Get the free Mortgage Allowance Scheme - galway

Show details

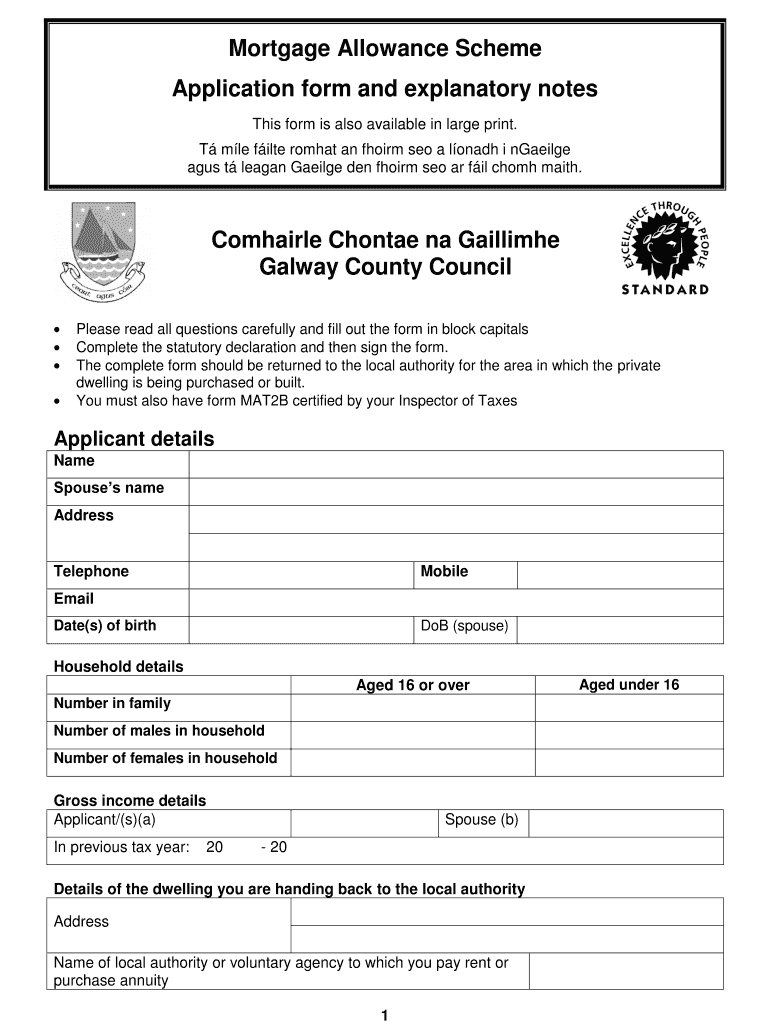

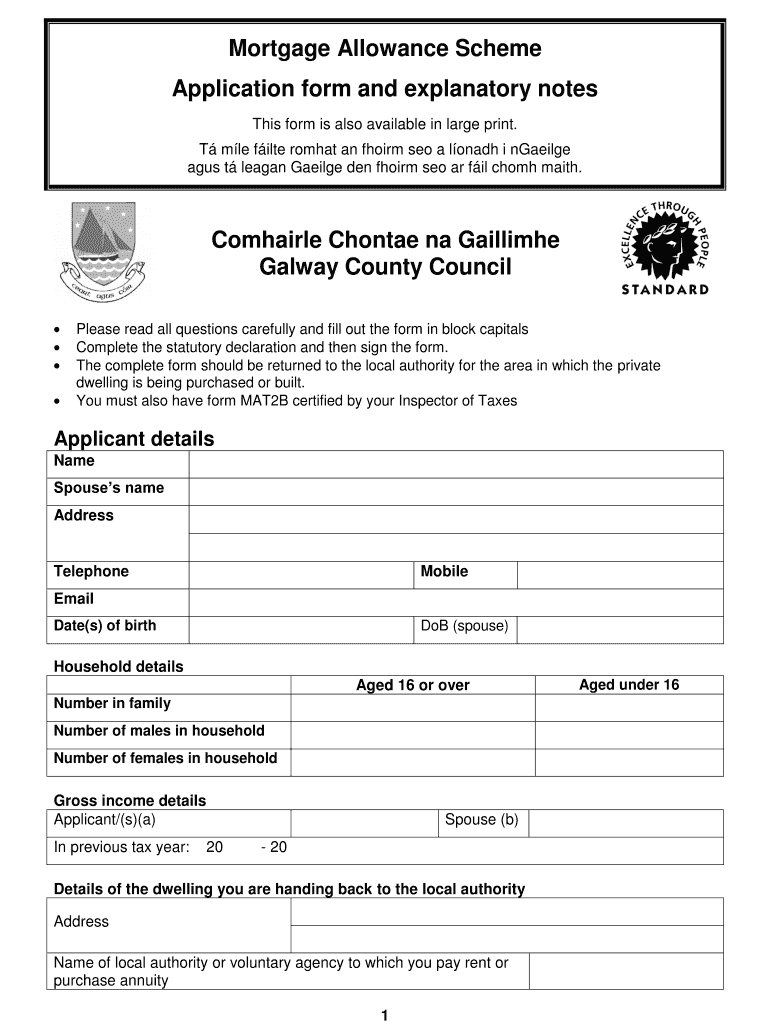

Mortgage Allowance Scheme Application form and explanatory notes This form is also available in large print. T me file Roman a form SEO a load I garage ages t Reagan Goalie den form SEO AR film chomp

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage allowance scheme

Edit your mortgage allowance scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage allowance scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage allowance scheme online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage allowance scheme. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage allowance scheme

01

Start by gathering all the necessary documents and information. This may include your identification card, proof of income, employment details, mortgage loan information, and any other relevant financial documents.

02

Familiarize yourself with the specific requirements and eligibility criteria for the mortgage allowance scheme in your country or region. This will help ensure that you meet all the necessary criteria and avoid any delays or complications.

03

Begin the application process by accessing the official website or contacting the relevant authority responsible for administering the mortgage allowance scheme. They will provide you with the necessary forms and guidelines to complete the application.

04

Carefully fill out the application form, providing accurate and complete information. Pay close attention to any instructions or requirements provided, as missing or incorrect information could lead to delays or rejection of your application.

05

Attach any supporting documents required, such as proof of income, employment contracts, mortgage loan agreements, or any other requested documentation. Make sure to make copies of all the documents you submit for your records.

06

Review your completed application form and supporting documents before submitting them. Check for any errors or omissions and make any necessary corrections to ensure the accuracy of your application.

07

Submit your completed application form and supporting documents according to the instructions provided by the mortgage allowance scheme authority. This may involve mailing them, submitting them electronically, or hand-delivering them to a designated location.

08

Wait for the review and processing of your application by the mortgage allowance scheme authority. Depending on the specific scheme and workload, this could take some time. Be patient and avoid contacting them unnecessarily for updates, as they will inform you of any progress or additional requirements if necessary.

Who needs mortgage allowance scheme?

