Get the free Business Internet Banking Risk Assessment - Busey Bank

Show details

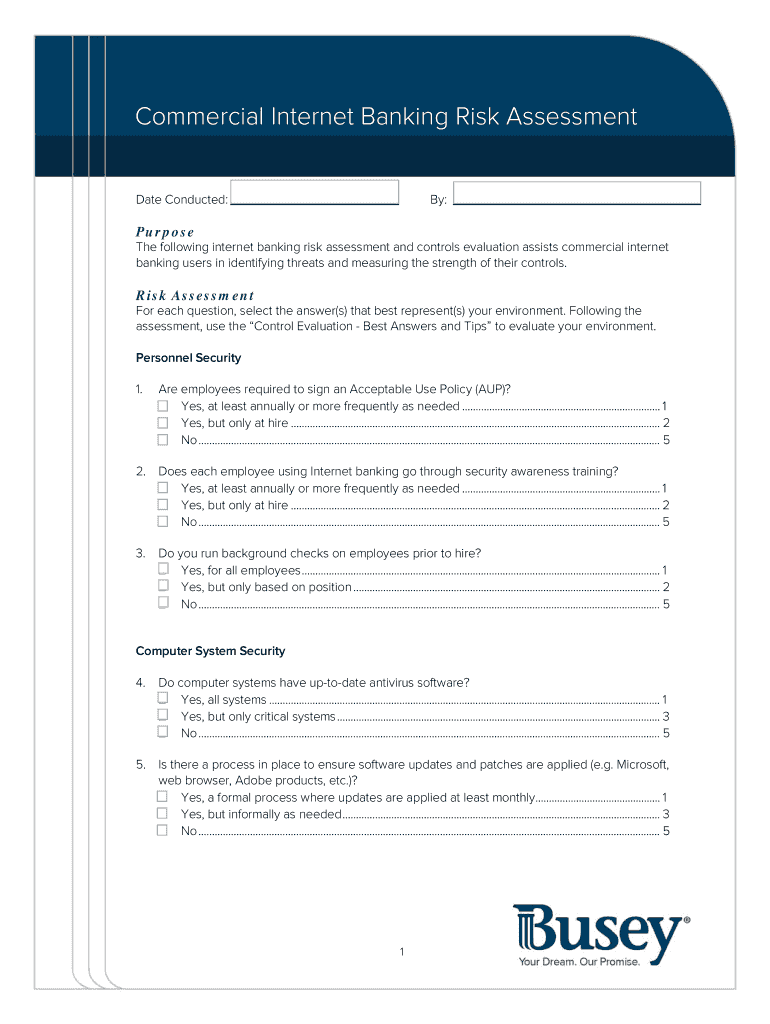

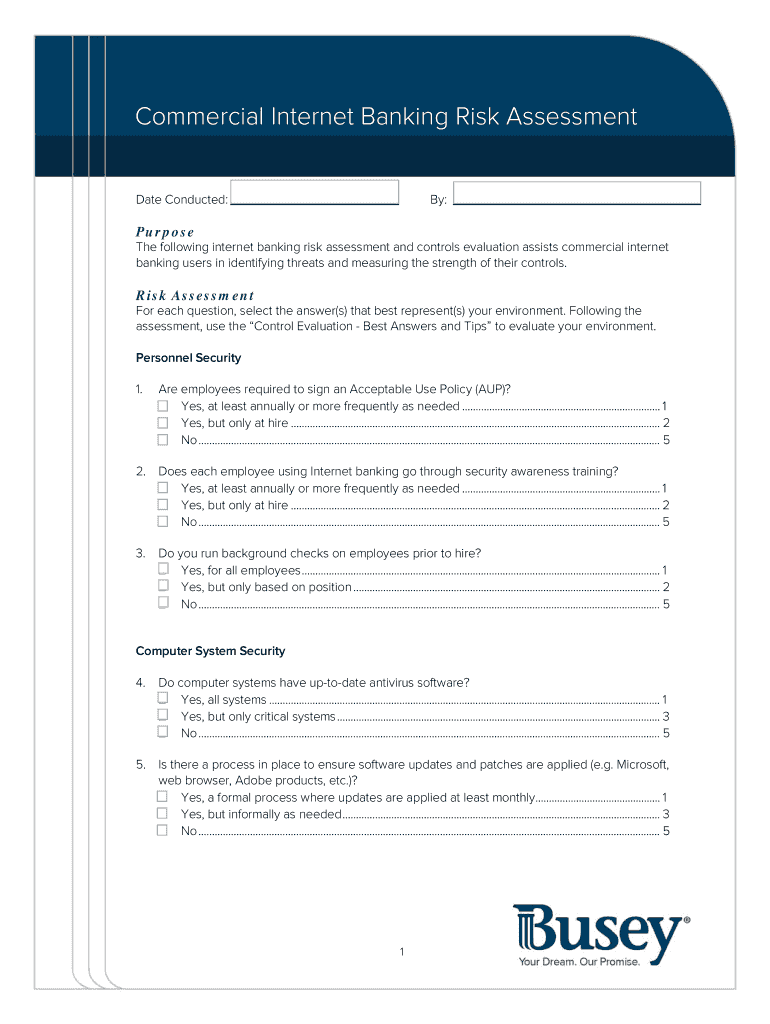

Commercial Internet Banking Risk Assessment Date Conducted: By: Purpose The following internet banking risk assessment and controls evaluation assists commercial internet banking users in identifying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business internet banking risk

Edit your business internet banking risk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business internet banking risk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business internet banking risk online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business internet banking risk. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business internet banking risk

How to fill out the business internet banking risk:

01

Start by identifying the potential risks associated with your business internet banking activities. This can include security threats, fraudulent activities, data breaches, or unauthorized access.

02

Assess the potential impact of these risks on your business operations, financial stability, reputation, and customer trust.

03

Develop a risk management plan that outlines the strategies and measures you will implement to mitigate these risks. This can include implementing strong security protocols, using multi-factor authentication, regularly updating software and firewalls, and educating employees on best practices.

04

Allocate resources and assign responsibilities to ensure the effective implementation of your risk management plan. This may involve training employees, hiring specialized IT professionals, or partnering with a reliable cybersecurity firm.

05

Regularly monitor and evaluate the effectiveness of your risk management measures. Conduct internal audits, review security logs, and stay updated on the latest threats and vulnerabilities.

06

Continuously adapt and improve your risk management plan as technology evolves and new risks emerge. Stay informed about industry best practices and regulatory requirements to ensure compliance.

07

Finally, regularly communicate with your stakeholders, such as employees, customers, and business partners, about the measures you are taking to safeguard against internet banking risks. This fosters transparency, trust, and reinforces your commitment to security.

Who needs business internet banking risk?

01

