Get the free Tax Collection Policy - Town of Pictou - townofpictou

Show details

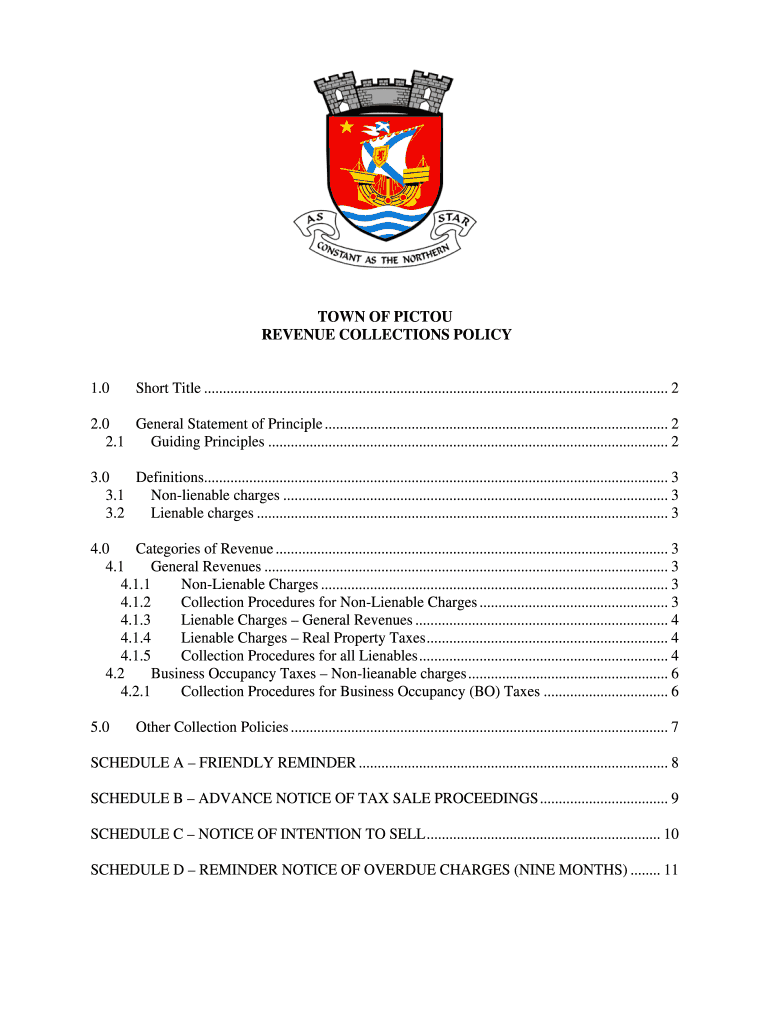

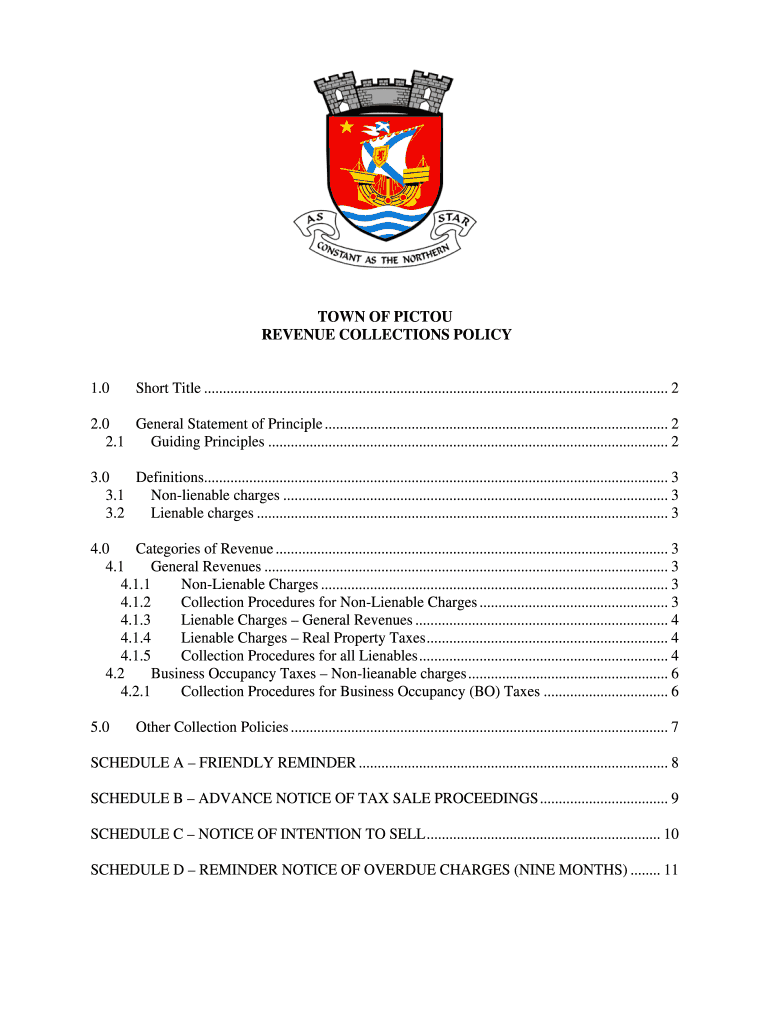

TOWN OF VICTOR REVENUE COLLECTIONS POLICY 1.0 Short Title ........................................................................................................................... 2 2.0 General

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax collection policy

Edit your tax collection policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax collection policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax collection policy online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax collection policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax collection policy

How to fill out tax collection policy:

01

Start by reviewing all relevant tax laws and regulations that apply to your specific jurisdiction. This will help you understand the legal requirements that need to be included in your policy.

02

Identify the types of taxes your organization is subject to and determine the specific collection processes and procedures that need to be outlined in the policy.

03

Clearly define the roles and responsibilities of individuals involved in the tax collection process. This may include designating a tax department or assigning specific employees to handle tax-related tasks.

04

Outline the steps for effectively calculating and assessing taxes. This includes providing clear instructions on how to determine the taxable income or value, as well as any applicable tax rates or exemptions.

05

Detail the procedures for issuing and distributing tax invoices or receipts. This includes specifying the required information that should be included on the documents, as well as any additional requirements for different types of transactions.

06

Specify the methods of payment accepted for tax collection, whether it's through cash, check, credit card, or electronic means. Also, include guidelines for handling payments and ensuring proper recording and reconciliation of tax revenue.

07

Provide instructions on how to deal with tax disputes, including the process for handling disagreements with taxpayers and the steps to pursue legal remedies if necessary.

08

Include any applicable timelines or deadlines for tax collection activities, such as the due dates for filing tax returns, making payments, or submitting required documentation. Make sure these timelines are aligned with the relevant tax laws and regulations.

09

