Get the free LINCOLN MEMORIAL LIFE INSURANCE

Show details

LINCOLN MEMORIAL LIFE INSURANCE COMPANY, MEMORIAL SERVICE LIFE INSURANCE COMPANY AND NATIONAL PREARRANGED SERVICES, INC. In Receivership 1250 Capital of Texas Hwy S. Building 1, Suite 470 PO Box 160050

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lincoln memorial life insurance

Edit your lincoln memorial life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lincoln memorial life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

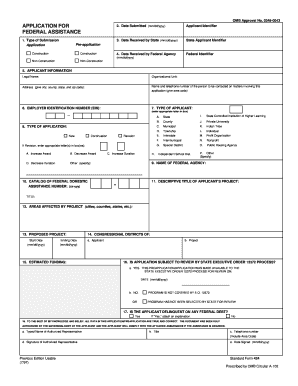

Editing lincoln memorial life insurance online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lincoln memorial life insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lincoln memorial life insurance

How to fill out Lincoln Memorial life insurance:

01

Gather necessary information: Start by collecting all the relevant personal and financial details required for the life insurance application. This may include your full name, date of birth, contact information, occupation, health history, and any existing insurance policies.

02

Understand policy options: Research and understand the different policy options offered by Lincoln Memorial life insurance. Familiarize yourself with the terms, coverage amounts, premiums, and any additional features or riders available. This will help you choose the policy that best suits your needs.

03

Contact a Lincoln Memorial representative: Reach out to a representative from Lincoln Memorial to discuss your life insurance needs and obtain further information about the application process. They can guide you through the necessary steps, explain any specific requirements, and address any questions or concerns you may have.

04

Complete the application form: Once you have the necessary information and guidance, carefully fill out the Lincoln Memorial life insurance application form. Provide accurate and detailed information to ensure the process goes smoothly. Double-check all the entered data to avoid any mistakes or inconsistencies.

05

Disclose your medical history: Life insurance applications typically require you to disclose your medical history and undergo a health evaluation. Be prepared to answer questions about your current health status, pre-existing conditions, medications, and family medical history. You may need to provide supporting documents or consent to medical examinations or tests.

06

Select beneficiaries: During the application process, you will also need to designate the beneficiaries who will receive the life insurance benefits in the event of your passing. Ensure you provide their names, contact information, and specify the percentage or amount of the benefit each beneficiary should receive.

07

Review and sign the application: Before submitting the application, carefully review all the provided information for accuracy. Make any necessary corrections or updates. Once satisfied, sign the application form and submit it to Lincoln Memorial as per their instructions, whether online, via mail, or through a representative.

Who needs Lincoln Memorial life insurance?

01

Individuals with dependents: If you have dependents, such as a spouse, children, or elderly parents who rely on your income, Lincoln Memorial life insurance can provide financial protection for them in case of your untimely death. It can help replace the lost income and cover any outstanding debts or financial obligations.

02

Breadwinners or primary income earners: If you are the main source of income for your family, having Lincoln Memorial life insurance can ensure that your loved ones can maintain their standard of living even if you are no longer around. It can provide a financial safety net to cover daily expenses, mortgage payments, education costs, and other financial needs.

03

Individuals with outstanding debts: If you have significant outstanding debts, such as a mortgage, car loan, or student loan, Lincoln Memorial life insurance can help alleviate the burden placed on your family if you were to pass away. The insurance proceeds can be used to pay off these debts, preventing financial strain on your loved ones.

04

Individuals seeking peace of mind: Even if you don't have dependents or significant debts, some people opt for life insurance to have peace of mind. Knowing that their loved ones will be taken care of financially can provide a sense of security and comfort. Lincoln Memorial life insurance can offer that peace of mind, allowing you to live life with reassurance.

05

Individuals planning for the future: Life insurance can also serve as a financial planning tool. Some policies, such as whole life or universal life insurance, can accumulate cash value over time, which can be borrowed against or used for various financial goals, such as retirement planning or funding education expenses.

In summary, anyone who wants to secure the financial future of their loved ones, have outstanding debts, or wishes to have peace of mind should consider Lincoln Memorial life insurance. It is crucial to assess your individual circumstances, financial needs, and goals to determine if life insurance is the right choice for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in lincoln memorial life insurance?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your lincoln memorial life insurance to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in lincoln memorial life insurance without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your lincoln memorial life insurance, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the lincoln memorial life insurance in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your lincoln memorial life insurance and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is lincoln memorial life insurance?

Lincoln Memorial Life Insurance is a type of life insurance policy that provides coverage in case of the policyholder's death.

Who is required to file lincoln memorial life insurance?

Individuals who purchase a Lincoln Memorial Life Insurance policy are required to file it.

How to fill out lincoln memorial life insurance?

To fill out a Lincoln Memorial Life Insurance policy, individuals must provide personal information, beneficiary information, and select coverage options.

What is the purpose of lincoln memorial life insurance?

The purpose of Lincoln Memorial Life Insurance is to provide financial protection for loved ones in case of the policyholder's death.

What information must be reported on lincoln memorial life insurance?

Information such as personal details, beneficiary details, coverage amount, and policy terms must be reported on Lincoln Memorial Life Insurance.

Fill out your lincoln memorial life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lincoln Memorial Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.