Get the free td ameritrade form tda266

Show details

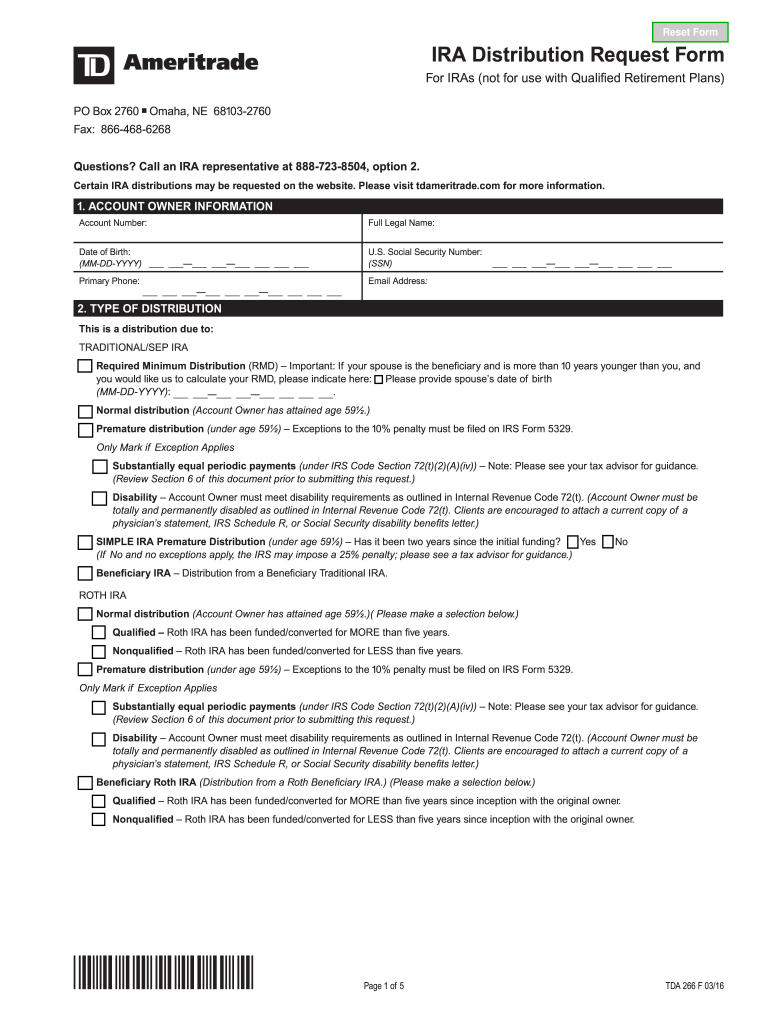

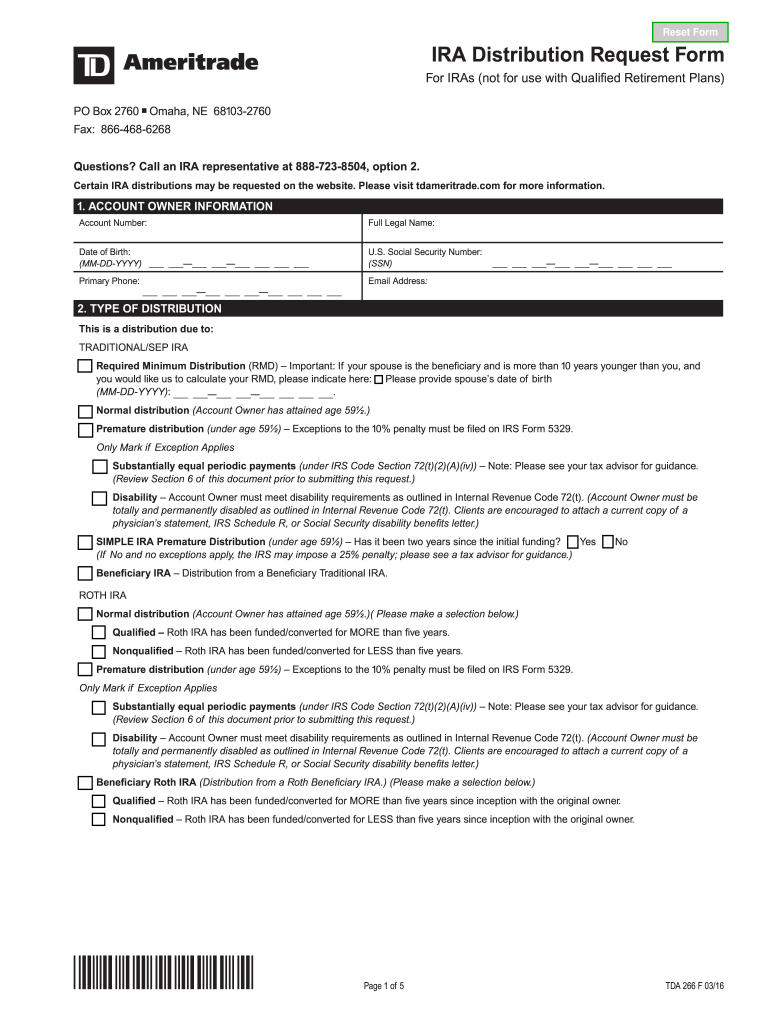

M Mark here if this request is to update your current systematic payments. Mark here if you would like to be able to request verbal IRA Distributions in the future. Please note Witholding elections indicated on this form will apply to any future verbal distribution requests. By signing this document you are authorizing TD Ameritrade to accept verbal distribution instructions for variable amounts. By signing this document you are authorizing TD Am...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign td ameritrade form tda266

Edit your td ameritrade form tda266 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your td ameritrade form tda266 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing td ameritrade form tda266 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit td ameritrade form tda266. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out td ameritrade form tda266

How to fill out td ameritrade form tda266:

01

Start by reading the instructions provided with the form carefully. This will give you a clear understanding of what information is required and how to complete the form accurately.

02

Gather all the necessary documents and information needed to fill out the form. This may include your personal identification details, financial information, and any supporting documents that may be required.

03

Begin filling out the form by entering your personal details such as your name, address, contact information, and social security number.

04

Proceed to the sections related to your financial information. This may involve providing details about your employment, income, assets, and liabilities. Fill out each section accurately and truthfully.

05

If there are specific instructions or fields that you are unsure about, consider reaching out to a representative from td ameritrade for clarification. They will be able to provide guidance and answer any questions you may have.

06

Once you have completed all the required sections, review the form to ensure all information is accurate and complete. Double-check for any errors or omissions that may cause delays or complications.

07

Sign and date the form as required. Keep a copy of the completed form for your records before submitting it to td ameritrade.

Who needs td ameritrade form tda266:

01

Individuals who intend to open a td ameritrade account may need to fill out form tda266. This form is typically required during the account opening process.

02

Investors who want to authorize certain actions or make specific requests related to their td ameritrade account may also need to use this form.

03

It is recommended to check with td ameritrade customer support or review their website for specific situations or circumstances where form tda266 may be necessary.

Fill

form

: Try Risk Free

People Also Ask about

How do I take RMD from TD Ameritrade?

1:24 2:50 Taking Required Minimum Distributions - YouTube YouTube Start of suggested clip End of suggested clip Process go to planning and retirement. And select IRA then select either distributions on the leftMoreProcess go to planning and retirement. And select IRA then select either distributions on the left side menu or you can select manage distributions. From there select take a distribution. Here. You

