Get the free sale of acquired asset properties at 7th Flr - pagibigfund gov

Show details

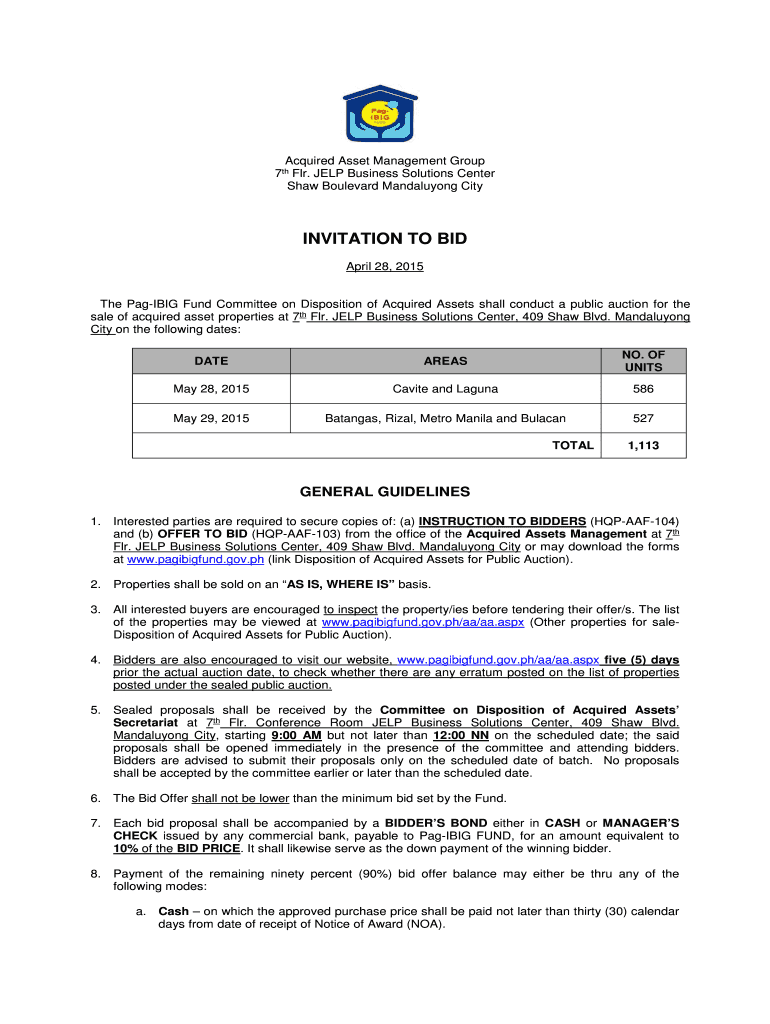

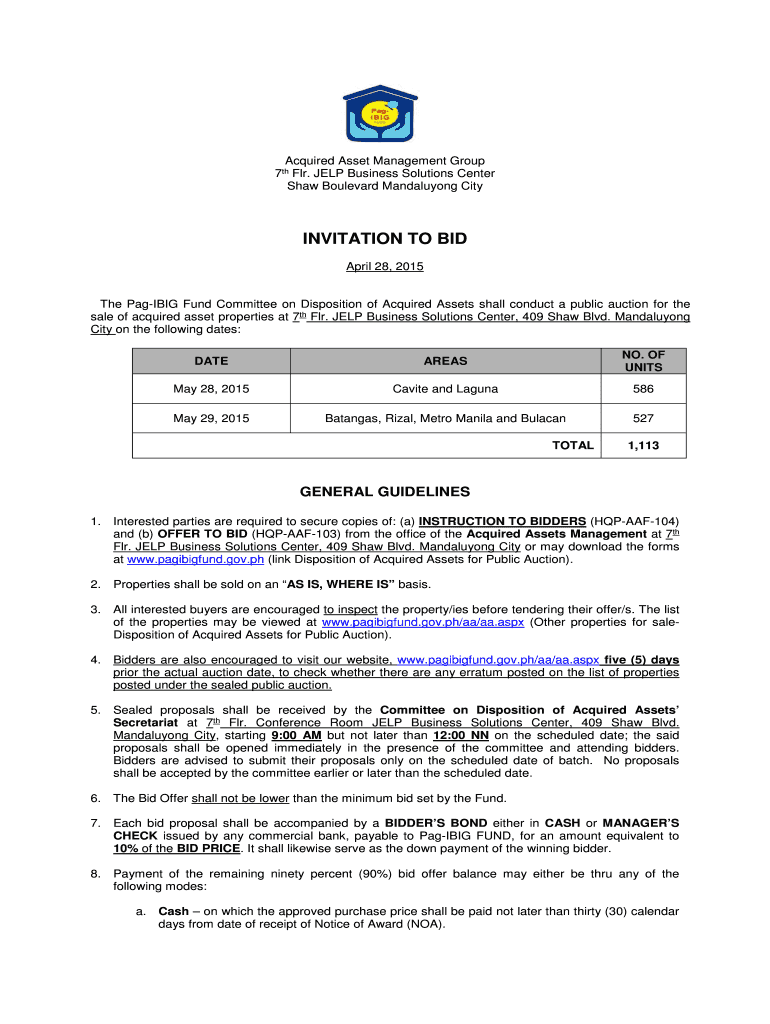

Acquired Asset Management Group 7th FLR. HELP Business Solutions Center Shaw Boulevard Mandaluyong City INVITATION TO BID April 28, 2015, The Paging Fund Committee on Disposition of Acquired Assets

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sale of acquired asset

Edit your sale of acquired asset form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sale of acquired asset form via URL. You can also download, print, or export forms to your preferred cloud storage service.

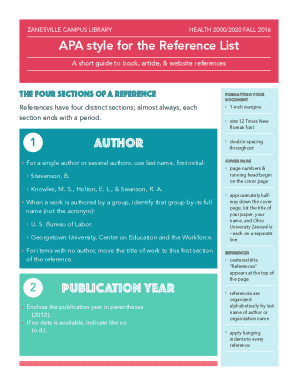

Editing sale of acquired asset online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sale of acquired asset. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sale of acquired asset

How to fill out sale of acquired asset:

01

Gather the necessary information: Before filling out the sale of an acquired asset, gather all the relevant information about the asset. This may include details such as the purchase price, date of acquisition, any improvements made to the asset, and the current market value.

02

Determine the method of sale: Decide on the method of sale for the acquired asset. This can include options like selling it privately, listing it for sale with a real estate agent, or participating in an auction. Consider factors like convenience, time constraints, and potential market conditions when making this decision.

03

Prepare the necessary documentation: Depending on the nature of the asset, prepare the necessary documentation. This may include a bill of sale, deed or title transfer documents, disclosure statements, and any other legal or regulatory documents required for the sale.

04

Determine the selling price: Set a selling price for the acquired asset. Consider factors like its current market value, any outstanding loans or liens on the asset, and your own desired profit margin. It may be helpful to consult with a professional appraiser or real estate agent to determine a fair and competitive selling price.

05

Advertise the asset for sale: Market the acquired asset to potential buyers. Utilize various channels such as online listings, print advertisements, social media platforms, and word of mouth to reach a wide audience and attract potential buyers.

06

Negotiate and finalize the sale: Once you have interested buyers, negotiate the terms of the sale. This may include discussing the selling price, any contingencies or conditions of the sale, and the timeline for completing the transaction. Ensure that all parties involved are in agreement before finalizing the sale.

Who needs sale of acquired asset?

01