Businesses of all sizes and industries that utilize internet banking services can benefit from assessing and managing their internet banking risks. This includes small businesses, startups, multinational corporations, financial institutions, and non-profit organizations.

02

Companies that handle sensitive customer information, such as personal or financial data, are particularly susceptible to internet banking risks. This includes e-commerce businesses, financial service providers, healthcare organizations, and government agencies.

03

Any organization that conducts financial transactions online or stores valuable data on their business internet banking platform must prioritize risk management to protect themselves and their customers from potential threats. This is crucial for maintaining the trust and confidence of clients and stakeholders while safeguarding the integrity and confidentiality of sensitive information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business internet banking risk?

Business internet banking risk refers to the potential threats and vulnerabilities associated with conducting financial transactions online.

Who is required to file business internet banking risk?

Businesses that utilize internet banking services are required to assess and report their business internet banking risk.

How to fill out business internet banking risk?

Businesses can fill out the business internet banking risk assessment by identifying potential risks, evaluating their impact, and implementing mitigation strategies.

What is the purpose of business internet banking risk?

The purpose of business internet banking risk assessment is to proactively identify and address any potential security threats or vulnerabilities in online financial transactions.

What information must be reported on business internet banking risk?

Businesses must report the identified risks, impact assessment, and mitigation strategies implemented to address the risks on the business internet banking risk assessment.

How can I modify business internet banking risk without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your business internet banking risk into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in business internet banking risk?

With pdfFiller, the editing process is straightforward. Open your business internet banking risk in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the business internet banking risk in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your business internet banking risk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Internet Banking Risk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.