Get the free Fund Switch Investment Choice Change Form - MetLife - metlife co

Show details

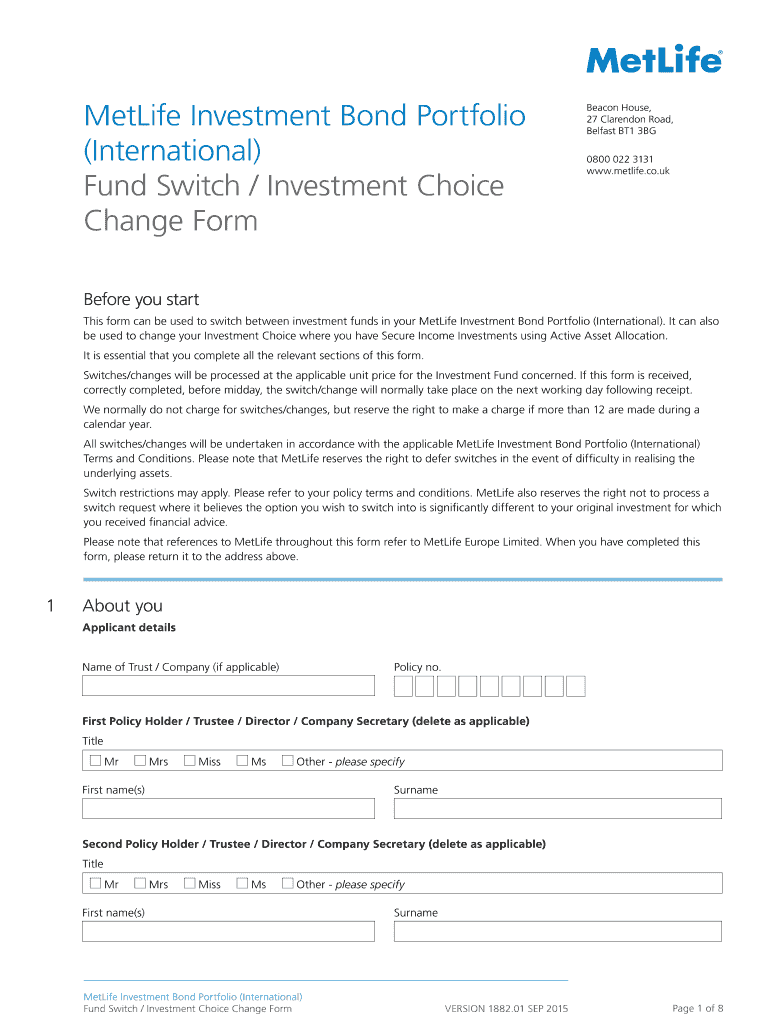

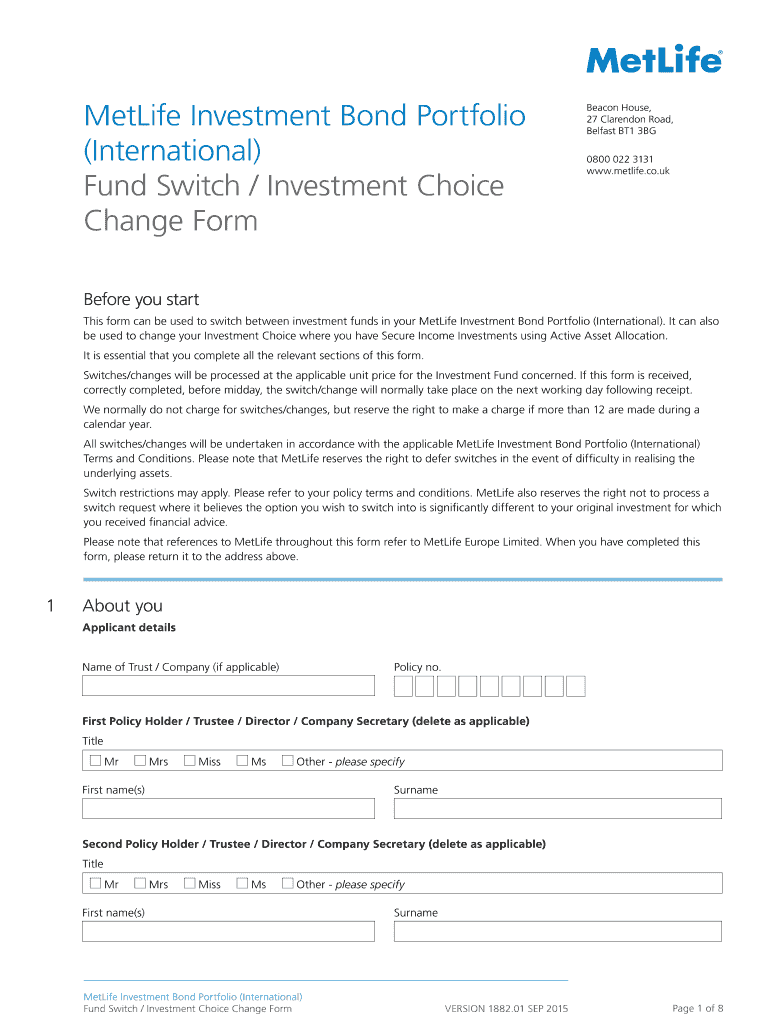

MetLife Investment Bond Portfolio (International) Fund Switch / Investment Choice Change Form Beacon House, 27 Clarendon Road, Belfast BT1 3BG 0800 022 3131 www.metlife.co.uk Before you start This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fund switch investment choice

Edit your fund switch investment choice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fund switch investment choice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fund switch investment choice online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fund switch investment choice. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fund switch investment choice

How to fill out fund switch investment choice:

01

Begin by logging into your investment account or contacting your investment provider directly.

02

Locate the section or tab labeled "Fund Switch" or "Investment Choice" within your account.

03

Choose the fund or funds you wish to switch your investment to. Consider factors such as your investment goals, risk tolerance, and the performance of different funds.

04

Specify the amount or percentage of your current investment that you would like to switch to the new fund(s). You may have the option to switch a partial or full amount.

05

Review and confirm the details of your fund switch. Take a moment to ensure that all the information provided is accurate and meets your investment needs.

06

If necessary, provide any additional information or documentation that may be required for the fund switch process. This could include forms, identification, or specific investment instructions.

07

Submit your fund switch request. Depending on the investment provider and the platform used, you may have different methods of submission, such as online submission, phone call, or in-person visit to a branch office.

08

Keep track of your fund switch request. Take note of any confirmation numbers or reference codes provided by the investment provider. It may also be helpful to save screenshots or print copies of any confirmation emails or documents.

09

Monitor the progress of your fund switch. You may be able to do this through your investment account's online portal or by contacting your investment provider directly. Make sure that the fund switch is executed within a reasonable time frame.

10

Review your new investment allocation once the fund switch is complete. Ensure that it aligns with your investment goals and provides the diversification and risk profile you desire.

Who needs fund switch investment choice?

01

Investors who want to reallocate their investments within their existing investment account.

02

Individuals who have experienced a change in financial goals, risk tolerance, or investment strategy and need to adjust their investment portfolio accordingly.

