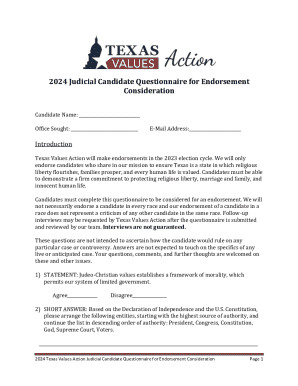

Get the free BAPPLICATIONb FOR EARNINGS WITHHOLDING ORDER bb

Show details

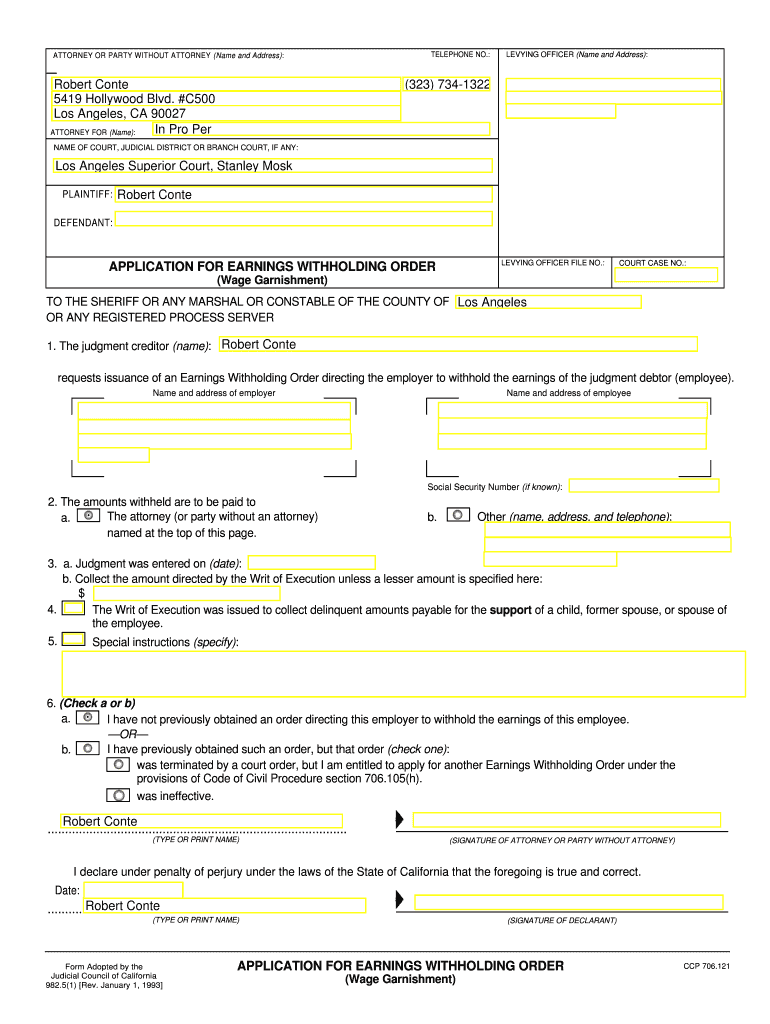

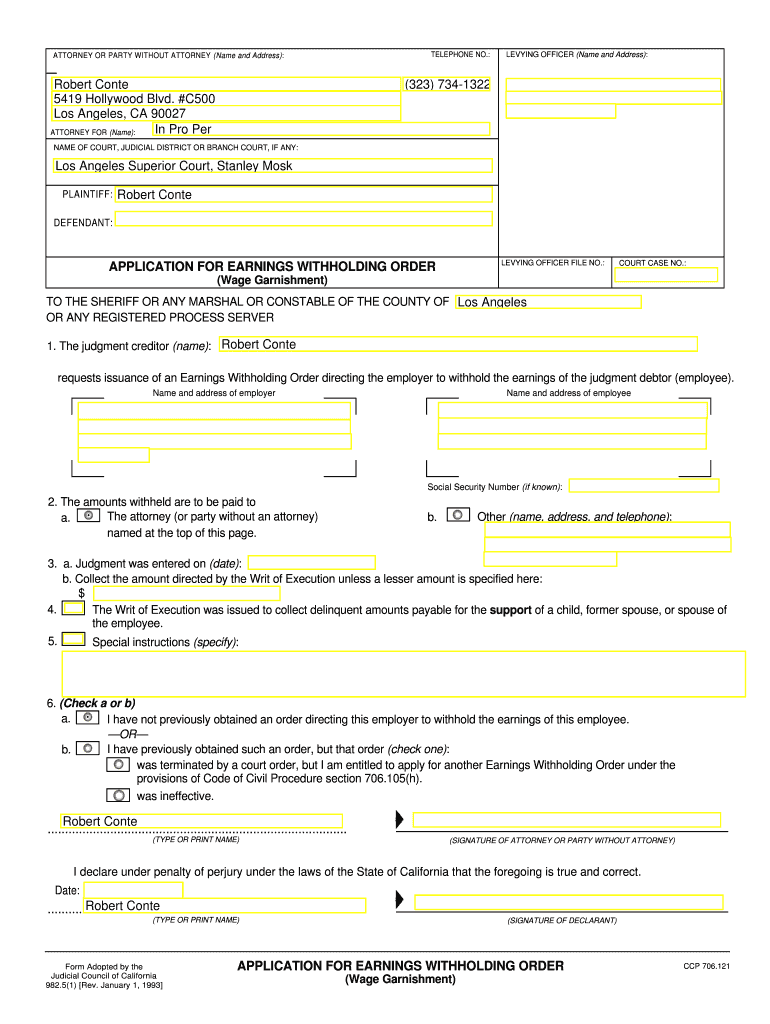

TELEPHONE NO.: ATTORNEY OR PARTY WITHOUT ATTORNEY (Name and Address): Robert Cone 5419 Hollywood Blvd. #C500 Los Angeles, CA 90027 In Pro Per ATTORNEY FOR (Name): LEVYING OFFICER (Name and Address):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bapplicationb for earnings withholding

Edit your bapplicationb for earnings withholding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bapplicationb for earnings withholding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bapplicationb for earnings withholding online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bapplicationb for earnings withholding. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bapplicationb for earnings withholding

How to fill out an application for earnings withholding:

01

Obtain the necessary forms: Start by contacting the appropriate authority or agency that handles earnings withholding in your region. They will provide you with the application forms required to apply for earnings withholding.

02

Fill out personal information: Begin by entering your personal details accurately. This includes your full name, contact information, Social Security number, and any other identification details requested on the form.

03

Provide employer information: Next, you will need to provide information about your current or previous employer(s). This may include the company name, employer identification number, address, and contact information. Be sure to include all relevant employers from whom you anticipate receiving income.

04

Specify the reason for earnings withholding: Indicate the reason why you are applying for earnings withholding. Common reasons include child or spousal support, tax arrears, student loan repayments, or any other debts that may be collected through wage garnishment.

05

Calculate the withholding amount: Determine the amount that is allowed to be withheld from your earnings based on the regulations governing earnings withholding in your region. This may require providing supporting documentation such as court orders or official notices detailing the amount to be withheld.

06

Sign the application: Once you have completed all the required sections of the application form, review it for accuracy and sign the document. Make sure to follow any additional instructions regarding witness signatures or notarization if applicable.

Who needs an application for earnings withholding?

01

Individuals owing financial obligations: An application for earnings withholding is typically needed by individuals who owe financial obligations such as child support, spousal support, tax debts, or student loan repayments. It allows these obligations to be collected directly from their income.

