Get the free Child Care Investment Tax Credit Application

Show details

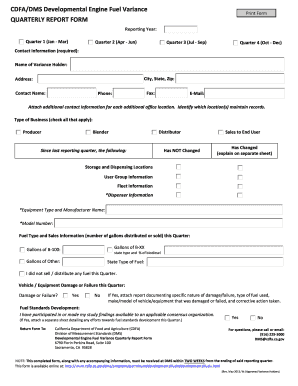

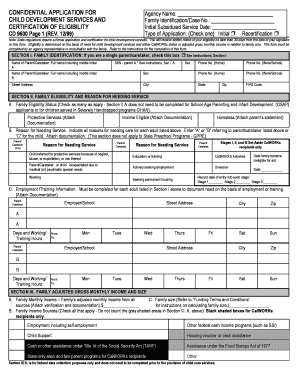

Child Care Investment Tax Credit Qualified Investments in Child Care Programs Application for Certification When this application receives a certificate number below attach this document to your Maine income tax return to claim the credit. Maine Revenue Service will be informed of the certificate number and the amount of the credit Taxpayer Information Check one Taxpayer/Entity Name Address Phone Social Security Number or Federal ID Number Description of Qualified Investment Applicant must...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign child care investment tax

Edit your child care investment tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your child care investment tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing child care investment tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit child care investment tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out child care investment tax

How to fill out Child Care Investment Tax Credit Application

01

Obtain the Child Care Investment Tax Credit Application form from your local tax authority or the official government website.

02

Read the instructions carefully to understand the eligibility requirements and guidelines for filling out the application.

03

Fill in your personal information including name, address, and contact details in the designated sections of the application.

04

Provide details about your child care facility such as its name, address, and type of services offered.

05

Include information about the number of children enrolled and their ages as required on the application.

06

Calculate the eligible expenses incurred for child care services and provide documentation as proof of those expenses.

07

Review the application for completeness, ensuring all required fields are filled in correctly.

08

Sign and date the application, confirming that the information provided is accurate and truthful.

09

Submit the completed application by the specified deadline, either online or by mailing it to the appropriate authorities.

Who needs Child Care Investment Tax Credit Application?

01

Parents or guardians who are seeking financial assistance for child care expenses.

02

Child care providers looking to benefit from tax credits to reduce operational costs.

03

Businesses offering child care services wanting to apply for tax incentives related to their services.

04

Employers providing child care benefits to their employees.

Fill

form

: Try Risk Free

People Also Ask about

What proof do you need for a child care tax credit?

To complete Form 2441, you typically need the following information from your childcare provider: The name, address, and taxpayer identification number (TIN), social security number (SSN), or employer identification number (EIN) of the childcare provider. The total amount paid for childcare services during the tax year.

How do you claim the $8000 Child Tax Credit?

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

What disqualifies the taxpayer from claiming the Child and Dependent Care Credit?

In most years you can claim the credit regardless of your income. The Child and Dependent Care Credit does get smaller at higher incomes, but it doesn't disappear - except for 2021. In 2021, the credit is unavailable for any taxpayer with adjusted gross income over $438,000.

What documents are needed to prove Child Tax Credit?

Birth certificates or other official documents of birth, marriage certificates, letter from an authorized adoption agency, letter from the authorized placement agency, or applicable court document that verify your relationship to the child (send these documents only for a qualifying child who is not your natural or

Why am I only getting $1200 for dependent care credit?

The percentage of expenses a family can claim steadily decreases as income rises, until families with AGI of $43,000 or more reach the minimum claim rate of 20 percent, qualifying for a maximum potential credit of $1,200. Unlike the Earned Income Tax Credit and the Child Tax Credit, the CDCTC is non-refundable.

Do I have to fill out form 2441?

Eligible taxpayers must complete and submit Form 2441 with their Form 1040 tax returns to claim the Child and Dependent Care Credit. This form details the amount paid for dependent care under qualifying circumstances and to whom payment was made. It also calculates the available tax credit.

What information do you need to claim childcare on taxes?

You must report the name, address, and TIN (either the Social Security number or the employer identification number) of the care provider on your return. If the care provider is a tax-exempt organization, you need only report the name and address of the organization on your return.

Does the IRS ask for proof of child care expenses?

You need to be able to verify childcare expenses in case of an audit. If you don't have proof that you paid these expenses, you can't claim the credit. You don't have to bring the receipts to your tax pro or mail them with your return. Just keep them with your personal records for at least three years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Child Care Investment Tax Credit Application?

The Child Care Investment Tax Credit Application is a form that allows eligible taxpayers to apply for tax credits related to investments in child care facilities or programs that serve children.

Who is required to file Child Care Investment Tax Credit Application?

Individuals and businesses that have made qualified investments in child care facilities and wish to claim tax credits are required to file the Child Care Investment Tax Credit Application.

How to fill out Child Care Investment Tax Credit Application?

To fill out the application, you must provide personal and business information, details of the qualifying investment, and any supporting documentation to prove eligibility for the tax credit.

What is the purpose of Child Care Investment Tax Credit Application?

The purpose of the application is to incentivize investments in child care infrastructure, thus aiding in the development of more accessible and quality child care options for families.

What information must be reported on Child Care Investment Tax Credit Application?

The application must report information such as the type of investment, the amount of investment, the location of the child care facility, and any relevant financial documents that demonstrate the investment's qualification.

Fill out your child care investment tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Care Investment Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.