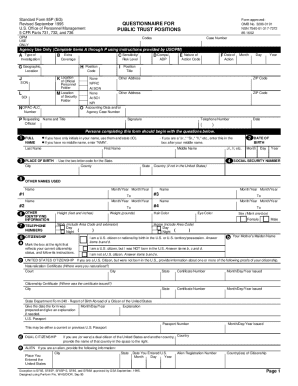

Get the free Form 1094C

Show details

KAUFMAN N & CANDLES attorneys at law Kaufman & Candles. P.C. 150 W. Main Street Suite 2100 Norfolk, VA 23510 Mailing Address: Post Office Box 3037 Norfolk, VA 23514 T (757) 6243000 F (757) 6243169

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1094c

Edit your form 1094c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1094c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1094c online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 1094c. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1094c

How to fill out form 1094c:

01

Begin by providing your employer identification number (EIN) at the top of the form. This is a unique identifier assigned to your business by the IRS.

02

Fill in your business name, address, and contact information in the corresponding fields.

03

Indicate your business's classification as an applicable large employer (ALE) or a member of an aggregated ALE group. This information determines the type of reporting required.

04

Enter the total number of Forms 1095-C that you're submitting with Form 1094-C. This represents the employee statements that you're providing to the IRS.

05

Determine if you are part of an aggregated ALE group. If yes, indicate the name, EIN, and address of the designated ALE member of the group.

06

Identify the months during the calendar year for which you offered minimum essential coverage to your full-time employees. Check the relevant boxes in Part III.

07

Calculate the number of full-time employees (including full-time equivalents) for each month of the calendar year. Record this information in Part III as well.

08

Complete the certification section by providing the signature, name, and title of the person responsible for filing the form on behalf of your business.

09

Keep a copy of Form 1094-C for your records and submit the original form to the IRS.

Who needs form 1094c:

01

Employers who are considered applicable large employers (ALE) are required to file Form 1094-C. An ALE is typically a business with 50 or more full-time employees (including full-time equivalents) during the previous calendar year.

02

Additionally, members of an aggregated ALE group, which consists of two or more related businesses that collectively meet the ALE criteria, must also file Form 1094-C.

03

Form 1094-C is used to report the employer's offer of health coverage to its employees, as well as provide additional information on the size and composition of the workforce.

04

Employers who sponsor self-insured health plans must also use Form 1094-C to report information about the coverage offered to employees and dependents.

Overall, Form 1094-C is essential for employers subject to the Affordable Care Act's employer shared responsibility provisions to accurately report their health coverage offerings and comply with the IRS guidelines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 1094c?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific form 1094c and other forms. Find the template you need and change it using powerful tools.

How do I execute form 1094c online?

Completing and signing form 1094c online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit form 1094c on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing form 1094c.

What is form 1094c?

Form 1094-C is a transmittal form that is used to report to the IRS summary information for all 1095-C forms related to employer-provided health insurance.

Who is required to file form 1094c?

Applicable large employers (ALEs) with 50 or more full-time employees, including full-time equivalents, must file Form 1094-C.

How to fill out form 1094c?

Form 1094-C requires information about the employer, including contact details, employer identification number (EIN), and certification of whether the employer offered health insurance coverage to full-time employees.

What is the purpose of form 1094c?

The purpose of Form 1094-C is to provide the IRS with information necessary to administer the employer shared responsibility provisions of the Affordable Care Act.

What information must be reported on form 1094c?

Form 1094-C requires information about the employer's offer of health insurance coverage, including the type of coverage offered, number of full-time employees, and whether coverage was affordable.

Fill out your form 1094c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1094c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.