Get the free Lender-placed mortgage hazard - American Modern

Show details

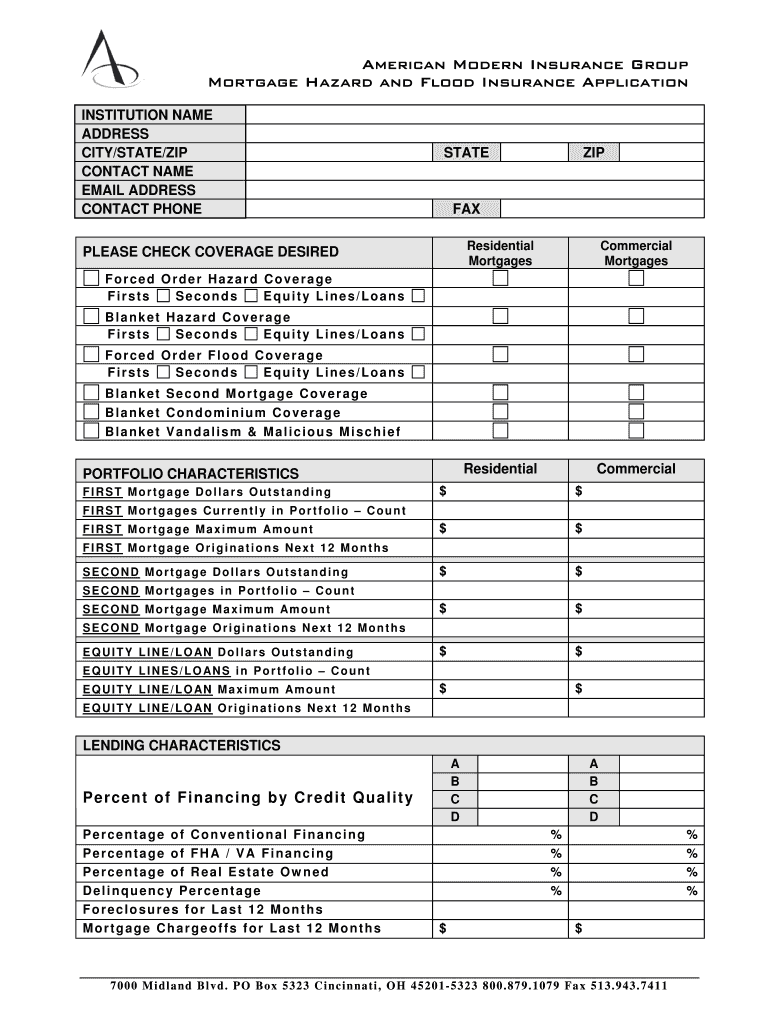

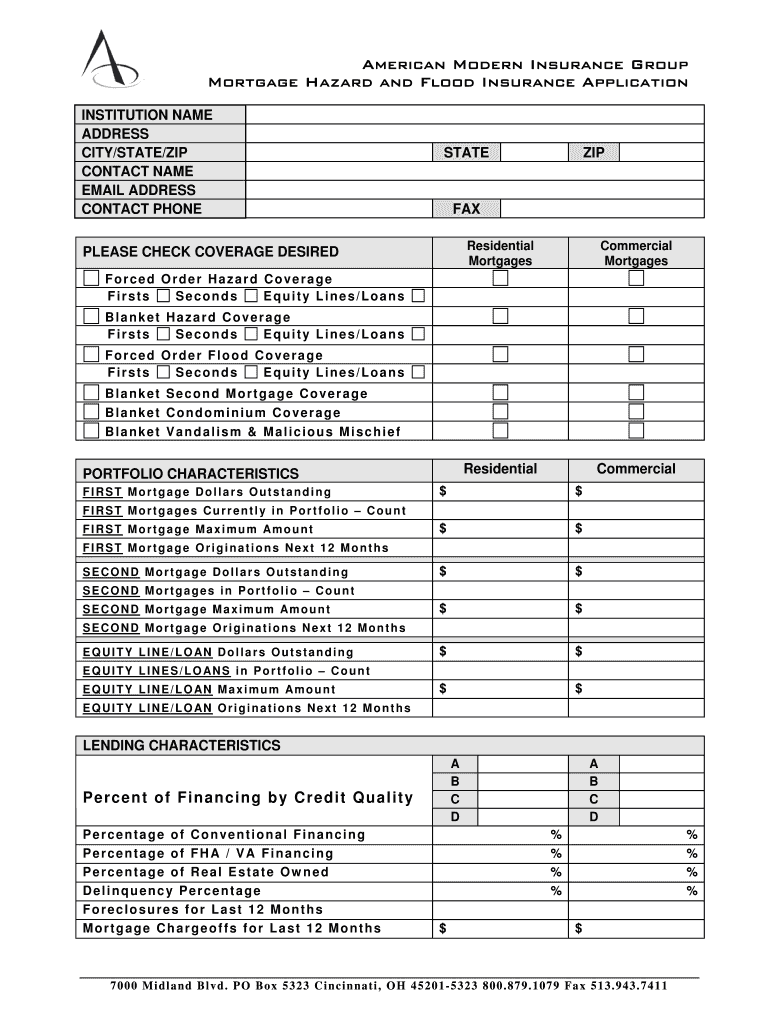

American Modern Insurance Group Mortgage Hazard and Flood Insurance Application INSTITUTION NAME ADDRESS CITY/STATE/ZIP CONTACT NAME EMAIL ADDRESS CONTACT PHONE STATE ZIP FAX Residential Mortgages

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lender-placed mortgage hazard

Edit your lender-placed mortgage hazard form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lender-placed mortgage hazard form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lender-placed mortgage hazard online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lender-placed mortgage hazard. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lender-placed mortgage hazard

How to fill out lender-placed mortgage hazard?

01

Obtain the necessary forms and documents from your lender. Contact your lender to request the specific forms required to fill out the lender-placed mortgage hazard. They will usually provide you with a claim form and instructions on how to complete it.

02

Review the form and instructions carefully. Take the time to read through the form and instructions provided by your lender. Make sure you understand the requirements and any specific information or documentation needed to complete the form accurately.

03

Gather the required information. Collect all the necessary information and documentation needed to fill out the lender-placed mortgage hazard claim form. This may include details about your property, the hazard or damage that occurred, and any relevant insurance policies you had in place.

04

Provide accurate and detailed information. When filling out the form, ensure that you provide accurate and detailed information. Double-check all the information you enter to minimize errors or missing details that could delay the processing of your claim.

05

Attach supporting documentation. In many cases, you will be required to provide supporting documentation along with the claim form. This may include copies of your insurance policies, photographs or videos of the damage, repair estimates, and any other relevant documents.

06

Submit the completed form and documentation. Once you have filled out the lender-placed mortgage hazard claim form and gathered all the necessary documents, submit them to your lender following their instructions. It is recommended to retain copies of everything you submit for your own records.

Who needs lender-placed mortgage hazard?

01

Homeowners with lapsed insurance coverage: Lender-placed mortgage hazard is typically required by lenders when homeowners fail to maintain a valid and active hazard insurance policy on their property. In such cases, the lender purchases insurance on behalf of the homeowner to protect their interests.

