Get the free Discounted Gift Plan

Show details

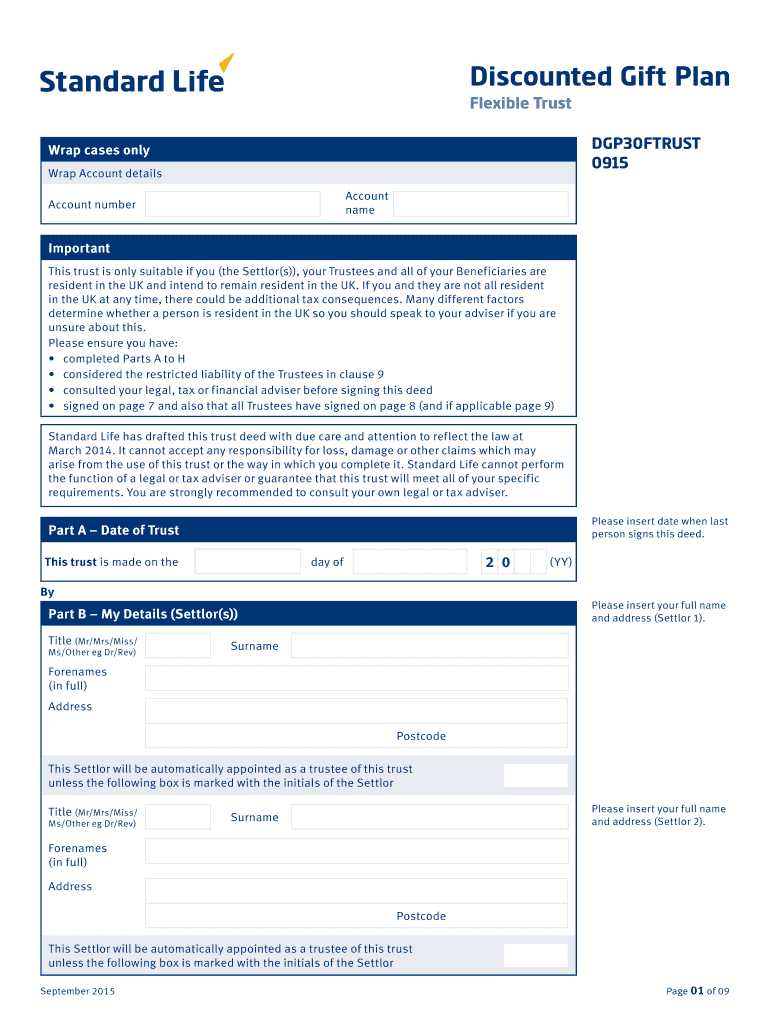

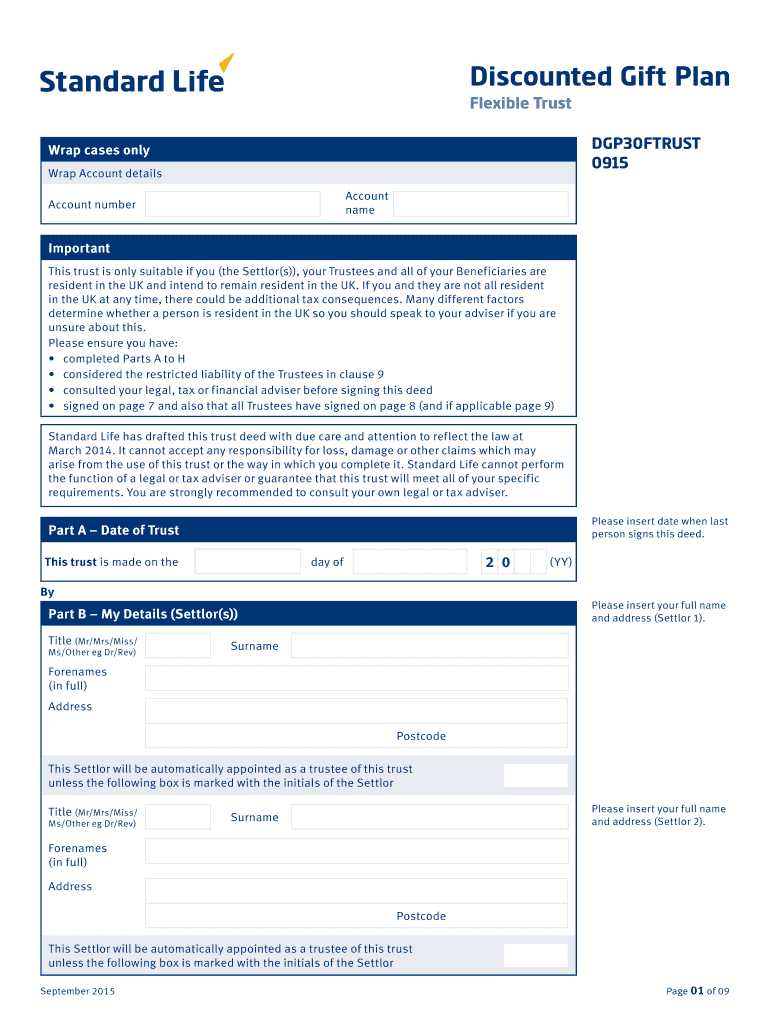

Discounted Gift Plan Flexible Trust DGP30FTRUST 0915 Wrap cases only Wrap Account details Account name Account number Important This trust is only suitable if you (the Settler(s)), your Trustees and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign discounted gift plan

Edit your discounted gift plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your discounted gift plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit discounted gift plan online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit discounted gift plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out discounted gift plan

How to fill out a discounted gift plan:

01

Start by gathering all the necessary information about the gift plan, including the name of the donor, the amount of the gift, and any specific terms or conditions associated with the plan.

02

Next, consult with a financial professional or an attorney who specializes in estate planning to ensure that the discounted gift plan aligns with your overall financial goals and objectives.

03

Create a formal written agreement that clearly outlines the terms of the discounted gift plan. This agreement should include details about the gift, the timing of the gift, any restrictions or limitations, and any tax implications.

04

Have both the donor and the recipient sign the agreement to formalize the discounted gift plan. It is important to ensure that both parties fully understand and agree to the terms of the plan.

05

Consider consulting with a tax professional to understand any potential tax consequences associated with the discounted gift plan. They can provide guidance on how to minimize tax liabilities and maximize the benefits of the plan.

Who needs a discounted gift plan?

01

Individuals who have a high net worth and are looking to reduce their taxable estate may consider a discounted gift plan. By gifting assets at a discounted value, they can potentially lower the value of their estate and reduce the estate tax burden for their heirs.

02

Charitable organizations that rely on donations may also benefit from discounted gift plans. These plans allow donors to give assets or property at a discounted value, providing the organization with a larger gift than if the assets were sold outright.

