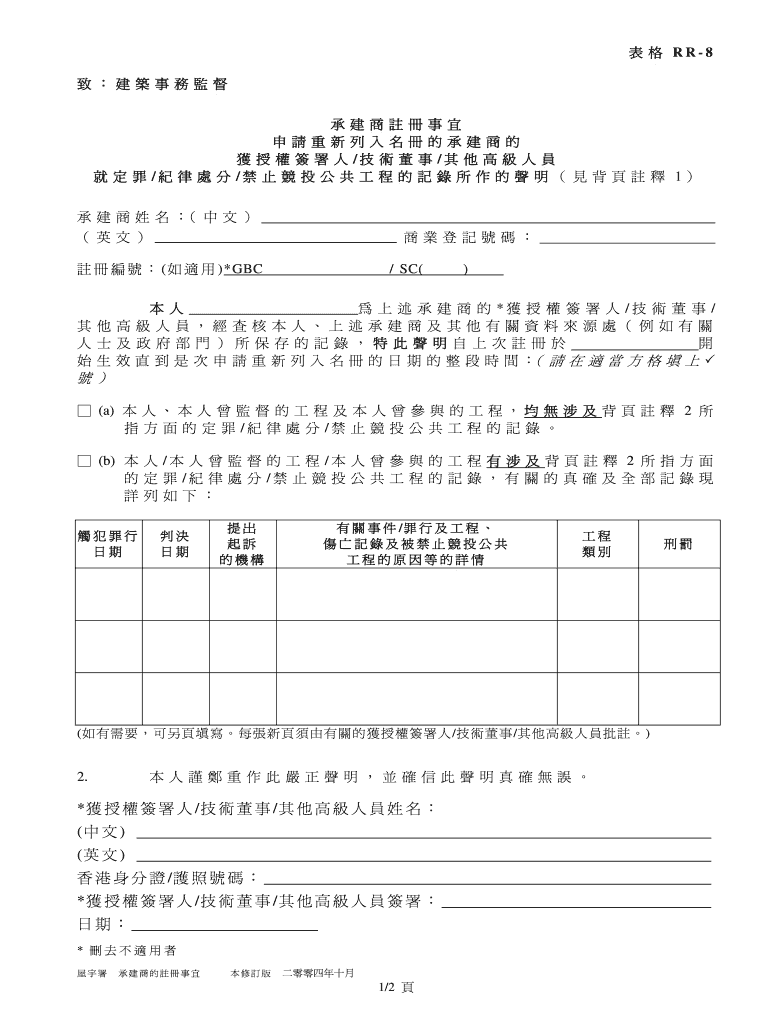

Get the free SC(

Show details

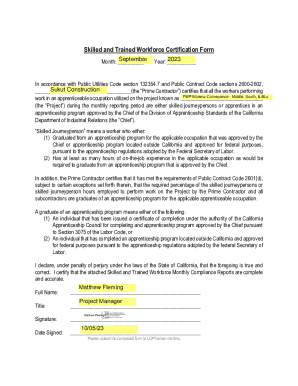

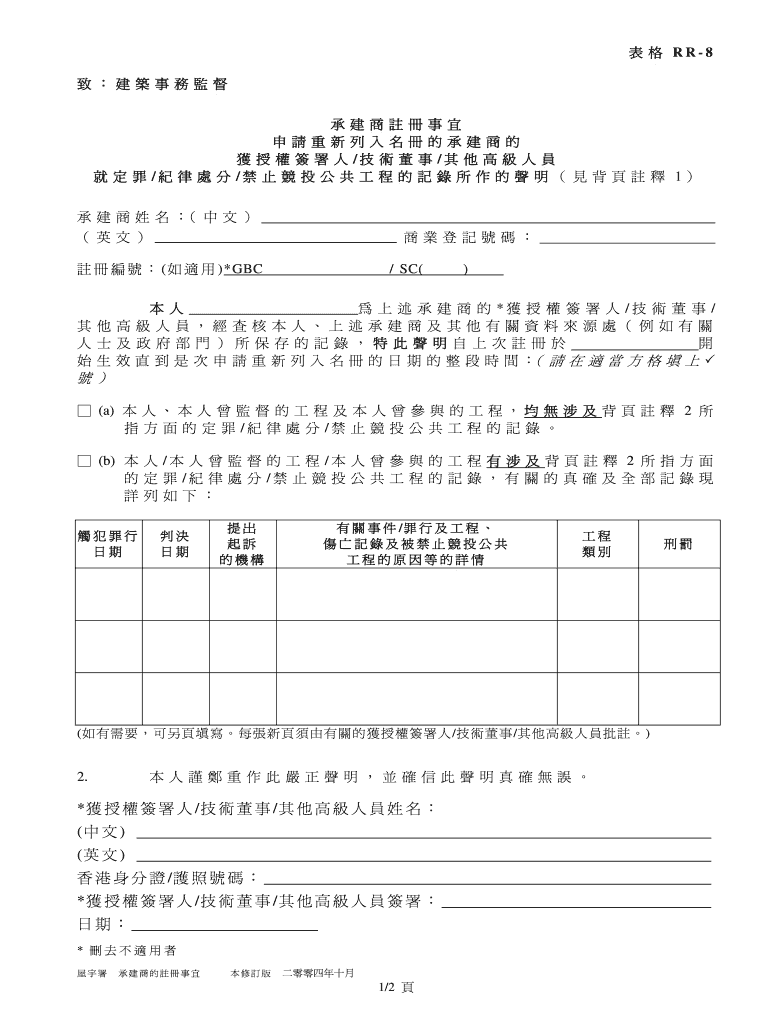

RR8 / / / / 1 ()*GBC / SC() *

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sc

Edit your sc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sc

How to fill out SC:

01

Gather all the necessary information: Before filling out the SC (Service Contract), gather all the relevant details such as the names of the parties involved, the scope of the services, the duration of the contract, and any additional terms or conditions.

02

Clearly outline the services: Begin by clearly stating the services that will be provided. Be specific and detailed to ensure clarity and avoid any possible misunderstandings.

03

Specify terms and conditions: Include any terms and conditions that are important for both parties to agree upon. This may include payment terms, termination clauses, confidentiality agreements, dispute resolution methods, and any other relevant provisions.

04

Define the compensation: Clearly specify the compensation or fees that will be paid for the services rendered. This can be a flat fee, an hourly rate, or any other payment agreement that both parties agree upon.

05

Review and revise: Once you have filled out the SC, take the time to review and revise it thoroughly. Make sure all the necessary information is accurately recorded and that there are no inconsistencies or errors.

Who needs SC:

01

Businesses: Companies often require SCs when hiring contractors or service providers to ensure that both parties are clear about the scope of work, payment terms, and other relevant details.

02

Freelancers or service providers: Individuals offering their services on a freelance basis may need to use SCs to establish a formal agreement and protect their rights and interests.

03

Professionals in creative fields: Artists, photographers, designers, and other creative professionals often use SCs to define the terms of their work, including things like copyright ownership and usage rights.

In conclusion, anyone who needs to establish a formal agreement for services rendered can benefit from using a SC. Whether you are a business hiring a contractor or a freelancer offering services, having a clear and comprehensive SC can help protect both parties and ensure a mutually beneficial relationship.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sc?

sc stands for self-assessment tax return in the UK.

Who is required to file sc?

Individuals, self-employed individuals, directors, and others earning income above a certain threshold are required to file sc in the UK.

How to fill out sc?

SC can be filled out online on the HMRC website or using commercial software approved by HMRC.

What is the purpose of sc?

The purpose of sc is to report income, expenses, and other relevant information to calculate tax liability.

What information must be reported on sc?

Income from employment, self-employment, savings, investments, pensions, and capital gains must be reported on sc.

How do I modify my sc in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your sc and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit sc on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sc.

How do I fill out sc using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign sc and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your sc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.