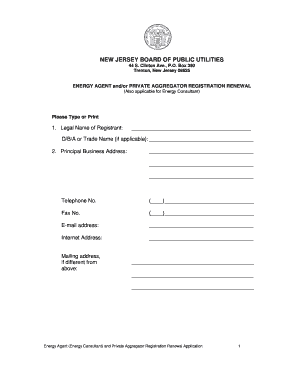

Get the free Commodity Trading and Futures

Show details

CHARTERED INSTITUTE OF STOCKBROKERS QUESTIONS Examination Paper 1.3 Derivative Valuation and Analysis Portfolio Management Commodity Trading and Futures Professional Examination March 2014 Level 1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commodity trading and futures

Edit your commodity trading and futures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

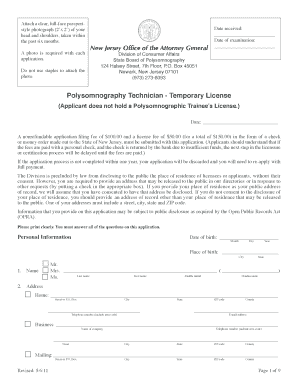

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commodity trading and futures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commodity trading and futures online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

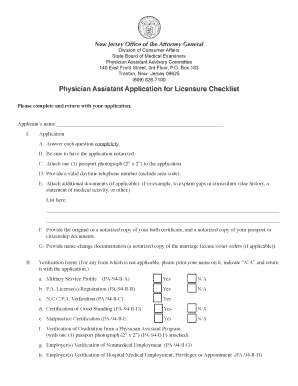

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit commodity trading and futures. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

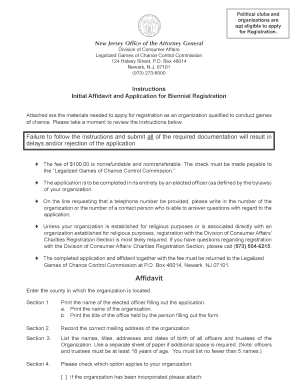

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commodity trading and futures

How to fill out commodity trading and futures:

01

Familiarize yourself with the basics: Start by understanding the concept of commodity trading and futures, including the terminology, trading platforms, and regulations involved. Research and educate yourself on the market dynamics and factors influencing commodity prices.

02

Open a trading account: Choose a reputable brokerage firm that offers commodity trading and futures services. Follow their registration process and provide the necessary documentation to open an account. This usually involves identity verification and financial information.

03

Determine your trading goals and risk tolerance: Before starting any trading activities, define your objectives and assess your risk tolerance. Commodity trading and futures involve market volatility and risks, so it is essential to have a clear understanding of your financial goals and risk appetite.

04

Learn technical and fundamental analysis: To make informed trading decisions, develop your knowledge in technical and fundamental analysis. Technical analysis involves studying price charts, patterns, and indicators, while fundamental analysis focuses on analyzing supply and demand factors, global events, and market trends.

05

Create a trading plan: Establish a well-defined trading plan that outlines your trading strategies, risk management rules, and profit targets. Stick to your plan and adapt it as necessary to meet changing market conditions.

06

Practice using a demo account: Before risking real capital, practice trading using a demo account. Most brokerage firms offer demo accounts that simulate real market conditions. Use this opportunity to refine your trading skills, understand the trading platform, and test different strategies.

07

Start trading with real money: Once you feel confident and comfortable with your trading abilities, start trading with real money. Start small and gradually increase your position size as you gain experience and attain consistent profitability.

08

Continuously analyze and adapt: Regularly review your trades, analyze your performance, and identify areas for improvement. Adapt your trading strategies, risk management techniques, and trading plan based on your analysis to optimize your results.

Who needs commodity trading and futures?

01

Individual investors: Individuals who want to diversify their investment portfolios or speculate on commodity price movements can engage in commodity trading and futures.

02

Hedgers: Businesses involved in the production, distribution, or consumption of commodities can use commodity futures contracts to hedge against price fluctuations. This helps them secure a predetermined price for their commodities and manage their exposure to market risks.

03

Speculators: Traders who aim to profit from short-term price fluctuations in the commodities market can participate in commodity trading and futures. These speculators analyze market trends, news, and other factors to predict price movements and generate profits.

04

Farmers and producers: Individuals engaged in agricultural activities or commodity production often use futures contracts to mitigate potential losses caused by adverse weather conditions, pests, or changes in market conditions.

05

Institutional investors: Banks, hedge funds, and other large financial institutions engage in commodity trading and futures to diversify their investment portfolios and capture opportunities in the commodities market.

Overall, commodity trading and futures are suitable for a wide range of market participants, including individuals, businesses, investors, and speculators, looking to manage risk, speculate on price movements, or diversify their investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit commodity trading and futures in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your commodity trading and futures, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the commodity trading and futures electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your commodity trading and futures and you'll be done in minutes.

How do I fill out the commodity trading and futures form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign commodity trading and futures and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is commodity trading and futures?

Commodity trading involves buying and selling raw materials or primary agricultural products, while futures trading involves the buying and selling of contracts for a specified amount of a commodity at a certain price on a specific future date.

Who is required to file commodity trading and futures?

Individuals or entities that engage in commodity trading and futures trading are required to file relevant documentation with the appropriate regulatory authorities.

How to fill out commodity trading and futures?

To fill out commodity trading and futures forms, individuals or entities must provide information about their trading activities, financial positions, and compliance with regulations.

What is the purpose of commodity trading and futures?

The purpose of commodity trading and futures is to provide a market for price discovery, risk management, and speculation related to raw materials and primary agricultural products.

What information must be reported on commodity trading and futures?

Information that must be reported on commodity trading and futures includes trading volume, positions held, financial statements, and compliance with regulatory requirements.

Fill out your commodity trading and futures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commodity Trading And Futures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.