Get the free Equipment Financing - downloads pbi

Show details

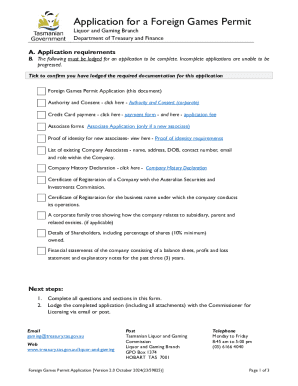

Equipment Financing Christine Gould Hamm February 27, 2015, Equipment means goods other than inventory, farm products, or consumer goods. UCC 9102(a)(33). Inventory goods held for sale or lease or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equipment financing - downloads

Edit your equipment financing - downloads form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equipment financing - downloads form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing equipment financing - downloads online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit equipment financing - downloads. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out equipment financing - downloads

How to fill out equipment financing?

01

Gather all necessary documents: Before starting the equipment financing process, make sure to collect all the required documents. This usually includes financial statements, tax returns, business plans, and any other relevant paperwork.

02

Research different lenders: Research and compare different lenders who offer equipment financing. Look for lenders with favorable terms, competitive interest rates, and a good reputation in the industry.

03

Determine your financing needs: Assess your specific equipment financing needs. Calculate the total cost of the equipment you require, and determine whether you will need additional funds for maintenance, accessories, or insurance.

04

Determine your desired repayment terms: Decide on the repayment terms that would work best for your business. Consider factors such as monthly payments, interest rates, and the length of the financing term. Choose terms that align with your cash flow and business goals.

05

Fill out the application: Complete the equipment financing application accurately and thoroughly. Provide all the requested information, including personal and business details, financial statements, and the specific equipment you intend to finance.

06

Submit the application: After filling out the application, submit it to the lender along with any supporting documents they may require. Double-check that you have included all the necessary information to avoid delays in the approval process.

07

Review the loan offer: Once the lender reviews your application, they will provide you with a loan offer if you meet their criteria. Carefully review the loan terms, interest rates, fees, and repayment schedule. Consult with a financial advisor if needed to ensure you understand the terms fully.

08

Accept the offer and sign the agreement: If you are satisfied with the loan offer, accept it and sign the financing agreement. Be sure to read and understand all the terms and conditions before signing to avoid any misunderstandings later on.

09

Receive funding and acquire the equipment: Once the financing agreement is signed, the lender will disburse the funds to you. Use the funds to acquire the equipment as planned, ensuring all necessary documentation and invoices are kept for future reference.

10

Make regular payments: As per the financing agreement, make regular payments on time to avoid any default or penalties. Stay on top of your payment schedule to maintain a good relationship with the lender and ensure business continuity.

Who needs equipment financing?

01

Startups and small businesses: Startups and small businesses often lack the necessary capital to purchase expensive equipment outright. Equipment financing provides them with the opportunity to acquire the necessary equipment while conserving their cash flow for other business expenses.

02

Established businesses looking to upgrade or expand: Established businesses may require equipment financing when they want to upgrade their existing equipment or expand their operations. Financing allows them to access the necessary funds without disrupting their business's financial stability.

03

Industries with high equipment costs: Industries that rely heavily on specialized equipment, such as construction, healthcare, manufacturing, and agriculture, often require equipment financing. The high costs of equipment in these industries make financing an attractive option for acquiring the necessary tools.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is equipment financing?

Equipment financing is a loan that helps businesses finance new equipment purchases.

Who is required to file equipment financing?

Businesses or individuals who are acquiring new equipment and need financial assistance.

How to fill out equipment financing?

To fill out equipment financing, you will need to provide information about the equipment being purchased, your financial situation, and the loan terms you are seeking.

What is the purpose of equipment financing?

The purpose of equipment financing is to help businesses acquire new equipment without having to make a large upfront payment.

What information must be reported on equipment financing?

Information such as the type of equipment being purchased, the cost of the equipment, the loan amount requested, and the borrower's financial information.

How do I make edits in equipment financing - downloads without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing equipment financing - downloads and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit equipment financing - downloads on an iOS device?

Create, edit, and share equipment financing - downloads from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I edit equipment financing - downloads on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share equipment financing - downloads on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your equipment financing - downloads online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equipment Financing - Downloads is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.