Get the free IN PUBLIC ACCOUNTING and BUSINESS MANAGEMENT & FINANCE CHECKLIST (June

Show details

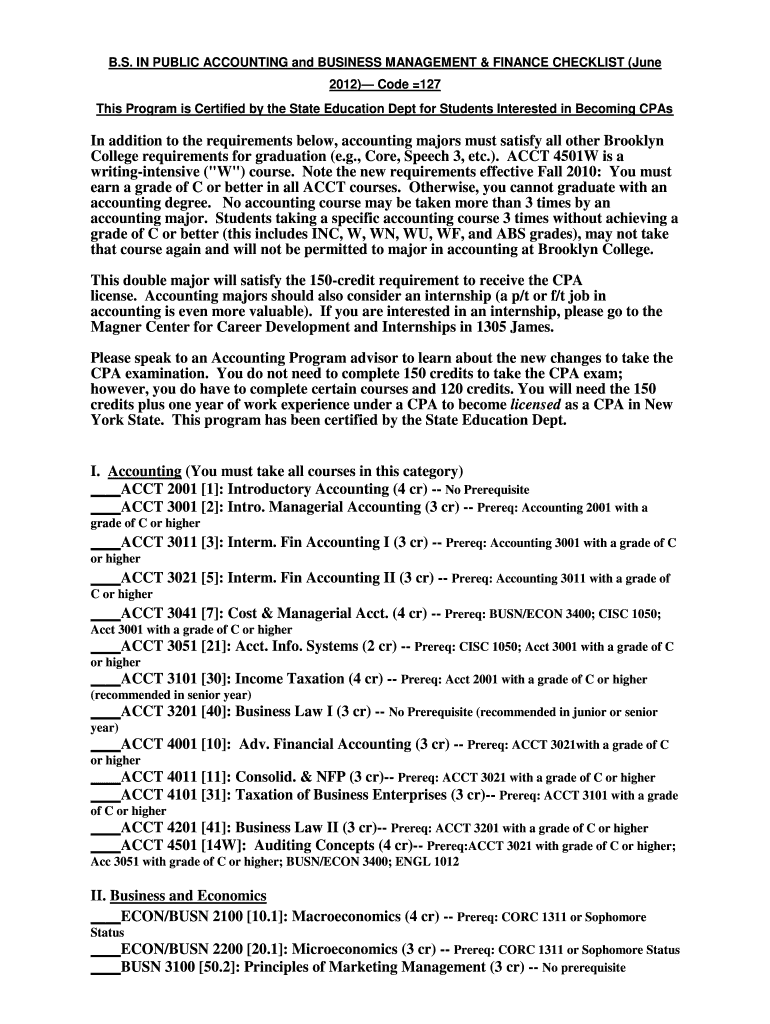

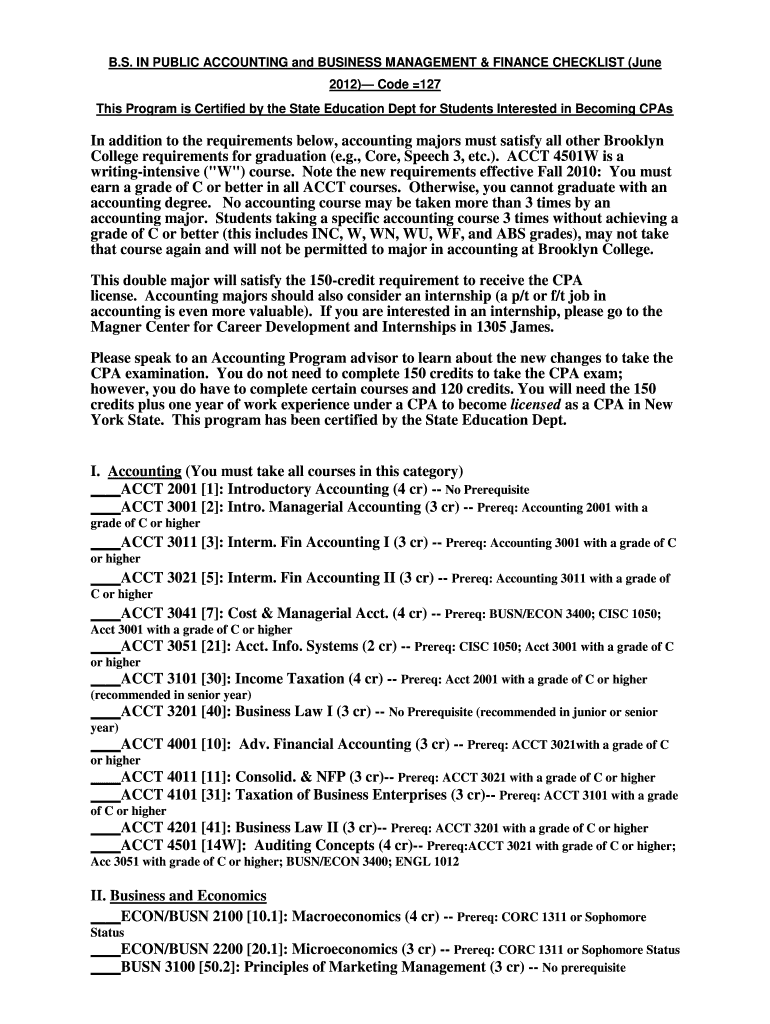

B.S. IN PUBLIC ACCOUNTING and BUSINESS MANAGEMENT & FINANCE CHECKLIST (June 2012) Code 127 This Program is Certified by the State Education Dept for Students Interested in Becoming Chain addition

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in public accounting and

Edit your in public accounting and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in public accounting and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in public accounting and online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit in public accounting and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in public accounting and

How to fill out in public accounting and:

01

Familiarize yourself with the necessary documents: When filling out forms or reports in public accounting, it is important to first understand the specific documents required. These may include financial statements, tax returns, or audit reports. Familiarize yourself with the format and content of these documents.

02

Gather all relevant financial information: In order to accurately complete the forms, you will need to gather all relevant financial information. This includes income statements, balance sheets, bank statements, and other financial records. Ensure that you have all the necessary data before beginning the filling process.

03

Review applicable accounting standards and regulations: Public accounting requires compliance with various accounting standards and regulations. It is essential to review and understand these guidelines to ensure accurate and compliant reporting. Examples of these standards include Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

04

Input data accurately and consistently: When filling out the necessary forms, it is crucial to input data accurately. Double-check all numbers and ensure that they are entered in the correct format. Consistency is also important, so use the same accounting conventions and units throughout the document.

05

Seek professional assistance if needed: Public accounting can be complex, especially for individuals without an accounting background. If you are unsure about any aspect of the filling process, do not hesitate to seek professional assistance. Consulting an accountant or a tax advisor can help ensure accuracy and adherence to regulations.

Who needs public accounting and:

01

Small and medium-sized businesses: Public accounting is vital for small and medium-sized businesses, as it helps with accurate financial reporting and compliance. It enables them to track their financial performance, identify areas for improvement, and meet regulatory requirements.

02

