Get the free Offer In Compromise Form - MassGov - mass

Show details

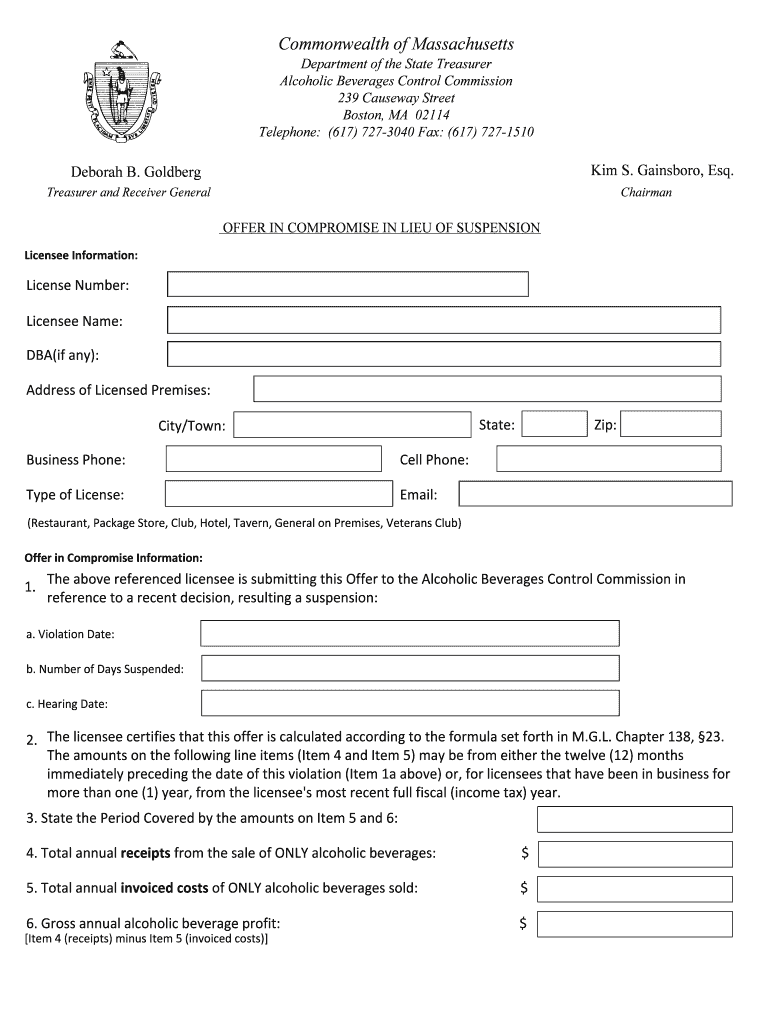

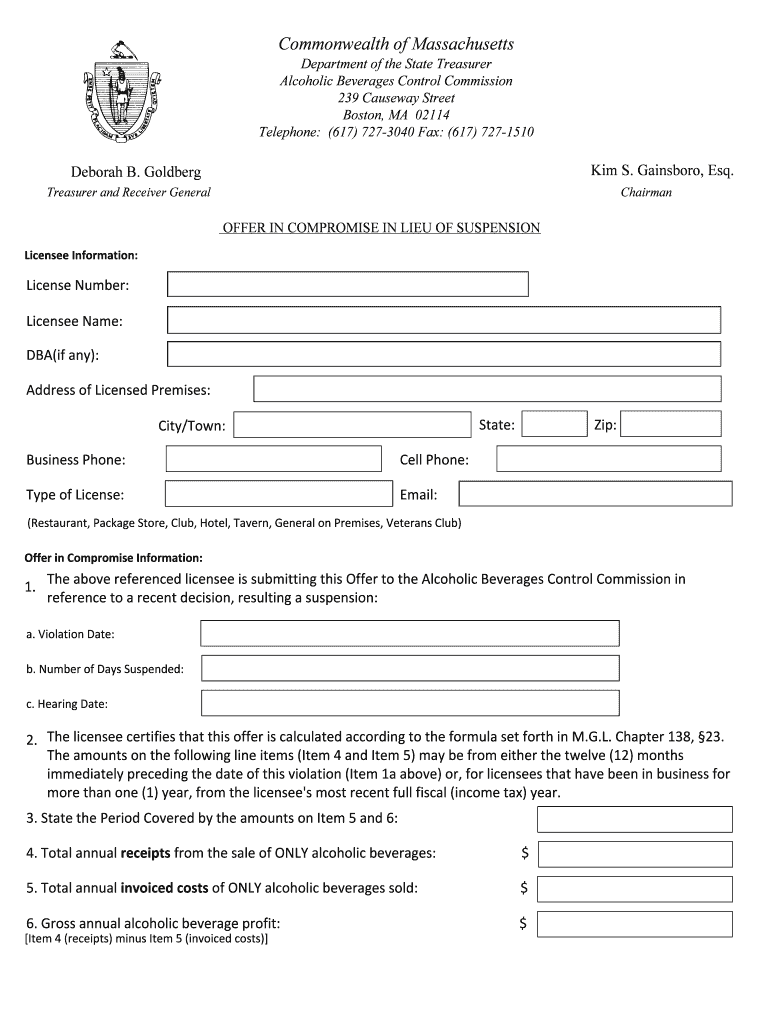

Commonwealth of Massachusetts Department of the State Treasurer Alcoholic Beverages Control Commission 239 Causeway Street Boston, MA 02114 Telephone: (617) 7273040 Fax: (617) 7271510 Kim S. Greensboro,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offer in compromise form

Edit your offer in compromise form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offer in compromise form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit offer in compromise form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit offer in compromise form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offer in compromise form

How to fill out an offer in compromise form:

01

Gather all necessary financial information: Before filling out an offer in compromise form, it is important to gather all relevant financial information. This may include bank statements, pay stubs, tax returns, and any other documentation that can help determine your financial situation.

02

Complete the necessary forms: The offer in compromise form typically requires individuals to provide their personal information, such as their name, address, social security number, and contact details. Additionally, you will need to provide information about your income, expenses, and assets.

03

Calculate your income and expenses: To accurately fill out the offer in compromise form, you will need to calculate your income and expenses. This may involve determining your monthly earnings and subtracting any necessary expenses, such as rent, utilities, and transportation costs. It is important to be thorough and provide accurate information.

04

Assess your assets: As part of the offer in compromise process, you will be required to assess your assets, such as real estate, vehicles, investments, and any other valuable possessions. The value of these assets will be considered when evaluating your ability to pay off your outstanding tax debt.

05

Write a detailed explanation: Along with the financial information, you will need to provide a detailed explanation of your circumstances and why you believe you qualify for an offer in compromise. This explanation should outline any extenuating circumstances, financial hardships, or other factors that may impact your ability to pay off your tax debt in full.

Who needs an offer in compromise form:

01

Individuals with significant tax debt: The offer in compromise program is primarily designed for individuals who are unable to pay their tax debt in full. If you have a substantial amount of unpaid taxes and are experiencing financial hardship, you may be eligible for an offer in compromise.

