Get the free PAYMENT ARRANGEMENTS

Show details

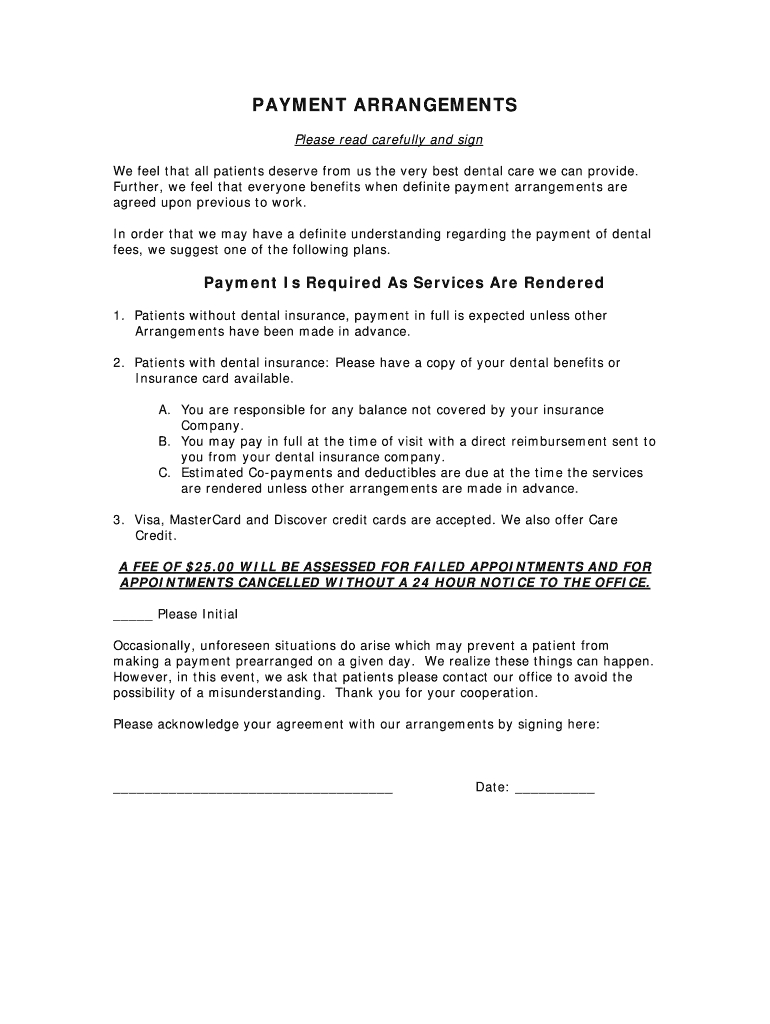

PAYMENT ARRANGEMENTS Please read carefully and sign We feel that all patients deserve from us the very best dental care we can provide. Further, we feel that everyone benefits when definite payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment arrangements

Edit your payment arrangements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment arrangements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payment arrangements online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payment arrangements. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment arrangements

How to fill out payment arrangements:

01

Gather all necessary information: Before filling out payment arrangements, it is important to gather all the relevant information. This includes your personal details, such as your name, address, and contact information, as well as any account or invoice numbers associated with the payment.

02

Assess your financial situation: Before making any payment arrangements, it is essential to assess your financial situation. Determine how much you can afford to pay, taking into consideration your income, expenses, and any outstanding debts. This will help you determine what type of payment arrangement is feasible for you.

03

Contact the payee or creditor: Reach out to the payee or creditor to discuss your payment situation. This can be done by phone, email, or in person, depending on their preferred method of communication. Explain your financial difficulties and the reasons why you are unable to make the full payment at once.

04

Discuss available payment options: During the conversation with the payee or creditor, inquire about the available payment options. There may be various alternatives, such as setting up a monthly installment plan, deferring payments, or negotiating a reduced settlement amount. Consider the options presented and choose the one that suits your financial situation the best.

05

Understand the terms and conditions: If the payee or creditor agrees to your proposed payment arrangement, make sure to thoroughly understand the terms and conditions. This includes the duration of the arrangement, the amount to be paid each month, any interest or fees involved, and any consequences for missed or late payments. It is important to clarify any doubts or concerns before finalizing the agreement.

Who needs payment arrangements:

01

Individuals facing financial difficulties: Payment arrangements are often needed by individuals who are experiencing financial difficulties. This can be due to unexpected expenses, job loss, or other circumstances that make it difficult to meet their financial obligations in full.

02

Small businesses and entrepreneurs: Small businesses and entrepreneurs may also require payment arrangements. They may encounter cash flow issues, delayed payments from clients, or unexpected expenses that affect their ability to pay bills or suppliers on time.

03

Individuals with large outstanding debts: People with large outstanding debts, such as credit card debt or loans, may need payment arrangements to help manage their repayments. This can include negotiating lower interest rates, extending the repayment period, or consolidating debts into a single payment plan.

Overall, payment arrangements are necessary for individuals and businesses who require temporary financial assistance or flexibility in meeting their payment obligations. By understanding how to fill out payment arrangements and assessing one's financial situation, it becomes easier to navigate these arrangements effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my payment arrangements directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your payment arrangements and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete payment arrangements online?

pdfFiller makes it easy to finish and sign payment arrangements online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit payment arrangements on an iOS device?

Create, edit, and share payment arrangements from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is payment arrangements?

Payment arrangements are agreements made between a debtor and a creditor outlining a schedule for payments to be made towards a debt.

Who is required to file payment arrangements?

Individuals or businesses who owe money to a creditor may be required to file payment arrangements in order to repay the debt.

How to fill out payment arrangements?

Payment arrangements can be filled out by providing information about the debtor, creditor, amount owed, payment schedule, and any other relevant terms.

What is the purpose of payment arrangements?

The purpose of payment arrangements is to establish a formal agreement for repaying a debt in a structured and manageable way.

What information must be reported on payment arrangements?

Payment arrangements must include details such as the names of the debtor and creditor, amount owed, payment schedule, interest rates, and any penalties for late payments.

Fill out your payment arrangements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Arrangements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.