Get the free 111215373-Fixed Maturity Plan - Series L-Form KIM

Show details

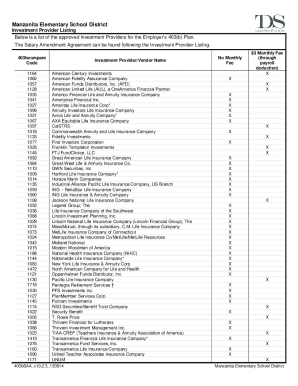

KEY INFORMATION MEMORANDUM Come APPLICATION FORM Baroda Pioneer Fixed Maturity Plan Series L (368 Days Close-Ended Debt Scheme) from Baroda Pioneer Mutual Fund Offer of Units of 10/- each for cash

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 111215373-fixed maturity plan

Edit your 111215373-fixed maturity plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 111215373-fixed maturity plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 111215373-fixed maturity plan online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 111215373-fixed maturity plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 111215373-fixed maturity plan

How to fill out 111215373-fixed maturity plan?

01

Gather the necessary documents: Before filling out the fixed maturity plan, ensure you have all the required documents at hand, such as your identification, financial information, and any relevant investment documents.

02

Review the terms and conditions: Familiarize yourself with the terms and conditions of the 111215373-fixed maturity plan. Understand the minimum investment amount, the maturity date, and any penalties or fees associated with early withdrawal.

03

Evaluate your financial goals: Consider your financial goals and investment objectives. Assess if the fixed maturity plan aligns with your risk tolerance and desired returns. If unsure, consult with a financial advisor to make an informed decision.

04

Complete the application: Fill out the application form provided by the issuer of the fixed maturity plan. Provide accurate and up-to-date information, ensuring that all fields are correctly filled.

05

Double-check the details: Review the completed application form to ensure all information is accurate and complete. If any mistakes or missing information are identified, correct them before submitting the form.

06

Submit the application: Once you are satisfied with the accuracy of the application form, submit it to the relevant institution or investment firm offering the 111215373-fixed maturity plan. Follow their instructions regarding submission methods, such as in-person or online.

Who needs 111215373-fixed maturity plan?

01

Individuals seeking fixed returns: The 111215373-fixed maturity plan is suitable for individuals who desire consistent and fixed returns on their investment without being exposed to market fluctuations.

02

Risk-averse investors: This plan appeals to those who prioritize capital preservation and have a low tolerance for investment risks. The fixed maturity plan provides a predetermined return at the end of the specified maturity period.

03

Investors with specific financial goals: Individuals with specific financial goals, such as saving for a down payment on a house or funding their child's education, can benefit from a fixed maturity plan. It allows for targeted savings within a defined timeframe.

04

Investors seeking liquidity control: Unlike some other investment options, the 111215373-fixed maturity plan offers investors control over the liquidity of their funds. The maturity date is predetermined, allowing investors to plan their financial commitments accordingly.

05

Those seeking diversification: Adding a fixed maturity plan to an investment portfolio can offer diversification benefits. It can complement other investments such as equities or mutual funds by providing a predictable and stable income stream.

Overall, the 111215373-fixed maturity plan is suitable for those who prioritize stability, fixed returns, and controlled liquidity in their investment strategy. It is important to assess your financial goals and risk tolerance before committing to this investment option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 111215373-fixed maturity plan in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your 111215373-fixed maturity plan and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit 111215373-fixed maturity plan on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 111215373-fixed maturity plan, you need to install and log in to the app.

How do I fill out 111215373-fixed maturity plan on an Android device?

Complete your 111215373-fixed maturity plan and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is 111215373-fixed maturity plan?

The 111215373-fixed maturity plan is a financial tool used to invest in debt instruments that mature on a specific date.

Who is required to file 111215373-fixed maturity plan?

Investors or entities investing in fixed maturity plans are required to file 111215373-fixed maturity plan.

How to fill out 111215373-fixed maturity plan?

To fill out the form, one must provide detailed information about the investments made, maturity dates, and other relevant financial details.

What is the purpose of 111215373-fixed maturity plan?

The purpose of 111215373-fixed maturity plan is to track and report the investments made in debt instruments with specific maturity dates.

What information must be reported on 111215373-fixed maturity plan?

Information such as the name of the issuer, maturity dates, investment amounts, and interest rates must be reported on the 111215373-fixed maturity plan.

Fill out your 111215373-fixed maturity plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

111215373-Fixed Maturity Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.