Large corporations and multinational companies: Public accounting is equally important for large corporations and multinational companies. These entities often have complex financial structures and international operations, requiring expert advice and auditing services to ensure accurate reporting and compliance with international accounting standards.

03

Non-profit organizations: Non-profit organizations also benefit from public accounting services. They must adhere to specific accounting standards and regulations, including reporting contributions, managing funds, and demonstrating transparency in financial activities. Public accounting helps them maintain accountability and gain trust from donors and stakeholders.

04

Individuals and high-net-worth individuals: Public accounting services are not limited to businesses and organizations. Individuals, including high-net-worth individuals, may also need public accounting services for tax planning, retirement planning, estate planning, and other financial matters. Public accountants provide guidance and assist individuals in navigating complex financial situations and maximizing tax benefits.

In conclusion, understanding how to fill out in public accounting and requires familiarity with the necessary documents, accurate data input, and compliance with accounting regulations. Public accounting services are needed by small and medium-sized businesses, large corporations, non-profit organizations, and individuals for various financial and compliance-related purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is in public accounting and?

Public accounting involves providing accounting services to individuals, businesses, and organizations.

Who is required to file in public accounting and?

Professional accountants and accounting firms are required to file in public accounting.

How to fill out in public accounting and?

In public accounting, forms and reports must be accurately completed following accounting standards and regulations.

What is the purpose of in public accounting and?

The purpose of public accounting is to provide assurance and financial information to stakeholders.

What information must be reported on in public accounting and?

In public accounting, financial statements, audits, tax returns, and other financial information must be reported.

How do I modify my in public accounting and in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign in public accounting and and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out the in public accounting and form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign in public accounting and and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit in public accounting and on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign in public accounting and right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your in public accounting and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In Public Accounting And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.