Get the free Personal Loan AppEng - HSBC - hsbc

Show details

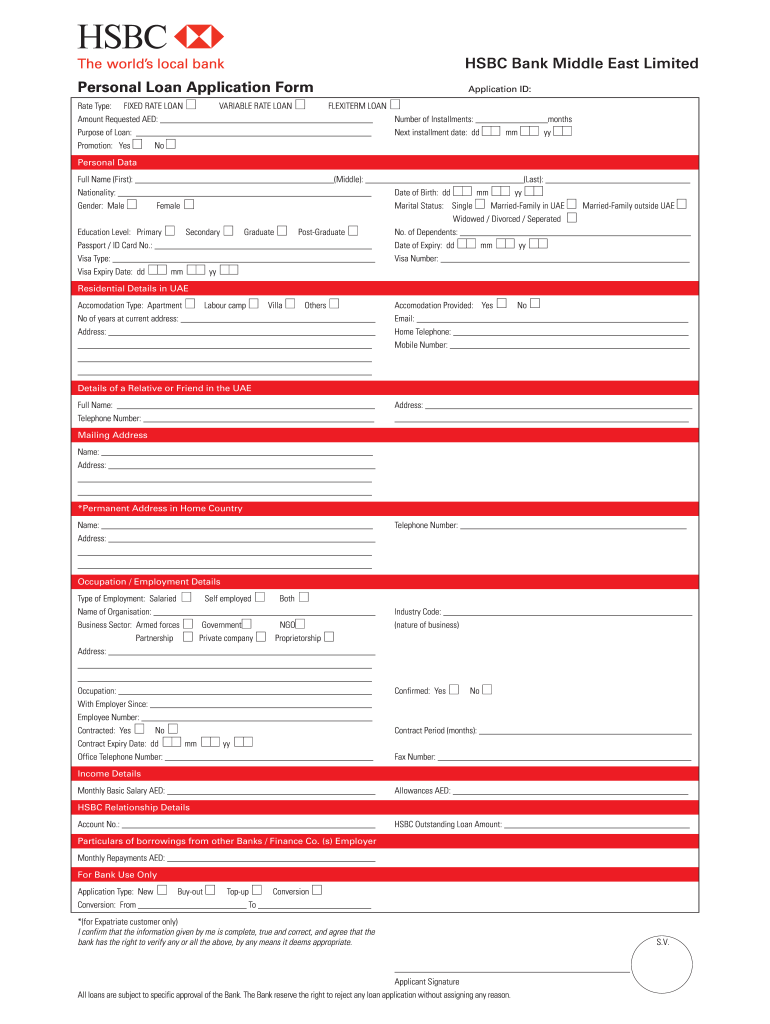

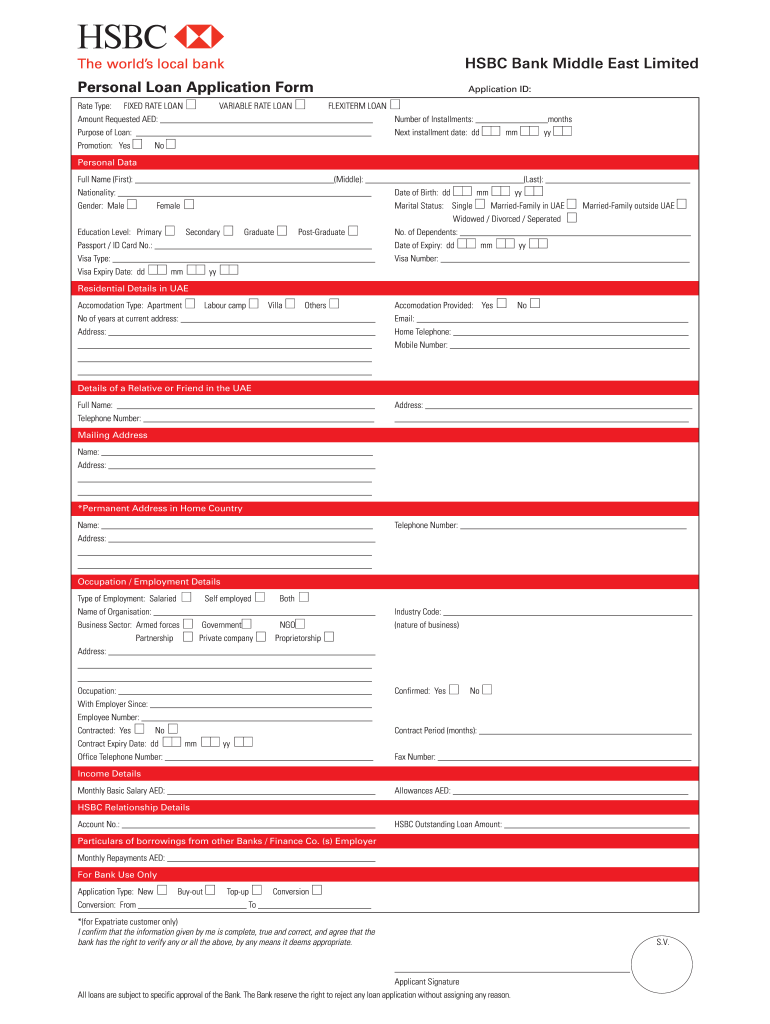

HSBC Bank Middle East Limited Personal Loan Application Form Rate Type: FIXED RATE LOAN VARIABLE RATE LOAN Application ID: FLEETER LOAN Amount Requested AED: Number of Installments: months Purpose

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal loan appeng

Edit your personal loan appeng form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal loan appeng form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal loan appeng online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal loan appeng. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal loan appeng

How to fill out a personal loan application:

01

Gather necessary documents: Before starting the application process, gather all the required documents such as identification proof, income proof, address proof, and any other relevant documents specified by the lender.

