Get the free Understanding Your Insurance Coverage Questions to Ask Your

Show details

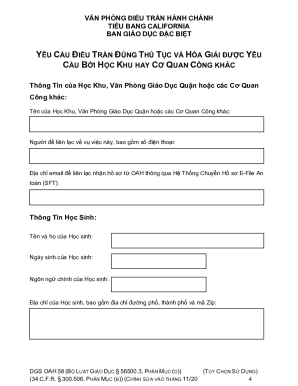

Understanding Your Insurance Coverage Questions to Ask Your Insurance Representative Name of Representative: BENEFITS / COVERED SERVICES Yes / No Does my plan cover hospital charges? Yes No Does my

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding your insurance coverage

Edit your understanding your insurance coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding your insurance coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding your insurance coverage online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding your insurance coverage. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding your insurance coverage

How to fill out understanding your insurance coverage:

01

Start by gathering all your insurance documentation, including policy statements, coverage details, and any correspondence from your insurance provider.

02

Read through each document carefully, paying close attention to the terms, conditions, and exclusions mentioned in your insurance coverage. Take notes or highlight important points for reference.

03

Familiarize yourself with the different types of insurance coverage you have, such as health insurance, auto insurance, home insurance, etc. Understand the specific coverage limits, deductibles, and any co-pays or premiums associated with each policy.

04

Identify the key benefits and protections provided by your insurance. This may include medical expenses coverage, liability protection, property damage coverage, or financial compensation for specific events or accidents.

05

Explore the details of any additional riders or endorsements you may have purchased. These are usually optional add-ons that provide extra coverage for specific needs, such as jewelry or electronics.

06

Assess your understanding of the insurance terminology used throughout the documents. If certain terms or concepts are unclear, refer to the glossary or contact your insurance provider for clarification.

07

Determine the scope of your insurance coverage by evaluating what is included and what is excluded. Be aware of any limitations, restrictions, or situations where the coverage may not apply.

08

Understand the process of filing a claim and the necessary steps involved. This may include contacting your insurance provider, documenting any damages or injuries, providing supporting documents, and adhering to any specified timelines.

09

Study the policy renewal guidelines to ensure you are aware of any changes or updates to your coverage. Stay informed about any revised terms, premium adjustments, or modifications that may affect your insurance benefits.

Who needs understanding your insurance coverage?

01

Individuals who have recently purchased insurance policies and want to make sure they fully comprehend the terms and benefits of their coverage.

02

People who are considering switching insurance providers and want to compare and contrast the different offerings and understand what is included in each policy.

03

Those who have experienced a significant life event, such as marriage, divorce, the birth of a child, or a change in employment, as these events may impact their insurance needs and require a review of their coverage.

04

Policyholders who have encountered a claim situation and need to navigate the claims process, understanding their entitlements, and ensuring fair compensation.

05

Anyone who wants to have peace of mind by knowing the extent of their insurance coverage and the level of protection it provides in different situations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is understanding your insurance coverage?

Understanding your insurance coverage means knowing the details of what is covered by your insurance policy, including the types of coverage, limits, and any exclusions.

Who is required to file understanding your insurance coverage?

Policyholders or individuals covered by an insurance policy are required to understand their insurance coverage.

How to fill out understanding your insurance coverage?

To fill out understanding your insurance coverage, carefully review your policy documents, ask questions to your insurance provider, and seek clarification on any terms or coverage options.

What is the purpose of understanding your insurance coverage?

The purpose of understanding your insurance coverage is to ensure that you are adequately protected in case of unexpected events or losses, and to avoid any misunderstandings or disputes with your insurance provider.

What information must be reported on understanding your insurance coverage?

Information such as policy number, coverage limits, deductible amount, terms and conditions, and contact information for the insurance provider must be reported on understanding your insurance coverage.

How do I complete understanding your insurance coverage online?

Easy online understanding your insurance coverage completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit understanding your insurance coverage on an iOS device?

Create, edit, and share understanding your insurance coverage from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit understanding your insurance coverage on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as understanding your insurance coverage. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your understanding your insurance coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Your Insurance Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.