02

Recipients of court orders: People who have received court orders specifying earnings withholding for certain payments may need to complete an application to have the process initiated.

03

Debtors with approved repayment agreements: Individuals who have entered into official repayment agreements with creditors or government agencies may be required to fill out an application for earnings withholding to facilitate timely and consistent payments.

Note: The specific requirements for who needs an application for earnings withholding may vary depending on your jurisdiction and the types of debts or obligations involved. It is always advisable to consult with the appropriate authority or seek legal advice to ensure compliance with relevant laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for earnings withholding?

An application for earnings withholding is a legal document filed by a creditor to request that an employer withhold a portion of a debtor's wages to satisfy a debt.

Who is required to file application for earnings withholding?

Creditors who have obtained a judgment from a court against a debtor are required to file an application for earnings withholding.

How to fill out application for earnings withholding?

The application for earnings withholding typically requires the creditor to provide information about the debtor, the amount of the debt, and details of the judgment obtained.

What is the purpose of application for earnings withholding?

The purpose of an application for earnings withholding is to ensure that creditors are able to collect on debts owed to them by deducting money directly from the debtor's wages.

What information must be reported on application for earnings withholding?

The application for earnings withholding must include details such as the debtor's name, address, social security number, and the specific amount to be withheld from their wages.

Can I create an eSignature for the bapplicationb for earnings withholding in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your bapplicationb for earnings withholding right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit bapplicationb for earnings withholding on an iOS device?

You certainly can. You can quickly edit, distribute, and sign bapplicationb for earnings withholding on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit bapplicationb for earnings withholding on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute bapplicationb for earnings withholding from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your bapplicationb for earnings withholding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bapplicationb For Earnings Withholding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.