Can you take money out of a Roth IRA and put it back without penalty?

You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. However, you may have to pay taxes and penalties on earnings in your Roth IRA.

Can I withdraw money from my Roth IRA and put it back?

Withdrawing and Returning Roth Funds ing to the IRS, you can make a tax-free withdrawal of some or all of the money in your Roth IRA as long as you put the money back into the same Roth IRA within 60 days. This is considered a Roth IRA rollover in the eyes of the IRS.

Does TD Ameritrade withhold taxes on IRA withdrawals?

Withholding will apply to the entire withdrawal, since the entire withdrawal may be included in your income that is subject to federal income tax. You may elect not to have withholding apply to your withdrawal payments by completing and dating this election and returning it to TD Ameritrade Clearing, Inc.

What happens if you withdraw cash from Roth IRA?

The early withdrawal penalty for a traditional or Roth individual retirement account (IRA) is 10% of the amount withdrawn. Also, you may owe income tax in addition to the penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the td ameritrade form tda266 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your td ameritrade form tda266 in seconds.

Can I edit td ameritrade form tda266 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign td ameritrade form tda266 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit td ameritrade form tda266 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as td ameritrade form tda266. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is td ameritrade form tda266?

Td ameritrade form tda266 is a tax form used to report financial transactions and investment activities to the Internal Revenue Service (IRS).

Who is required to file td ameritrade form tda266?

Individuals or entities who have engaged in financial transactions or investment activities through td ameritrade during the tax year are required to file td ameritrade form tda266.

How to fill out td ameritrade form tda266?

To fill out td ameritrade form tda266, you need to provide information about your financial transactions and investment activities conducted through td ameritrade. This may include details about the type of transactions, amounts invested, gains or losses incurred, and any applicable deductions or credits.

What is the purpose of td ameritrade form tda266?

The purpose of td ameritrade form tda266 is to report financial transactions and investment activities conducted through td ameritrade to the IRS for tax purposes.

What information must be reported on td ameritrade form tda266?

Td ameritrade form tda266 requires reporting of various information, including details about the type of transactions, amounts invested, gains or losses incurred, and any applicable deductions or credits.

Fill out your td ameritrade form tda266 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Td Ameritrade Form tda266 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.