Get the free Limited Liability Partnership (LLP) under the LLP Act 2008

Show details

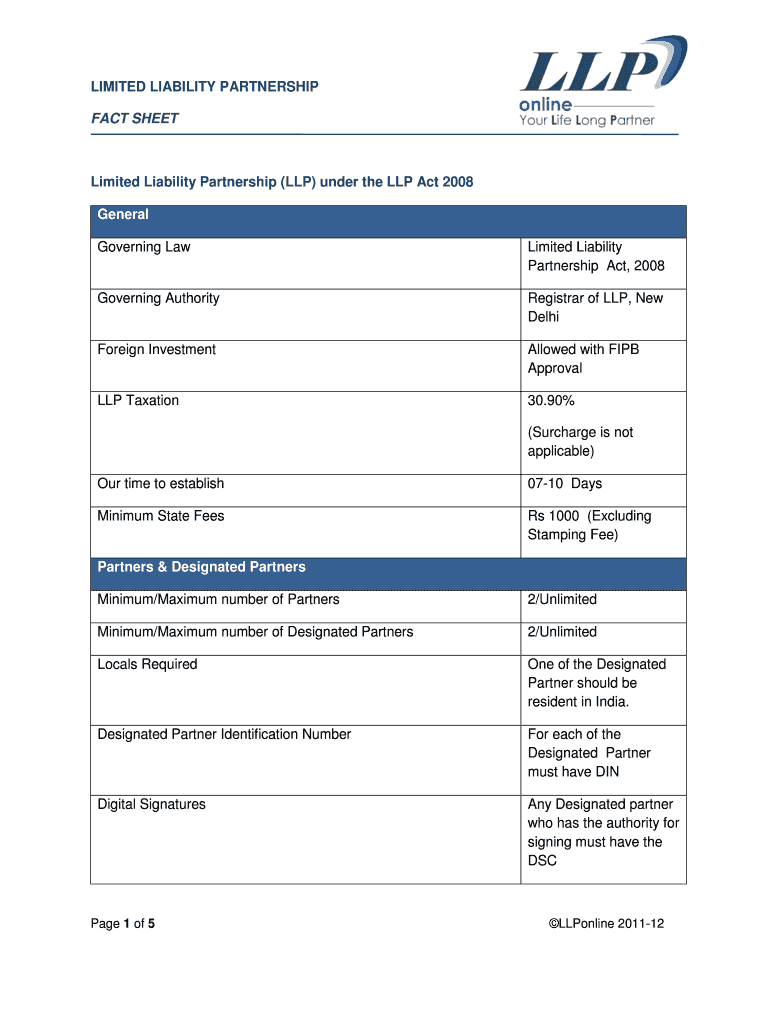

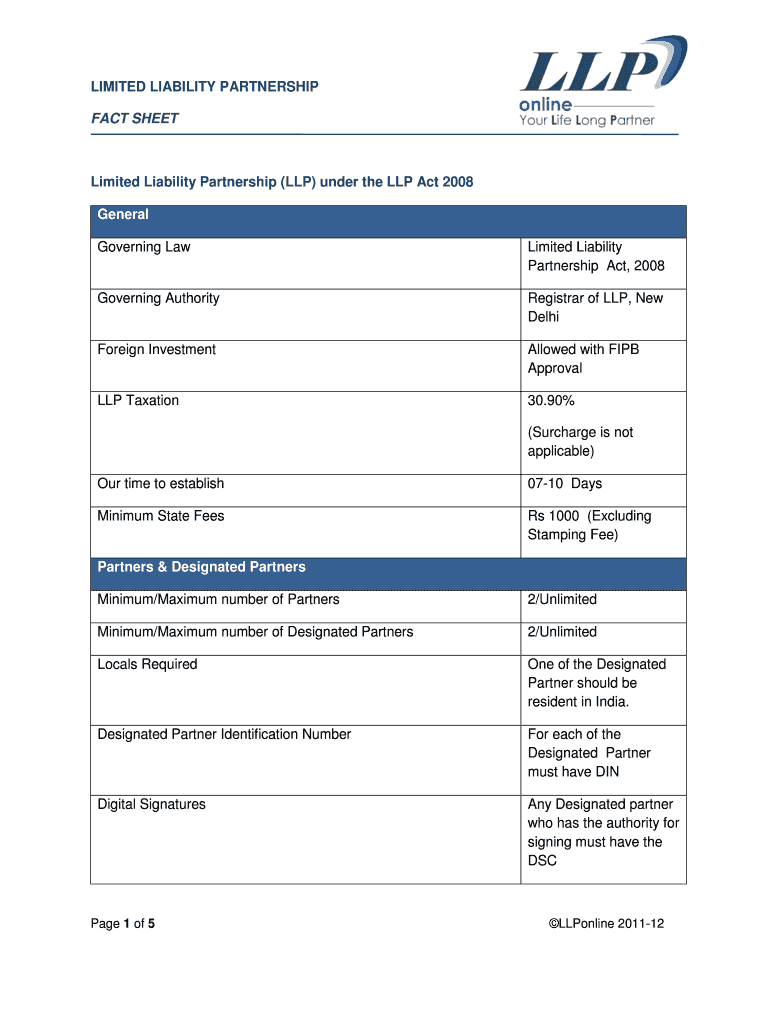

LIMITED LIABILITY PARTNERSHIP FACT SHEETLimited Liability Partnership (LLP) under the LLP Act 2008 General Governing Limited Liability Partnership Act, 2008Governing AuthorityRegistrar of LLP, New

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limited liability partnership llp

Edit your limited liability partnership llp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited liability partnership llp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit limited liability partnership llp online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit limited liability partnership llp. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited liability partnership llp

How to fill out limited liability partnership (LLP)?

Research and Consultation:

Before starting the process of filling out an LLP, it is crucial to conduct thorough research to understand the requirements and regulations specific to your jurisdiction. Additionally, seek professional advice from an attorney or a business consultant to ensure compliance with all legal aspects.

Choose a Name:

Select a unique name for your LLP that complies with the naming conventions and regulations set by the governing authority. Conduct a thorough name search to ensure that the name you choose is not already taken.

File Necessary Documents:

Prepare the necessary documents for the LLP formation, which may include the certificate of incorporation or formation, partnership agreement, and other legal forms as required by your jurisdiction. These documents typically include information about the partners, registered address, business purpose, and capital contribution.

Obtain Required Permits and Licenses:

Depending on the nature of your LLP's business activities, you may need to obtain specific permits, licenses, or certifications. Research and comply with all regulatory requirements to operate legally.

Determine Partnership Structure and Roles:

Clearly define the roles, responsibilities, and ownership distribution among partners. This includes determining the designations of general partners and limited partners, as well as their respective rights and obligations.

Register with the Relevant Authorities:

Register your LLP with the appropriate government agency or authority responsible for business registration, such as the secretary of state, company registrar, or similar governing body. Provide all necessary information and pay the required fees.

Comply with Tax Obligations:

Understand and fulfill the tax obligations associated with operating an LLP. This may involve obtaining an employer identification number (EIN) or other tax identification numbers, registering for applicable taxes, and maintaining proper financial records.

Who needs limited liability partnership (LLP)?

Professionals and Service-Based Businesses:

