Get the free Knox County Tax Abatement Informational Packet - knoxcountymaine

Show details

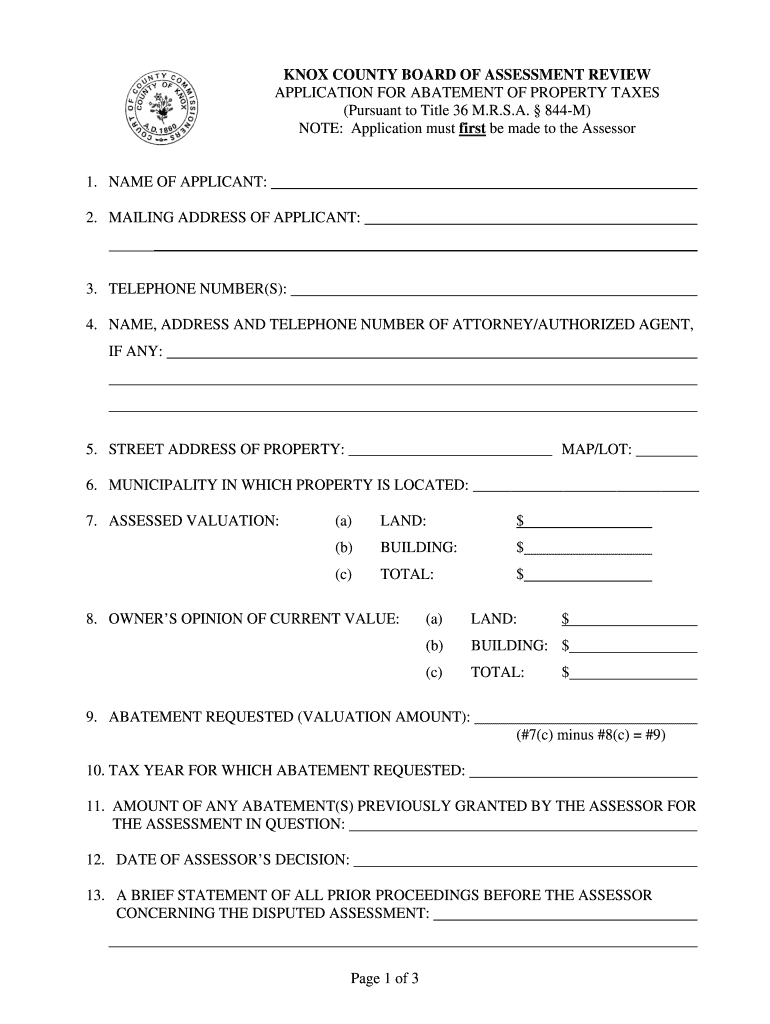

KNOX COUNTY BOARD OF ASSESSMENT REVIEW Informational Packet for Taxpayers August 12, 2011, Table of Contents I Instructions to Applicants II Application Form III Board of Assessment Review Rules &

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign knox county tax abatement

Edit your knox county tax abatement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your knox county tax abatement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit knox county tax abatement online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit knox county tax abatement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out knox county tax abatement

Point by Point Guide: How to fill out Knox County tax abatement:

01

Obtain the necessary forms: Begin the process by acquiring the required forms for Knox County tax abatement. These forms can typically be found on the official Knox County government website or can be obtained from the local tax office.

02

Familiarize yourself with the eligibility criteria: Before proceeding with the application, it is essential to understand who is eligible for Knox County tax abatement. Review the eligibility requirements, which may include factors such as location, property type, and intended use.

03

Gather supporting documents: Collect all the necessary supporting documents to accompany your Knox County tax abatement application. This may include property ownership documentation, financial statements, construction plans, and any other required paperwork specified in the application.

04

Complete the application form: Carefully fill out the Knox County tax abatement application form, ensuring that all fields are accurately completed. Double-check for any missing information or errors before submitting the form.

05

Include a detailed project description: Along with the application, provide a comprehensive description of your project, specifying its scope, objectives, and potential benefits to the Knox County community. Be concise yet thorough, highlighting the positive impact your project can bring.

06

Submit the application: Once you have completed the application form and gathered all necessary documents, submit your application to the designated department or office responsible for Knox County tax abatement. Ensure you adhere to any specified submission guidelines or deadlines.

Who needs Knox County tax abatement?

01

Property owners undertaking eligible projects: Individuals or businesses planning construction, renovation, or development projects in Knox County that align with the guidelines for tax abatement may find it beneficial to pursue this opportunity. By securing tax abatement, property owners can potentially reduce their property tax obligations, making the project financially more feasible.

02

Business owners looking to expand or relocate: Knox County tax abatement can be particularly appealing to businesses looking to expand or relocate to the area. The potential tax savings offered through abatement programs can make the county an attractive destination for investment and growth, fostering economic development.

03

Developers aiming to revitalize communities: For developers interested in revitalizing certain areas within Knox County, tax abatement can be a valuable tool. By incentivizing development, tax abatement programs encourage improvement and contribute to the overall enhancement of local neighborhoods and commercial districts.

Remember to consult the official Knox County tax abatement guidelines and seek professional advice if needed, as specific requirements and eligibility criteria may vary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is knox county tax abatement?

Knox County tax abatement is a program that aims to incentivize economic development by reducing or eliminating property taxes for a certain period of time.

Who is required to file knox county tax abatement?

Property owners or developers looking to receive tax abatements in Knox County are required to file an application for tax abatement.

How to fill out knox county tax abatement?

To fill out Knox County tax abatement, applicants must complete the application form provided by the county, submit any required documentation, and adhere to the guidelines and requirements set forth by the county.

What is the purpose of knox county tax abatement?

The purpose of Knox County tax abatement is to encourage economic development, stimulate growth in the community, attract new businesses, and create job opportunities.

What information must be reported on knox county tax abatement?

Applicants must provide information about the property for which they are seeking tax abatement, details about the proposed development or improvement project, and a justification for why they are requesting the tax abatement.

How can I send knox county tax abatement for eSignature?

To distribute your knox county tax abatement, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my knox county tax abatement in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your knox county tax abatement right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out knox county tax abatement on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your knox county tax abatement. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your knox county tax abatement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Knox County Tax Abatement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.