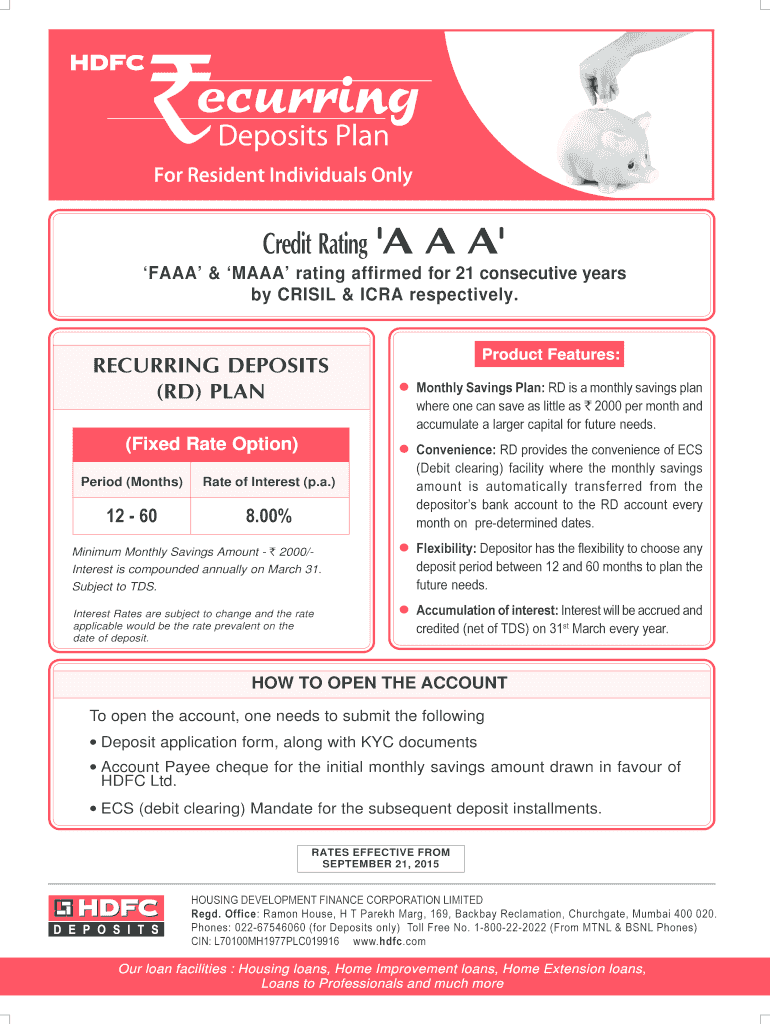

Credit Rating 'A A A' AAA & MAYA rating affirmed for 21 consecutive years by CRISIS & ICRA respectively. RECURRING DEPOSITS (RD) PLAN (Fixed Rate Option) Period (Months) Rate of Interest (p.a.) 12

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign recurring deposits plan

Edit your recurring deposits plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your recurring deposits plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit recurring deposits plan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit recurring deposits plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out recurring deposits plan

How to fill out a recurring deposits plan:

01

Determine the frequency and amount: Decide how often you want to make deposits and the amount you plan to deposit each time. This could be weekly, monthly, or at any other interval that suits your financial goals.

02

Choose the account: Research banks or financial institutions that offer recurring deposits plans. Consider factors such as interest rates, fees, and customer reviews before selecting the account that suits you best.

03

Open the account: Contact the chosen bank or financial institution and inquire about opening a recurring deposits plan. They will guide you through the process and provide the necessary paperwork, which may include an application form and proof of identification.

04

Provide necessary documentation: Fill out the application form accurately and attach any required documents, such as identification proof, address proof, and bank statements. Make sure to fulfill any additional requirements requested by the bank.

05

Set up automatic payments: To ensure regular deposits, set up automatic payments from your primary bank account to the recurring deposits account. This will make it convenient and save you the hassle of remembering to make manual payments.

06

Review and confirm: Before finalizing the plan, review all the details, such as the interest rate, deposit tenure, and any penalties for early withdrawal. Once satisfied, confirm your agreement with the bank or financial institution.

07

Monitor and manage the plan: Keep track of your deposits and regularly monitor the progress of your recurring deposits plan. This will help you stay on track towards achieving your savings goals.

Who needs a recurring deposits plan:

01

Individuals looking to save money: Recurring deposits plans are an excellent savings tool for individuals who wish to put aside a fixed amount of money regularly. It helps inculcate a habit of disciplined savings and can be useful for various purposes, such as emergency funds or future expenses.

02

People with specific financial goals: Whether you have a short-term goal, such as saving for a vacation, or a long-term goal, such as buying a house, a recurring deposits plan can aid you in achieving those objectives. It allows you to accumulate funds gradually with the added benefit of earning interest.

03

Individuals seeking to earn interest: Unlike regular savings accounts, recurring deposits plans often offer higher interest rates. If you want to earn interest on your savings consistently, a recurring deposits plan can be a viable option to explore.

04

Those who prefer lower risk options: Recurring deposits plans are considered to be relatively safe as they are offered by banks and financial institutions. If you prefer a low-risk investment option and want to avoid market fluctuations, a recurring deposits plan can be a suitable choice.

05

Individuals seeking financial discipline: The systematic nature of recurring deposits plans helps individuals cultivate a habit of regular saving. It encourages financial discipline and can be beneficial for those who struggle with impulsive spending or lack a structured approach to saving.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is recurring deposits plan?

Recurring deposits plan is a savings plan where a fixed amount is deposited regularly to accumulate a sum of money over a period of time. Interest is earned on the deposits made.

Who is required to file recurring deposits plan?

Any individual or entity that has a recurring deposits plan with a financial institution is required to file the plan.

How to fill out recurring deposits plan?

To fill out recurring deposits plan, one must provide personal details, deposit amount, frequency of deposits, and duration of the plan.

What is the purpose of recurring deposits plan?

The purpose of recurring deposits plan is to encourage regular savings and to earn interest on the deposited amount.

What information must be reported on recurring deposits plan?

The information to be reported on recurring deposits plan includes personal details, deposit amount, frequency of deposits, duration of the plan, and interest earned.

How do I complete recurring deposits plan online?

pdfFiller has made it simple to fill out and eSign recurring deposits plan. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in recurring deposits plan?

The editing procedure is simple with pdfFiller. Open your recurring deposits plan in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out recurring deposits plan on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your recurring deposits plan by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your recurring deposits plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Recurring Deposits Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.