02

Homeowners facing foreclosure: Lender-placed mortgage hazard may also be necessary for homeowners who are going through foreclosure. As the property remains the collateral for the mortgage until the foreclosure process is complete, lenders want to ensure that it is adequately protected against potential hazards.

03

Homeowners with high-risk properties: Some properties, such as those located in flood zones or areas prone to natural disasters, may be considered high-risk by lenders. In such cases, the lender may require lender-placed mortgage hazard insurance to mitigate their risk and protect their investment in the property.

04

Homeowners with lapsed insurance payment: If a homeowner fails to pay their hazard insurance premium on time, their coverage may lapse. In such situations, lenders may step in and purchase lender-placed mortgage hazard insurance to ensure continuous protection for the property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lender-placed mortgage hazard?

Lender-placed mortgage hazard insurance is a type of insurance that protects the lender's interest in the property in case the borrower's insurance policy lapses or is insufficient.

Who is required to file lender-placed mortgage hazard?

Lenders are required to file lender-placed mortgage hazard when the borrower's insurance coverage lapses.

How to fill out lender-placed mortgage hazard?

Lender-placed mortgage hazard is typically filled out by the lender or their insurance provider, and includes information on the property, borrower, and insurance coverage.

What is the purpose of lender-placed mortgage hazard?

The purpose of lender-placed mortgage hazard is to protect the lender's financial interest in the property by ensuring there is adequate insurance coverage in place.

What information must be reported on lender-placed mortgage hazard?

Information such as the property address, borrower's name, insurance coverage details, and policy effective dates must be reported on lender-placed mortgage hazard.

How can I send lender-placed mortgage hazard to be eSigned by others?

Once your lender-placed mortgage hazard is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find lender-placed mortgage hazard?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific lender-placed mortgage hazard and other forms. Find the template you need and change it using powerful tools.

How do I edit lender-placed mortgage hazard on an Android device?

You can make any changes to PDF files, such as lender-placed mortgage hazard, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your lender-placed mortgage hazard online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lender-Placed Mortgage Hazard is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.