Get the free Zero Interest Loan Application Updated 1-6-14

Show details

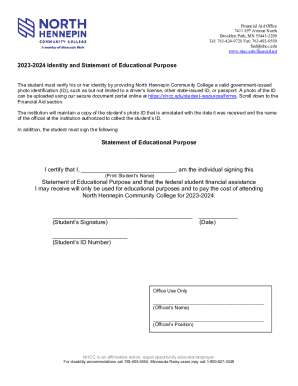

VILLAGE OF ARLINGTON HEIGHTS ZERO INTEREST LOAN PROGRAM POLICY AND PROCEDURES Prepared by: Village of Arlington Heights Department of Planning & Community Development Phone: 8473685200 Fax: 8473685988

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign zero interest loan application

Edit your zero interest loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your zero interest loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing zero interest loan application online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit zero interest loan application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out zero interest loan application

How to fill out zero interest loan application:

01

Gather all necessary documents: Before starting the application process, make sure you have all the required documents such as identification proof, income statements, and any additional paperwork specified by the lender.

02

Understand the terms and conditions: Carefully read and comprehend the terms and conditions of the loan. Make sure you fully understand the repayment terms, interest rate (or lack of interest), and any other important details.

03

Provide accurate personal and financial information: Fill out the application form with accurate personal and financial information. This typically includes your full name, contact details, social security number, employment information, monthly income, and expenses. Be honest and thorough in providing this information.

04

Explain your purpose for the loan: Zero interest loans may have specific criteria or purposes. Clearly explain why you need the loan and how you intend to use it. This may require providing supporting documents such as invoices, estimates, or bills related to the intended use of the funds.

05

Submit any required supporting documentation: Along with the application form, you may need to submit additional supporting documents. These can include bank statements, tax returns, proof of assets, or any other documents that validate your financial position and ability to repay the loan.

06

Review and verify your application: Before submitting the application, carefully review all the information you provided. Check for any errors or omissions that could hinder the approval process. Ensure that all supporting documents are attached and properly organized.

07

Submit the application: Once you are confident that the application is complete and accurate, submit it to the lender. Follow the specified submission instructions, whether it's through an online portal, email, fax, or in-person.

Who needs zero interest loan application:

01

Individuals with limited financial resources: Zero interest loans can be beneficial for individuals who have limited financial resources and cannot afford the interest charges associated with traditional loans. These loans help them avoid accumulating additional debt while fulfilling their financial needs.

02

Nonprofit organizations: Nonprofit organizations often rely on grants and donations to operate. Zero interest loans can provide them with additional financial support without burdening them with interest expenses.

03

Small businesses and startups: Zero interest loans can be a valuable source of funding for small businesses and startups. They allow these enterprises to access capital without the added burden of high interest rates, making it easier for them to manage their cash flow and achieve business growth.

04

Students and education-related expenses: Students seeking funds for education-related expenses can benefit from zero interest loans. These loans help reduce the overall cost of education, allowing students to focus on their studies without accumulating substantial interest on their loan amount.

In conclusion, filling out a zero interest loan application requires the careful gathering of necessary documents, understanding the loan terms and conditions, providing accurate information, explaining the loan purpose, submitting supporting documentation if required, reviewing and verifying the application, and finally, submitting it to the lender. Zero interest loan applications are generally advantageous for individuals with limited financial resources, nonprofit organizations, small businesses and startups, as well as students and education-related expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is zero interest loan application?

Zero interest loan application is a form used to apply for a loan where no interest is charged on the borrowed amount.

Who is required to file zero interest loan application?

Individuals or businesses seeking a loan with zero interest are required to file the application.

How to fill out zero interest loan application?

To fill out the zero interest loan application, applicants need to provide personal or business information, loan amount requested, and repayment terms.

What is the purpose of zero interest loan application?

The purpose of zero interest loan application is to help individuals or businesses access funds without incurring interest charges, potentially saving money on borrowing costs.

What information must be reported on zero interest loan application?

Information such as personal or business details, loan amount requested, repayment plan, and any collateral offered may need to be reported on the zero interest loan application.

How can I modify zero interest loan application without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your zero interest loan application into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I sign the zero interest loan application electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the zero interest loan application in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your zero interest loan application right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your zero interest loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Zero Interest Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.