FL FPL Form 6037A 2010-2026 free printable template

Show details

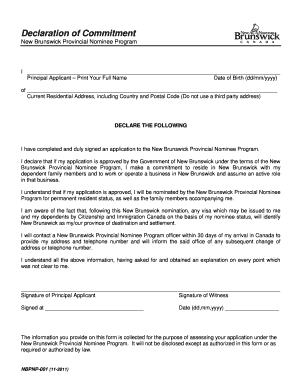

FORM 6037A Rev 6/2010-Page 1 of 2 FLORIDA STATE SALES AND USE TAX Exemption Certificate and Indemnity Agreement For Residential Facilities with Common Areas and 100% Exempt Usage FULL NAME OF PURCHASER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL FPL Form 6037A

Edit your FL FPL Form 6037A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL FPL Form 6037A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL FPL Form 6037A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL FPL Form 6037A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out FL FPL Form 6037A

How to fill out FL FPL Form 6037A

01

Obtain the FL FPL Form 6037A from the appropriate website or office.

02

Begin by entering your personal information, including your name, address, and contact information.

03

Fill out the relevant sections regarding your household composition and income details.

04

Complete any required declarations or certifications related to the information provided.

05

Review the form to ensure all information is accurate and complete.

06

Sign and date the form at the designated area.

07

Submit the form according to the provided instructions (mail, in-person, etc.).

Who needs FL FPL Form 6037A?

01

Individuals or families applying for financial assistance.

02

Residents seeking to qualify for low-income programs or subsidies.

03

Anyone who requires documentation for eligibility verification based on income.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a PA sales tax exemption certificate?

HOW TO GET A RESALE CERTIFICATE IN PENNSYLVANIA ✔ STEP 1 : Complete a PA-100 Form (sales tax registration) ✔ STEP 2 : Fill out the Pennsylvania REV-1220 exemption certificate form. ✔ STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

Who is exempt from paying PA sales tax?

Tax-exempt goods Some goods are exempt from sales tax under Pennsylvania law. Examples include most non-prepared food items, items purchased with food stamps, prescription drugs, and most (but not all) wearing apparel.

How long is a Pennsylvania exemption certificate good for?

The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies.

Who needs to pay PA sales tax?

Out-of-state businesses and Internet vendors often falsely advertise that they sell taxable items “tax free”. However, Pennsylvania law requires the payment of use tax by any person who purchases taxable goods or services delivered into or used in Pennsylvania if sales tax is not collected by the vendor.

How do I fill out a Pennsylvania exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

Who is exempt from sales tax in Pennsylvania?

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute FL FPL Form 6037A online?

Completing and signing FL FPL Form 6037A online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in FL FPL Form 6037A?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your FL FPL Form 6037A to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit FL FPL Form 6037A in Chrome?

FL FPL Form 6037A can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is FL FPL Form 6037A?

FL FPL Form 6037A is a form used in Florida for reporting financial information relating to tangible personal property.

Who is required to file FL FPL Form 6037A?

Any business or individual in Florida who owns tangible personal property with a total value above the established threshold is required to file FL FPL Form 6037A.

How to fill out FL FPL Form 6037A?

To fill out FL FPL Form 6037A, you need to provide details about the tangible personal property you own, including descriptions, values, and any applicable exemptions or deductions.

What is the purpose of FL FPL Form 6037A?

The purpose of FL FPL Form 6037A is to provide the Florida Department of Revenue with the necessary information to assess taxes on tangible personal property.

What information must be reported on FL FPL Form 6037A?

FL FPL Form 6037A must report information such as the type of tangible personal property, its location, value, and any exemptions that may apply.

Fill out your FL FPL Form 6037A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL FPL Form 6037a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.