CA LACIV 198 2007 free printable template

Show details

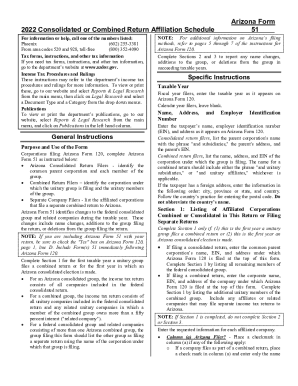

NAME ADDRESS AND TELEPHONE NUMBER OF ATTORNEY OR PARTY WITHOUT ATTORNEY Reserved for Clerk s File Stamp STATE BAR NUMBER TELEPHONE NUMBER Optional ATTORNEY FOR Name SUPERIOR COURT OF CALIFORNIA COUNTY OF LOS ANGELES COURTHOUSE ADDRESS PLAINTIFF DEFENDANT CASE NUMBER AFFIDAVIT OF IDENTITY AND ORDER I am the judgment creditor in the above entitled action. The name of the judgment debtor as stated in the judgment is List additional name or names by which the judgment debtor is known The facts...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA LACIV 198

Edit your CA LACIV 198 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA LACIV 198 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA LACIV 198 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA LACIV 198. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA LACIV 198 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA LACIV 198

How to fill out CA LACIV 198

01

Obtain a copy of the CA LACIV 198 form from the official website or the court clerk's office.

02

Fill in the top section with the name of the court and case number.

03

Provide your name and contact information in the designated section.

04

List the parties involved in the case accurately, including their addresses.

05

Fill in the details of the service request, including the type of service and the date.

06

Sign and date the form at the bottom.

07

Make copies of the completed form for your records and to serve to the other parties.

Who needs CA LACIV 198?

01

Individuals or attorneys who are involved in a legal case in Los Angeles County.

02

Parties who need to formally document service of pleadings or other documents in court proceedings.

03

Those who are required by the court to provide proof of service as part of their legal obligation.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out an identity theft affidavit?

To complete the FTC's Identity Theft Affidavit, you need to provide personal data including your Social Security number, address and contact information. You also will need to provide your driver's license number or information from another government-issued ID.

What is a California affidavit?

An affidavit is a written statement you're asserting is true. Affidavits can be used for a number of reasons such as in court cases as evidence, and outside of court to verify facts in a business transaction (for instance,if you need to assure a buyer you really own what you're selling them).

How do I prove I am a victim of identity theft?

Use the ID Theft Affidavit The Federal Trade Commission's ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name.

How long does it take IRS to investigate identity theft?

How long does that take? It depends on the complexity of your problem. The IRS says that it resolves tax identity theft cases in 120 to 180 days, depending on your circumstances. But in many instances, victims of complex tax identity theft have experienced resolution times of more than one year.

Should I fill out identity theft affidavit?

In the vast majority of tax-related identity theft cases, there is no need to file the Form 14039 affidavit. The Form 14039 affidavit should be filed if the taxpayer attempts to file an electronic tax return and the IRS rejects it because a return bearing the taxpayer's Social Security number already has been filed.

Why does a court ask for an affidavit?

Affidavits are extensively used in Courts and except in the cases of final judgments, orders are passed based on affidavits. Further, for invoking the powers of Courts under various provisions of relevant enactments including procedural acts, applications are to be filed supported by affidavits.

What does it mean when the IRS sends you a letter to verify identity?

This letter is to notify you that the agency received a tax return with your name and Social Security number that it believes may not be yours. The letter asks you to take specific steps to verify your identity and confirm whether or not the return is actually yours.

What is the purpose of an affidavit?

An affidavit is a document that is sworn before a notary public or other official to be true. The main purpose of an affidavit is to establish the truth of a statement. In India, an affidavit can be used to confirm facts in legal proceedings.

What does a identity theft affidavit mean?

The ID Theft Affidavit provides a model form that can be used to report information to many companies, simplifying the process of alerting companies where a new account was opened in the victim's name.

What is form 14039 identity theft affidavit?

Taxpayers file the Form 14039 to inform the Internal Revenue Service that they think they may be a victim of tax-related identity theft. They are having specific tax-related issues, such as not being able to file electronically because a tax return with their SSN already has been filed.

Does the IRS send you a letter for identity theft?

You may receive a Letter 4883C from the IRS asking you to verify your identity within 30 days. Follow the letter's instructions to verify your identity. Call the toll-free number provided in the letter. You must have the letter with you when you call the Taxpayer Protection Program.

Why did the IRS send me an identity theft affidavit?

The primary purpose of the form is to provide a method of reporting identity theft issues to the IRS so that the IRS may document situations where individuals are or may be victims of identity theft.

What info is needed for identity theft?

What they want are account numbers, passwords, Social Security numbers, and other confidential information that they can use to loot your checking account or run up bills on your credit cards. Identity thieves can take out loans or obtain credit cards and even driver's licenses in your name.

What is difference between notarized and affidavit?

The notary public is there to ensure the validity of the signature and guarantee that the signature was applied voluntarily and without coercion. Once the affiant acknowledges signing the document for its intended purpose and signs the affidavit, the document is notarized and becomes a sworn affidavit.

When filing an identity theft affidavit with the IRS you must include a copy of?

You should plan on providing picture identification plus the letter and a copy of the affected tax return if you did file one.

What should be included in an identity theft affidavit?

To complete the FTC's Identity Theft Affidavit, you need to provide personal data including your Social Security number, address and contact information. You also will need to provide your driver's license number or information from another government-issued ID.

What are the two parts of the identity theft affidavit?

This affidavit has two parts: ID Theft Affidavit is where you report general information about yourself and the theft. Fraudulent Account Statement is where you describe the fraudulent account(s) opened in your name. Use a separate Fraudulent Ac- count Statement for each company you need to write to.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the CA LACIV 198 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit CA LACIV 198 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign CA LACIV 198. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out CA LACIV 198 on an Android device?

Complete CA LACIV 198 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CA LACIV 198?

CA LACIV 198 is a form used in Los Angeles County for civil cases, specifically for providing initial disclosures of information relevant to a case.

Who is required to file CA LACIV 198?

Parties involved in civil litigation cases in Los Angeles County are required to file CA LACIV 198 to ensure transparency and fair legal proceedings.

How to fill out CA LACIV 198?

To fill out CA LACIV 198, parties must provide basic information about the case, including names, contact details, and relevant facts or documents that may be used as evidence.

What is the purpose of CA LACIV 198?

The purpose of CA LACIV 198 is to facilitate the discovery process by ensuring that both parties disclose relevant information upfront, which can help streamline case management.

What information must be reported on CA LACIV 198?

The information that must be reported on CA LACIV 198 includes the names and contact information of parties, a summary of claims, defenses, and any documents or evidence that may be relevant to the case.

Fill out your CA LACIV 198 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA LACIV 198 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.