01

Individuals or families purchasing a property and requiring financial assistance to help pay their mortgage may benefit from a mortgage allowance scheme.

02

Individuals with lower incomes who struggle to meet the financial burden of a mortgage may find the mortgage allowance scheme helpful in reducing their monthly payments and making homeownership more affordable.

03

The mortgage allowance scheme may be particularly relevant for first-time homebuyers, as it can provide them with an opportunity to enter the property market and achieve homeownership.

04

Those who qualify for the mortgage allowance scheme may also benefit from potential tax deductions or other incentives, depending on the specific regulations and policies of the scheme.

05

It is important to note that eligibility criteria and requirements may vary depending on the country or region, so it is essential to research and understand the specific conditions of the mortgage allowance scheme available to you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage allowance scheme?

The mortgage allowance scheme is a government program that provides financial aid to help individuals or families pay for their mortgage.

Who is required to file mortgage allowance scheme?

Individuals or families who have a mortgage and meet the eligibility criteria set by the government are required to file for the mortgage allowance scheme.

How to fill out mortgage allowance scheme?

To fill out the mortgage allowance scheme, individuals or families need to provide information about their mortgage, income, and other relevant details as required by the government.

What is the purpose of mortgage allowance scheme?

The purpose of mortgage allowance scheme is to assist individuals or families in paying for their mortgage and to reduce financial burden.

What information must be reported on mortgage allowance scheme?

The information that must be reported on mortgage allowance scheme includes details about mortgage, income, number of dependents, and any other relevant information required by the government.

How do I modify my mortgage allowance scheme in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your mortgage allowance scheme along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute mortgage allowance scheme online?

pdfFiller has made it simple to fill out and eSign mortgage allowance scheme. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit mortgage allowance scheme online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your mortgage allowance scheme to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your mortgage allowance scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Allowance Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.