Get the free Personal Pension Flex - Adviserzone

Show details

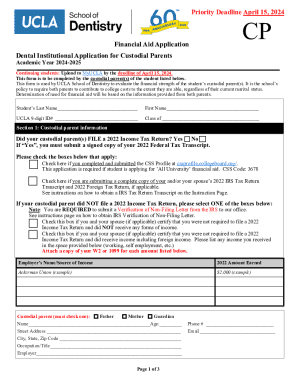

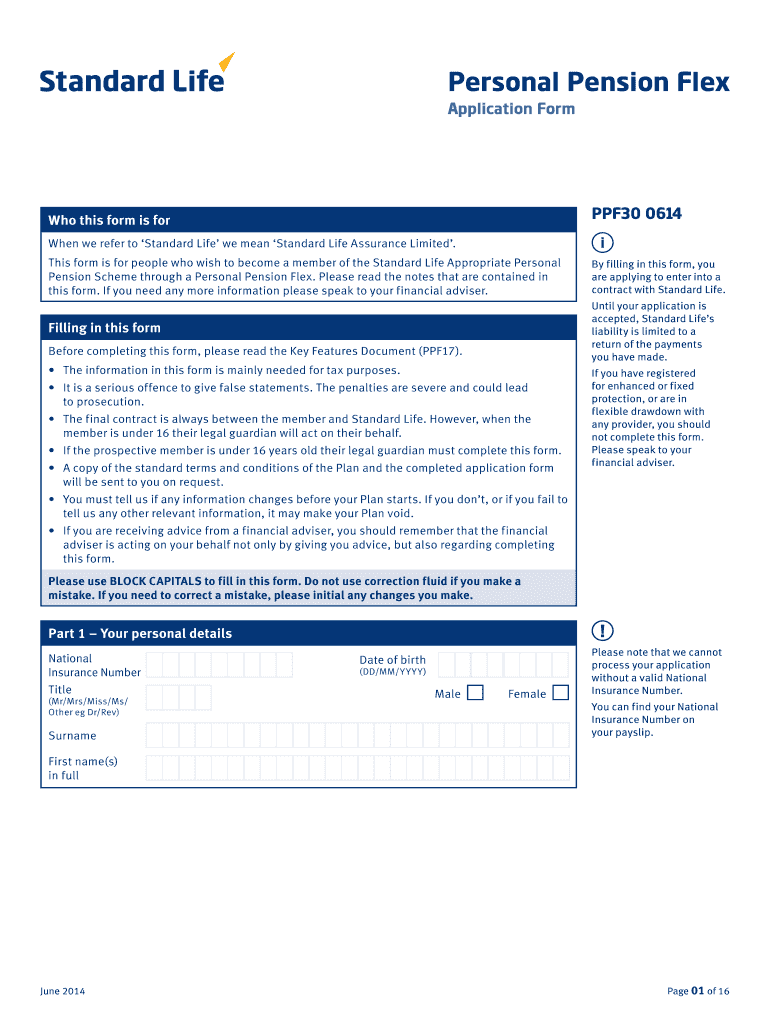

Personal Pension Flex Application Form PPF30 0614 Who this form is for When we refer to Standardize we mean Standardize Assurance Limited. This form is for people who wish to become a member of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal pension flex

Edit your personal pension flex form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal pension flex form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal pension flex online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal pension flex. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal pension flex

How to fill out personal pension flex:

01

Start by gathering all the necessary documents and information. This includes your personal details, such as your full name, address, and contact information. You will also need your National Insurance number, date of birth, and employment details.

02

Next, you need to indicate your investment choices. Decide on the level of risk you are comfortable with and choose the appropriate investment funds for your personal pension flex. You can seek advice from a financial advisor if needed.

03

Provide your nomination details. This involves deciding who will receive your pension benefits if you pass away before taking your retirement benefits. You will need to name your beneficiaries and specify their relationship to you.

04

Consider your retirement options. Indicate whether you plan to take a tax-free cash lump sum, choose an annuity, or opt for income drawdown. Research and understand the implications of each option to make an informed decision.

05

Check if any additional forms or declarations are required. Some personal pension flex providers may ask for additional information or forms, such as a declaration of health or updates on your personal circumstances. Make sure to complete these accurately and truthfully.

Who needs personal pension flex:

01

Individuals who want more flexibility and control over their retirement savings. Personal pension flex allows you to make decisions regarding your pension investments and retirement options, giving you greater freedom and choices.

02

Those who aim to optimize their retirement income. Personal pension flex offers various options for accessing your pension funds, such as taking a tax-free lump sum or income drawdown. This flexibility can help you tailor your retirement income to suit your specific needs and goals.

03

People with varying risk profiles. Personal pension flex allows you to choose your investment funds based on your risk appetite. If you are comfortable with higher risks in pursuit of potential higher returns, this option can be suitable for you. Conversely, if you prefer more stable and lower-risk investments, personal pension flex can accommodate your preferences.

04

Individuals who wish to pass on their pension benefits. Personal pension flex enables you to nominate beneficiaries who will receive your pension benefits in case of your death. This can be advantageous if you want to ensure your loved ones are financially supported after you're gone.

05

Those who want to consolidate multiple pension accounts. If you have multiple pension accounts from previous employments, personal pension flex allows you to consolidate them, making it more convenient to manage and keep track of your retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal pension flex?

Personal pension flex is a flexible retirement savings option that allows individuals to choose how much they want to contribute and when they want to receive payments in retirement.

Who is required to file personal pension flex?

Individuals who have a personal pension plan and want to make adjustments to their contributions or withdrawals may need to file a personal pension flex form.

How to fill out personal pension flex?

Individuals can fill out the personal pension flex form provided by their pension provider, providing details such as contribution amounts, withdrawal preferences, and beneficiary information.

What is the purpose of personal pension flex?

The purpose of personal pension flex is to give individuals more control and flexibility over their retirement savings, allowing them to tailor their pension plan to their specific needs and preferences.

What information must be reported on personal pension flex?

Individuals must report details such as contribution amounts, investment choices, beneficiary information, and any changes to their retirement goals on the personal pension flex form.

How do I edit personal pension flex online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your personal pension flex to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the personal pension flex form on my smartphone?

Use the pdfFiller mobile app to fill out and sign personal pension flex on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out personal pension flex on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your personal pension flex. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your personal pension flex online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Pension Flex is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.