Individuals: Individuals who have acquired assets such as real estate, vehicles, or valuable items may need to sell them for various reasons. This could include a change in financial circumstances, downsizing, or the need to liquidate assets.

02

Businesses: Companies often acquire assets as part of their operations or investments. However, there may be instances where they need to sell these assets. This could be to free up capital, dispose of underperforming assets, or streamline their operations.

03

Probate proceedings: In cases of a deceased individual's estate, the sale of acquired assets may be necessary to distribute the assets among beneficiaries or to settle outstanding debts.

04

Investors: Investors who acquire assets as part of their investment strategy may need to sell these assets to realize a profit or to rebalance their investment portfolio.

Overall, the sale of acquired assets is a common need for individuals, businesses, legal proceedings, and investors. It involves careful planning, documentation, and marketing strategies to ensure a successful sale.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sale of acquired asset?

Sale of acquired asset refers to the process of selling an asset that was previously obtained through purchase or inheritance.

Who is required to file sale of acquired asset?

Individuals or businesses who have sold an acquired asset are required to file a sale of acquired asset. This typically includes reporting the sale on tax returns.

How to fill out sale of acquired asset?

To fill out a sale of acquired asset, one must provide details such as the date of sale, the selling price, the cost basis, any related expenses, and any gain or loss from the sale.

What is the purpose of sale of acquired asset?

The purpose of a sale of acquired asset is to accurately report the transaction for tax purposes. This ensures compliance with tax laws and regulations.

What information must be reported on sale of acquired asset?

Information that must be reported on the sale of acquired asset includes the description of the asset, the date of acquisition, the date of sale, the selling price, the cost basis, any related expenses, and any gain or loss.

How can I send sale of acquired asset for eSignature?

Once your sale of acquired asset is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find sale of acquired asset?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific sale of acquired asset and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I fill out sale of acquired asset on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your sale of acquired asset, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your sale of acquired asset online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sale Of Acquired Asset is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.