Get the free Private Equity amp Venture Forum Korea 2015

Show details

Private Equity & Venture Forum Korea 2015 15 September, South Korea Weston Chosen, Seoul 9 15, GLOBAL PERSPECTIVE, LOCAL OPPORTUNITY / Driving the creative economy through private equity and venture

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private equity amp venture

Edit your private equity amp venture form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private equity amp venture form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private equity amp venture online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit private equity amp venture. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private equity amp venture

How to fill out private equity and venture?

01

Understand the investment process: Familiarize yourself with the basics of private equity and venture capital, including the different stages of funding, investment structures, and types of investors involved. This will help you navigate the complexities of the process.

02

Identify your investment goals: Determine what you hope to achieve through private equity and venture capital investments. Whether you're looking for high returns, long-term partnerships, or strategic growth opportunities, clarifying your goals will guide your investment decisions.

03

Research potential investment opportunities: Conduct thorough research to identify potential investment opportunities. Explore industries and sectors that align with your interests and investment goals. Look for companies with strong growth potential, innovative business models, and experienced management teams.

04

Perform due diligence: Before making any investment, conduct comprehensive due diligence to assess the financial health, market position, and growth prospects of the companies you are considering. This may involve analyzing financial statements, conducting interviews with management, and reviewing market research reports.

05

Seek professional advice: Engage with experts in the field of private equity and venture capital to gain valuable insights and advice. Consult with investment advisors, financial analysts, and legal professionals who specialize in this area to ensure you make informed investment decisions.

06

Assess the risk profile: Evaluate the risk associated with each investment opportunity. Private equity and venture capital investments typically carry a higher level of risk compared to traditional investments. Consider factors such as industry volatility, market conditions, and the stage of the company's development when assessing risk.

07

Prepare a diversified portfolio: To spread the risk and maximize potential returns, it is important to build a diversified portfolio of private equity and venture capital investments. Allocate your capital across different industries, geographies, and stages of companies to minimize the impact of individual investment failures.

Who needs private equity and venture?

01

Entrepreneurs and startups: Private equity and venture capital are crucial sources of funding for entrepreneurs and startups seeking capital to launch or expand their businesses. These funds provide not only financial support but also industry expertise and networking opportunities.

02

Established companies seeking growth: Established companies looking to fuel their growth strategies often turn to private equity and venture capital firms for capital injections. These funds can help companies scale their operations, enter new markets, or invest in research and development.

03

Institutional investors: Institutional investors, such as pension funds, endowments, and insurance companies, often allocate a portion of their portfolios to private equity and venture capital. These investments provide the potential for higher returns than traditional investment vehicles and help diversify their holdings.

04

High-net-worth individuals: Wealthy individuals often invest in private equity and venture capital funds as part of their overall investment strategy. These investments offer the opportunity for significant returns and access to innovative startups or industry disruptors.

05

Fund managers and financial intermediaries: Professionals in the finance industry, such as fund managers and financial intermediaries, play a crucial role in connecting investors with private equity and venture capital opportunities. They provide expertise in identifying and evaluating investment opportunities and help manage the investment process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my private equity amp venture in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your private equity amp venture and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make edits in private equity amp venture without leaving Chrome?

private equity amp venture can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the private equity amp venture electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your private equity amp venture in seconds.

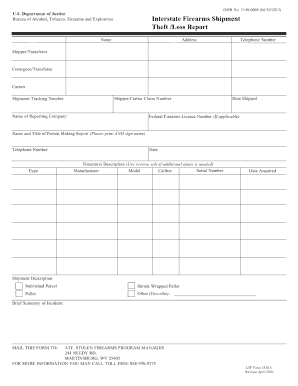

What is private equity amp venture?

Private equity and venture capital are forms of investment where investors provide capital to companies in exchange for ownership stakes.

Who is required to file private equity amp venture?

Companies and individuals involved in private equity and venture capital transactions are required to file reports with regulatory authorities.

How to fill out private equity amp venture?

To fill out a private equity and venture capital report, detailed information about the investment transactions must be provided, including financial terms and ownership structure.

What is the purpose of private equity amp venture?

The purpose of private equity and venture capital is to provide funding to companies to help them grow and expand their operations.

What information must be reported on private equity amp venture?

Information such as the amount of capital invested, the ownership stake acquired, and the financial performance of the company must be reported on private equity and venture capital transactions.

Fill out your private equity amp venture online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Equity Amp Venture is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.