03

Those who have identified better investment opportunities or funds that align more closely with their investment objectives.

04

Investors who want to take advantage of market trends, economic conditions, or changes in investment strategies.

05

Individuals who wish to diversify their investment holdings by moving funds into different asset classes or sectors.

06

Investors who have received financial advice recommending a change in their investment allocation.

07

Those who are unsatisfied with the performance or fees associated with their current investments and wish to switch to potentially better-performing or more cost-effective funds.

08

Individuals who have experienced a life event, such as marriage, retirement, or the birth of a child, and need to adjust their investment portfolio to reflect their new circumstances.

09

Investors who want a more hands-on approach to managing their investments and prefer to have control over their allocation.

10

Those who want to take advantage of tax planning strategies and make use of specific investment options or funds that offer tax benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fund switch investment choice?

Fund switch investment choice allows investors to switch their investments from one fund to another within the same investment company.

Who is required to file fund switch investment choice?

Investors who want to switch their investments within the same investment company are required to file a fund switch investment choice.

How to fill out fund switch investment choice?

To fill out a fund switch investment choice, investors need to contact their investment company and request the necessary forms to make the switch.

What is the purpose of fund switch investment choice?

The purpose of fund switch investment choice is to allow investors to reallocate their investments based on their financial goals and market conditions.

What information must be reported on fund switch investment choice?

Investors must report the details of the funds they are switching from and to, the amount of the switch, and any applicable fees.

How do I edit fund switch investment choice online?

The editing procedure is simple with pdfFiller. Open your fund switch investment choice in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit fund switch investment choice on an iOS device?

Use the pdfFiller mobile app to create, edit, and share fund switch investment choice from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit fund switch investment choice on an Android device?

The pdfFiller app for Android allows you to edit PDF files like fund switch investment choice. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your fund switch investment choice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fund Switch Investment Choice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.