02

Taxpayers facing financial difficulties: The offer in compromise form is for taxpayers who are facing financial difficulties that prevent them from satisfying their tax obligations. This could include individuals who have lost their job, faced unexpected medical expenses, or experienced other financial hardships.

03

Those unable to enter into a payment plan: If you are unable to enter into a payment plan with the IRS due to your financial situation, the offer in compromise form may be an option to settle your tax debt for a lesser amount.

In summary, filling out an offer in compromise form requires gathering necessary financial information, completing the necessary forms, calculating income and expenses, assessing assets, and providing a detailed explanation. This form is typically used by individuals with significant tax debt and financial difficulties who are unable to enter into a traditional payment plan with the IRS.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is offer in compromise form?

An offer in compromise form is a document used to propose a settlement agreement between a taxpayer and the IRS in order to resolve a tax debt for less than the full amount owed.

Who is required to file offer in compromise form?

Taxpayers who are unable to pay their full tax liability or have a legitimate reason for not paying the full amount owed may be required to file an offer in compromise form.

How to fill out offer in compromise form?

To fill out an offer in compromise form, taxpayers need to provide detailed financial information, including income, expenses, assets, and liabilities, along with a proposal for settling the tax debt.

What is the purpose of offer in compromise form?

The purpose of an offer in compromise form is to provide taxpayers with a way to settle their tax debt for less than the full amount owed and to help them avoid further financial hardship.

What information must be reported on offer in compromise form?

Information such as income, expenses, assets, liabilities, and a proposed settlement amount must be reported on an offer in compromise form.

Can I create an electronic signature for signing my offer in compromise form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your offer in compromise form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit offer in compromise form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing offer in compromise form.

How do I complete offer in compromise form on an Android device?

Use the pdfFiller app for Android to finish your offer in compromise form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your offer in compromise form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offer In Compromise Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.