03

Estate planning professionals, such as attorneys or financial advisors, may recommend discounted gift plans to their clients as part of their overall estate planning strategy. These plans can offer various benefits, including estate tax savings, asset protection, and philanthropic contributions.

In conclusion, filling out a discounted gift plan involves gathering information, consulting with professionals, creating a written agreement, and considering tax implications. This plan may be suitable for individuals seeking estate tax reductions, charitable organizations, and those receiving guidance from estate planning professionals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is discounted gift plan?

A discounted gift plan is a strategy used to transfer assets to beneficiaries with a reduced value for gift tax purposes.

Who is required to file discounted gift plan?

Individuals who transfer assets to beneficiaries using a discounted gift plan are required to file the plan.

How to fill out discounted gift plan?

To fill out a discounted gift plan, one must provide detailed information about the transferred assets and the valuation methods used.

What is the purpose of discounted gift plan?

The purpose of a discounted gift plan is to minimize gift tax liability while transferring assets to beneficiaries.

What information must be reported on discounted gift plan?

The discounted gift plan must include information about the transferred assets, the valuation methods used, and the relationship between the transferor and the beneficiaries.

How can I edit discounted gift plan from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your discounted gift plan into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit discounted gift plan online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your discounted gift plan and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit discounted gift plan in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your discounted gift plan, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Fill out your discounted gift plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Discounted Gift Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.