Get the free Standard Lump Sum Coverage - Santa Fe

Show details

Thinking Relocation? Think Santa Fe. STANDARD LUMP SUM INSURANCE Enrollment From All Risk Protection Coverage for your household goods, personal effects and automobiles moving by land, sea or air.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard lump sum coverage

Edit your standard lump sum coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard lump sum coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing standard lump sum coverage online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit standard lump sum coverage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

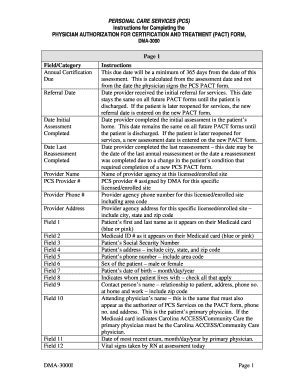

How to fill out standard lump sum coverage

How to fill out standard lump sum coverage:

01

Start by obtaining the necessary forms from your insurance provider. These forms may be available online or can be requested through mail or email.

02

Read through the instructions carefully to understand the information required and the sections that need to be filled out. This will help ensure accuracy and prevent any mistakes.

03

Begin by providing your personal information, including your full name, address, contact details, and any other relevant details requested. Be sure to double-check the accuracy of this information.

04

Next, you will need to specify the coverage amount you desire. This is the lump sum of money that will be paid out in the event of your death.

05

You may be required to answer several health-related questions to assess your eligibility for coverage. Be honest and provide detailed information to the best of your knowledge.

06

If necessary, consult your medical records or healthcare provider for accurate and updated information about your health. This will help avoid any discrepancies that may affect your coverage.

07

You might need to designate a beneficiary who will receive the insurance payout in case of your death. Provide the beneficiary's full name, relationship to you, and their contact information. Ensure their details are accurate and up-to-date.

08

Review the completed form to ensure all the sections are accurately filled out. This includes verifying that all required fields are complete and that there are no errors or missing information.

09

If needed, attach any supporting documents requested, such as medical reports or identification proofs. Ensure these are photocopies and keep the originals for your records.

10

Sign and date the form in the designated sections to acknowledge your understanding and agreement to the terms and conditions outlined.

11

Send the completed form and any required documents to the address provided by your insurance provider. Use secured mail or online submission methods to ensure the safe delivery of your application.

12

Keep a copy of the filled-out form and any supporting documents for your records, as well as for future reference or any potential follow-ups.

Who needs standard lump sum coverage?

01

Individuals who have financial dependents, such as spouses, children, or elderly parents, may need standard lump sum coverage. This insurance can provide a substantial amount of money to support their loved ones financially in the event of the policyholder's death.

02

People with significant debts, such as mortgages, loans, or credit card balances, may require standard lump sum coverage. It can help pay off these debts, relieving the financial burden for their family members.

03

Individuals who want to leave a financial legacy or provide an inheritance to their loved ones may opt for standard lump sum coverage. It ensures that a predetermined amount of money will be available for their beneficiaries.

04

Business owners or self-employed individuals who want to protect their business and ensure its continuity may consider standard lump sum coverage. It can provide funds that can be used to pay off business debts, fund buy-sell agreements, or cover any other financial obligations.

05

People who want to cover funeral or end-of-life expenses can benefit from standard lump sum coverage. It allows their family members to receive a lump sum payout to cover these costs, relieving them of the financial burden during an already difficult time.

06

Standard lump sum coverage may also be suitable for individuals who want additional peace of mind and financial security for their loved ones, knowing that they will be financially taken care of in their absence.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute standard lump sum coverage online?

Easy online standard lump sum coverage completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my standard lump sum coverage in Gmail?

Create your eSignature using pdfFiller and then eSign your standard lump sum coverage immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete standard lump sum coverage on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your standard lump sum coverage, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is standard lump sum coverage?

Standard lump sum coverage is a fixed amount of insurance coverage that is paid out in a single payment.

Who is required to file standard lump sum coverage?

Employers are required to file standard lump sum coverage for their employees.

How to fill out standard lump sum coverage?

Standard lump sum coverage can be filled out using the appropriate forms provided by the insurance company or employer.

What is the purpose of standard lump sum coverage?

The purpose of standard lump sum coverage is to provide a one-time payment to beneficiaries in the event of the insured's death.

What information must be reported on standard lump sum coverage?

Standard lump sum coverage typically requires information about the insured individual, beneficiaries, and policy details.

Fill out your standard lump sum coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Lump Sum Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.