Get the free Tax Filers Income Verification - fresnostate

Show details

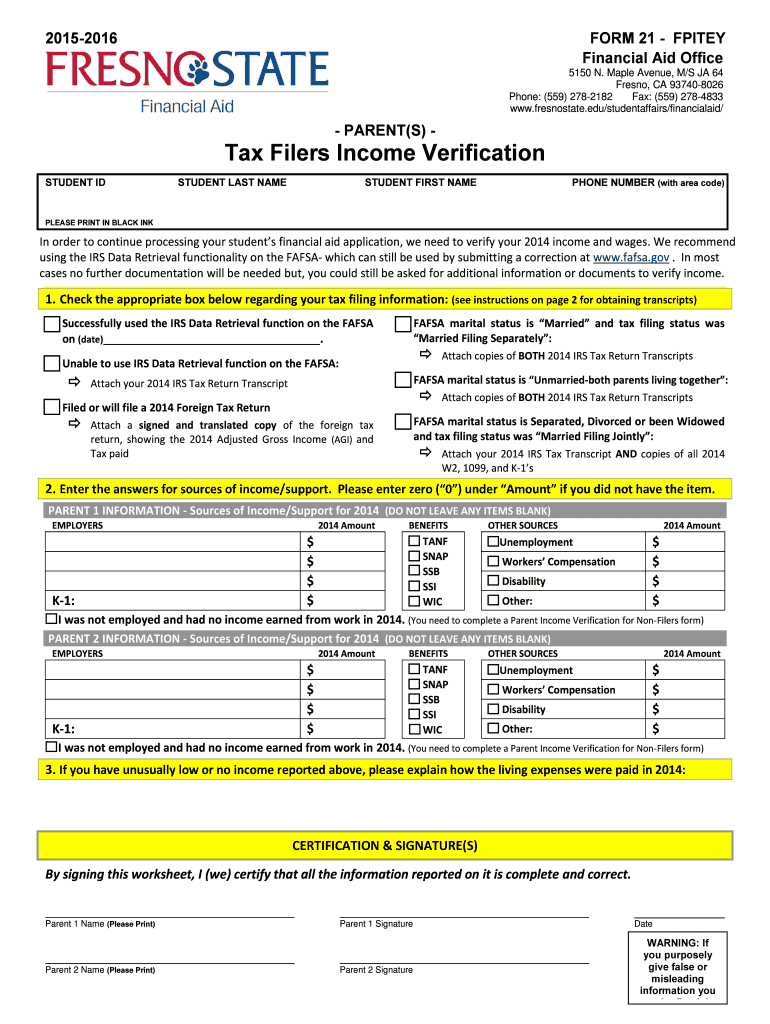

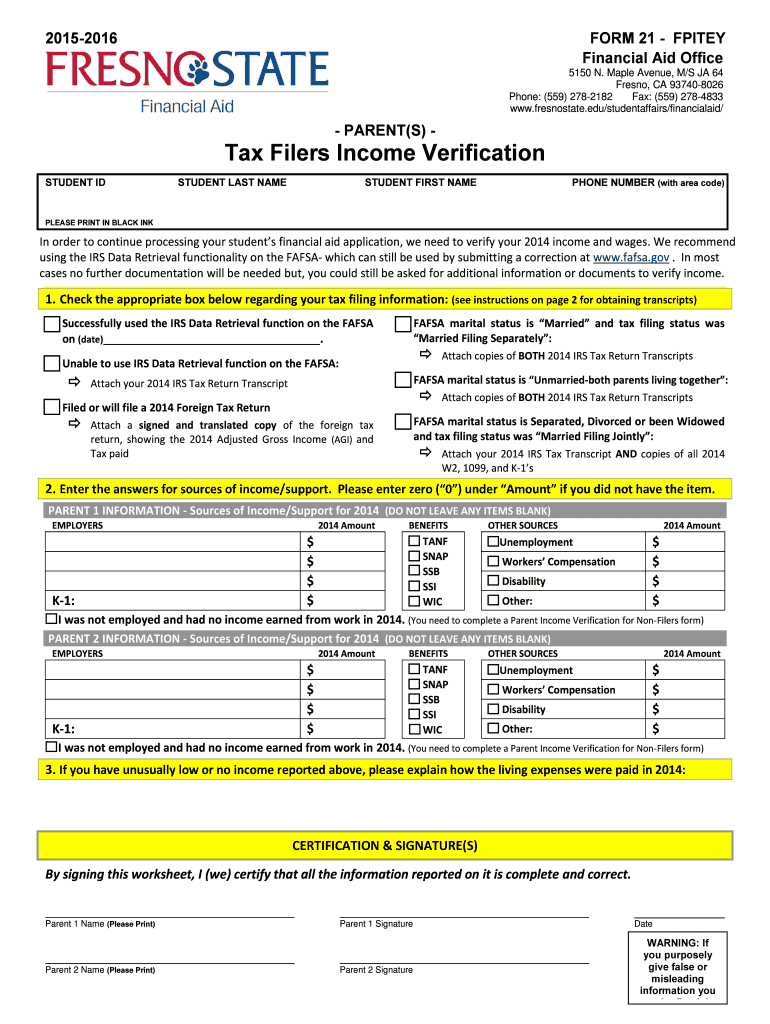

20152016 FORM 21 SPITE Financial Aid Office 5150 N. Maple Avenue, M/S JA 64 Fresno, CA 937408026 Phone: (559) 2782182 Fax: (559) 2784833 www.fresnostate.edu/studentaffairs/financialaid/ PARENT(S)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax filers income verification

Edit your tax filers income verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax filers income verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax filers income verification online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax filers income verification. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax filers income verification

How to fill out tax filers income verification:

01

Gather all necessary documents: Begin by collecting all relevant documents such as W-2 forms, 1099 forms, and any other income-related statements. Make sure to have accurate and up-to-date information on hand.

02

Understand the requirements: Familiarize yourself with the specific requirements for tax filers income verification. Check if there are any specific forms or procedures that need to be followed, as these may vary depending on your jurisdiction or the institution requesting the verification.

03

Complete the necessary forms: Fill out the required forms accurately and completely. Provide all necessary information, including your personal details and income-related information.

04

Attach supporting documents: Make sure to attach all relevant supporting documents to the completed forms. This may include copies of your recent tax returns, pay stubs, or any other documentation that proves your income.

05

Review and double-check: Before submitting the income verification, thoroughly review all the information provided. Double-check for any errors or missing details that may render the verification incomplete or inaccurate.

06

Submit the verification: Once you are confident that all the information is correct, submit the completed income verification along with the supporting documents to the relevant authority or institution requesting the verification.

Who needs tax filers income verification:

01

Government institutions: Various government agencies, such as social services departments or financial aid offices, may require tax filers income verification to determine eligibility for assistance programs or benefits.

02

Educational institutions: Colleges, universities, and other educational institutions may request tax filers income verification to determine financial aid eligibility or award scholarships.

