Get the free Schwab SEP-IRA Employer39s Agreement with bb - Blunck Financial

Show details

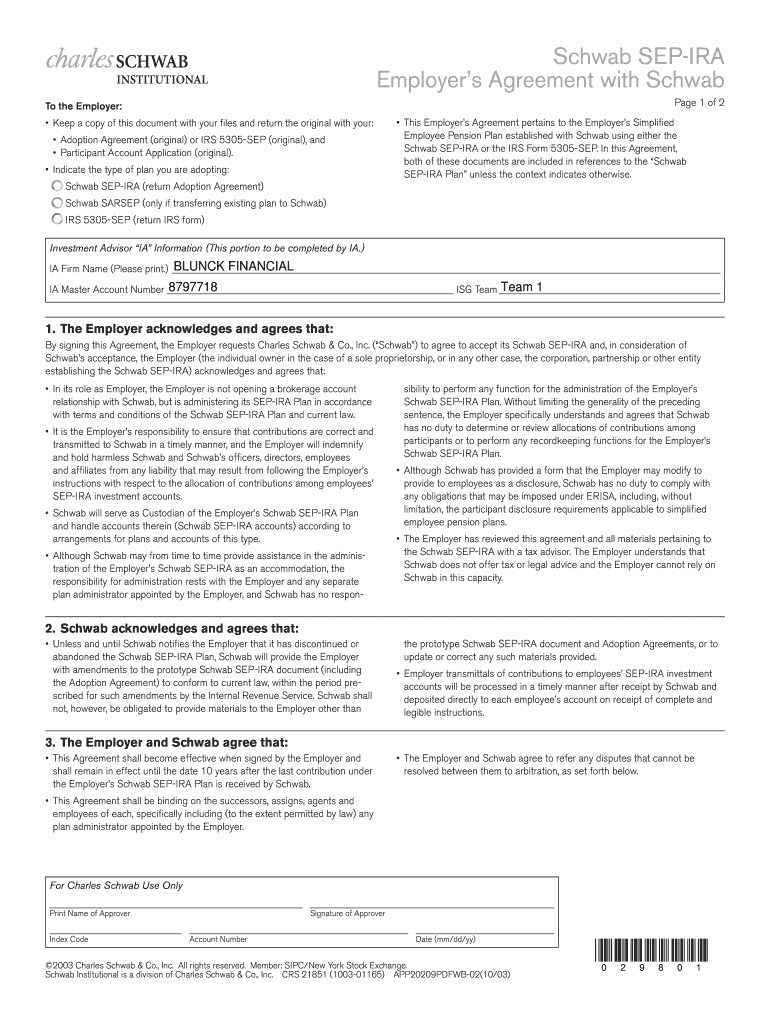

Quit Help Clear Fields Save Form Only Print Schwab SEPIA Employers Agreement with Schwab Page 1 of 2 To the Employer: Keep a copy of this document with your less and return the original with your:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schwab sep-ira employer39s agreement

Edit your schwab sep-ira employer39s agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schwab sep-ira employer39s agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schwab sep-ira employer39s agreement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schwab sep-ira employer39s agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schwab sep-ira employer39s agreement

How to fill out Schwab SEP-IRA Employer's Agreement:

01

Obtain the form: The Schwab SEP-IRA Employer's Agreement can be obtained from Charles Schwab's official website or by contacting their customer service.

02

Enter employer information: Fill out the employer details section of the form, including the business name, employer identification number (EIN), address, and contact information.

03

Choose the plan type: Select the type of SEP-IRA plan you are establishing, such as a Profit Sharing SEP or a Simplified Employee Pension (SEP) plan. This decision may depend on the specific needs and goals of your business.

04

Determine eligibility requirements: Specify the eligibility criteria for employees to participate in the SEP-IRA plan. This may include factors such as age, years of service, or minimum compensation requirements.

05

Determine contribution amounts: Decide on the contribution amounts for the SEP-IRA plan. These contributions can be a percentage of compensation or a flat dollar amount and are usually subject to annual limits set by the IRS.

06

Set up a contribution schedule: Establish a schedule for making employer contributions to the SEP-IRA accounts of eligible employees. This schedule should indicate the frequency and timing of the contributions.

07

Designate a Plan Administrator: Identify an individual or entity responsible for overseeing the administration of the SEP-IRA plan, ensuring compliance with IRS regulations, and communicating with employees about the plan.

Who needs Schwab SEP-IRA Employer's Agreement:

01

Employers offering a retirement plan: The Schwab SEP-IRA Employer's Agreement is necessary for employers who wish to establish a Simplified Employee Pension (SEP) plan or a Profit Sharing SEP for their employees.

02

Small business owners: The SEP-IRA can be an attractive retirement savings option for small businesses, as it allows for tax-deductible contributions, flexibility in contributions, and offers a low-cost and straightforward administrative process.

03

Companies with eligible employees: The agreement is relevant for businesses with eligible employees who meet the criteria for participating in the SEP-IRA plan. This may include individuals working full-time, part-time, or even self-employed individuals.

By following the steps outlined above, employers can successfully complete the Schwab SEP-IRA Employer's Agreement and establish a SEP-IRA plan that aligns with their business needs and provides a valuable retirement savings option for their employees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schwab sep-ira employer39s agreement?

The Schwab SEP-IRA Employer's Agreement is a document that outlines the terms and conditions of establishing and maintaining a SEP-IRA plan for employees.

Who is required to file schwab sep-ira employer39s agreement?

Employers who want to offer a SEP-IRA retirement plan to their employees are required to file the Schwab SEP-IRA Employer's Agreement.

How to fill out schwab sep-ira employer39s agreement?

To fill out the Schwab SEP-IRA Employer's Agreement, the employer needs to provide information about the plan details, eligible employees, contribution amounts, and other relevant information requested in the document.

What is the purpose of schwab sep-ira employer39s agreement?

The purpose of the Schwab SEP-IRA Employer's Agreement is to establish and document the terms of the SEP-IRA retirement plan being offered to employees, including eligibility criteria, contribution limits, and other plan rules.

What information must be reported on schwab sep-ira employer39s agreement?

The Schwab SEP-IRA Employer's Agreement must include information about the employer, eligible employees, plan details, contribution amounts, and any other relevant information required to administer the SEP-IRA plan.

How do I modify my schwab sep-ira employer39s agreement in Gmail?

schwab sep-ira employer39s agreement and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for signing my schwab sep-ira employer39s agreement in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your schwab sep-ira employer39s agreement and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit schwab sep-ira employer39s agreement on an Android device?

You can make any changes to PDF files, such as schwab sep-ira employer39s agreement, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your schwab sep-ira employer39s agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schwab Sep-Ira employer39s Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.