02

Choose the right lender: Research different lenders and compare their interest rates, terms, and conditions. Select a lender that aligns with your financial needs and offers competitive rates.

03

Understand the application form: Read through the application form carefully to understand the information required. This may include personal details, employment information, financial statements, and loan amount requested.

04

Provide accurate information: Fill out the application form accurately, providing all the required information in a clear and concise manner. Double-check the provided details to ensure accuracy.

05

Income and expenses: Be prepared to provide details about your income and expenses, including salary, other sources of income, and monthly obligations such as rent, loan payments, and utility bills. This information helps the lender assess your repayment capability.

06

Loan purpose: Clearly specify the purpose for which you are seeking the personal loan. It could be for debt consolidation, medical expenses, home improvements, or any other legitimate reason.

07

Read and understand terms and conditions: Carefully read the terms and conditions mentioned in the application form. Be aware of the interest rate, repayment period, any additional fees, and consequences of late payments or defaults.

08

Review and submit: Before submitting the application form, review all the information provided to ensure its accuracy. Submit the completed form to the lender either online or in person, as per their instructions.

Who needs a personal loan application?

01

Individuals with financial emergencies: Personal loans can be helpful for individuals facing unexpected financial emergencies such as medical bills, home repairs, or car repairs. If you do not have sufficient savings to cover these expenses, a personal loan can provide the necessary funds.

02

Individuals seeking debt consolidation: If you have multiple outstanding debts with high-interest rates, a personal loan can be used to consolidate these debts into a single loan with a lower interest rate. This can simplify your finances and potentially reduce your monthly payments.

03

Individuals planning major purchases: Personal loans can be utilized for significant purchases such as buying a new car, funding a wedding, or financing a vacation. It allows you to make these purchases upfront and then repay the loan in fixed installments.

04

Individuals looking to improve credit score: Personal loans, when repaid consistently and on time, can positively impact your credit score. It demonstrates responsible financial behavior and improves your creditworthiness, making it easier to obtain future credit.

05

Individuals aiming for higher education: Personal loans can be used to fund higher education expenses, including tuition fees and living expenses. This option can be favorable for individuals who do not qualify for student loans or need additional funds to supplement their education costs.

Overall, personal loans can benefit a wide range of individuals in various financial situations, providing access to funds when needed while offering flexibility in repayment terms. However, it is crucial to consider your repayment capability and choose a loan amount and terms that align with your financial goals and obligations.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay off my HSBC personal loan early?

If you have an HSBC Personal Loan, you can make as many overpayments as you like, including paying off the loan early, without facing any fees or charges.

How do I check the status of my HSBC personal loan application?

A person can check the loan status by calling the numbers 1860 266 2667 for any financial queries including Personal Loan. You can also directly go to the branch you apply at to meet the officer in charge to know the status of your personal loan application.

How long does it take for personal loan to be approved HSBC?

How soon will my loan be approved? If you're an HSBC customer, you should receive a credit decision instantly after applying. Non-customers may have to wait a little longer but you should receive your approval in three to five working days.

What is the interest rate for loan in HSBC bank?

HSBC Bank Personal Loan HSBC India Personal Loan HighlightsInterest rates9.99%-16.00% p.a.Loan AmountUp to Rs. 15 lakh For Select Customers-Up to Rs. 30 LakhTenure6 months-5 YearsProcessing FeesUp to 2% of Loan Amount1 more row

What is the current interest rate for HSBC?

A loyalty rate applies for 12 months from the date of each payment into your ISA.HSBC Loyalty Cash ISA. Effective dateLoyalty rateStandard rate1 December 20222.50% AER (2.47% tax-free)2.10% AER (2.08% tax-free)20 October 2022 to 30 November 20221.60% AER / (1.59% tax-free)1.20% AER / (1.19% tax-free)

What is the current interest rate to borrow?

Weekly national mortgage interest rate trends 30 year fixed6.96%15 year fixed6.30%10 year fixed6.39%5/1 ARM5.83%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal loan appeng?

Personal loan appeng is an application for a personal loan that individuals can submit to financial institutions or lenders.

Who is required to file personal loan appeng?

Anyone looking to borrow money through a personal loan is required to file a personal loan application.

How to fill out personal loan appeng?

To fill out a personal loan appeng, individuals need to provide personal information, financial details, and indicate the amount they wish to borrow.

What is the purpose of personal loan appeng?

The purpose of a personal loan appeng is to request a loan from a financial institution for personal use, such as debt consolidation, home improvement, or emergencies.

What information must be reported on personal loan appeng?

Information such as personal identification, income details, employment history, current debts, and the purpose of the loan must be reported on a personal loan application.

How do I modify my personal loan appeng in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign personal loan appeng and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get personal loan appeng?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the personal loan appeng. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the personal loan appeng in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your personal loan appeng in minutes.

Fill out your personal loan appeng online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Loan Appeng is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.