03

Lending institutions: When applying for loans, especially mortgages or personal loans, lending institutions often require tax filers income verification to assess the borrower's ability to repay the loan.

04

Landlords: Some landlords may request tax filers income verification as part of the tenant screening process to ensure that potential tenants have a stable source of income.

05

Insurance companies: Certain insurance providers may require tax filers income verification to assess an individual's financial standing or determine premium rates.

It is important to note that the specific individuals or organizations requiring tax filers income verification may vary depending on the circumstances and requirements. Always consult the specific guidelines or instructions provided by the requesting party to ensure accurate and timely submission of the verification.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax filers income verification?

Tax filers income verification is the process of confirming and reporting an individual's income to the relevant authorities for taxation purposes.

Who is required to file tax filers income verification?

Individuals who earn income above a certain threshold set by the tax authorities are required to file tax filers income verification.

How to fill out tax filers income verification?

Tax filers income verification can be filled out online through the tax authority's website or submitted in person at their offices.

What is the purpose of tax filers income verification?

The purpose of tax filers income verification is to ensure that individuals are reporting their income accurately and paying the correct amount of taxes.

What information must be reported on tax filers income verification?

Information such as income earned from wages, investments, rental properties, and any other sources of income must be reported on tax filers income verification.

How do I modify my tax filers income verification in Gmail?

tax filers income verification and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get tax filers income verification?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the tax filers income verification in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit tax filers income verification online?

The editing procedure is simple with pdfFiller. Open your tax filers income verification in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Fill out your tax filers income verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Filers Income Verification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.