Document any specific record-keeping or reporting requirements related to tax collection. This includes outlining the necessary documents, reports, or forms that need to be maintained and the timeframe for retaining these records.

Who needs tax collection policy?

01

Any organization or business that is subject to taxation needs a tax collection policy. This can include companies of all sizes, nonprofits, government agencies, and other entities that have tax obligations.

02

The policy is particularly important for organizations that regularly collect and remit taxes, such as retailers, service providers, manufacturers, and professional service firms.

03

It is also essential for organizations that deal with international tax issues, as they need to comply with both domestic and cross-border tax laws.

04

Additionally, government agencies responsible for tax administration may also need their own tax collection policies to ensure consistency and fairness in the collection process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax collection policy?

Tax collection policy refers to the guidelines and procedures implemented by a government or tax authority for collecting taxes from individuals or businesses.

Who is required to file tax collection policy?

Individuals or businesses who are liable to pay taxes in a particular jurisdiction are required to file tax collection policy.

How to fill out tax collection policy?

Tax collection policy can be filled out by providing accurate information about income, deductions, credits, and any other relevant tax-related information as required by the tax authority.

What is the purpose of tax collection policy?

The purpose of tax collection policy is to ensure that taxes are collected efficiently and fairly in order to fund government programs and services.

What information must be reported on tax collection policy?

Information such as income, deductions, credits, tax liability, and any other relevant tax-related information must be reported on tax collection policy.

How can I send tax collection policy for eSignature?

When your tax collection policy is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I fill out tax collection policy on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your tax collection policy. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit tax collection policy on an Android device?

You can make any changes to PDF files, such as tax collection policy, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your tax collection policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Collection Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.