LLPs are often suitable for professionals like lawyers, accountants, architects, engineers, and consultants. It allows them to have liability protection while enjoying the benefits of a partnership structure.

Small and Medium Enterprises (SMEs):

SMEs seeking to operate as a partnership while protecting their personal assets consider LLPs as an ideal structure. It combines the flexibility of a partnership with limited liability protection for the partners.

Joint Ventures:

When two or more entities or individuals collaborate on a specific project or venture, forming an LLP can provide a legal framework that protects the interests of each party while limiting their liability.

Businesses Expanding Internationally:

Some businesses opt for LLPs when expanding operations overseas. This structure offers advantages in terms of taxation, limited liability, and ease of operation in various jurisdictions.

Note: The specific requirements and applicability of LLPs may vary depending on the jurisdiction. It is important to consult with professionals or refer to your local laws and regulations for accurate guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is limited liability partnership llp?

A limited liability partnership (LLP) is a legal business structure that combines the flexibility and tax benefits of a partnership with the limited liability protection of a corporation.

Who is required to file limited liability partnership llp?

LLPs are required to be filed by businesses that wish to operate as a partnership while limiting the personal liability of the individual partners.

How to fill out limited liability partnership llp?

LLPs can be formed by filing the necessary paperwork with the appropriate state authorities and meeting any other requirements as specified by law.

What is the purpose of limited liability partnership llp?

The purpose of an LLP is to provide partners with limited liability protection while allowing them to operate as a partnership, sharing profits, losses, and management responsibilities.

What information must be reported on limited liability partnership llp?

The information required to be reported on an LLP typically includes details about the partners, the business activities, and the registered office address.

How do I make changes in limited liability partnership llp?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your limited liability partnership llp to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in limited liability partnership llp without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing limited liability partnership llp and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the limited liability partnership llp in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your limited liability partnership llp.

Fill out your limited liability partnership llp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limited Liability Partnership Llp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.