Get the free Application for Permission to Organize a Credit Union

Show details

FIS 1056 6/13 Department of Insurance and Financial Services Page 1 of 15 Credit Union Organization Information Package The following pages contain information on how to start a new credit union* Article 3 Part 1 of the Michigan Credit Union Act which addresses the origination of statechartered credit unions can be viewed here. You should understand that all members of the credit union have an equal share of the institution* Any excess capital over the par share value that may be contributed...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for permission to

Edit your application for permission to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for permission to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for permission to online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for permission to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

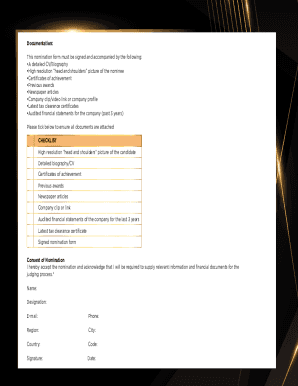

How to fill out application for permission to

How to fill out Application for Permission to Organize a Credit Union

01

Gather necessary documents such as identification and organizational documents.

02

Download the Application for Permission to Organize a Credit Union form from the appropriate regulatory agency's website.

03

Fill out the application form with accurate information about the proposed credit union.

04

Provide detailed information about the proposed membership and financial projections.

05

Outline the governance structure and management team qualifications.

06

Submit the completed application along with any required fees to the designated regulatory authority.

07

Await feedback or requests for additional information from the regulatory agency.

Who needs Application for Permission to Organize a Credit Union?

01

Individuals or groups planning to establish a new credit union.

02

Organizations looking to create a member-owned financial cooperative.

03

Community groups seeking to serve a specific population with financial services.

Fill

form

: Try Risk Free

People Also Ask about

Who owns a credit union?

Credit unions are owned and controlled by their members.

Who typically owns a credit union?

It is member-owned and controlled through a board of directors elected by the membership. The board serves on a volunteer basis and may hire a management team to run the credit union. The board also establishes and revises policy, sets dividend and loan rates, and directs certain operations.

Who owns and controls a credit union?

Most financial institutions are owned by stockholders, who own a part of the institution and intend on making money from their investment. A credit union doesn't operate in that manner. Rather, each credit union member owns one "share" of the organization.

Who is the shareholder of a credit union?

In other words, credit unions are member-owned, giving members immediate and direct control. You aren't just a depositor like you are with a big bank. Instead, the credit union you join is a locally-owned and community-focused organization.

How to become a credit union?

How to Start a Credit Union Step One: Determine Need. Step Two: Form a Committee. Step Three: Establish Membership Guidelines. Step Four: Decide Financial Services. Step Five: Create a Business Plan. Step Six: Secure Startup Costs. Step Seven: Apply for a Charter. Step Eight: Choose a Location and Open.

How much capital do you need to start a credit union?

Historical data suggests that newly chartered credit unions typically require at least $500,000 in start-up capital to achieve economic viability. At this preliminary stage, the NCUA will review your general plan for obtaining donated funds to start operations and cover operating losses until you are profitable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Permission to Organize a Credit Union?

The Application for Permission to Organize a Credit Union is a formal request submitted to regulatory authorities by individuals or groups intending to establish a new credit union. This application outlines the proposed credit union's structure, purpose, and operational plans.

Who is required to file Application for Permission to Organize a Credit Union?

Individuals or groups proposing to form a new credit union must file the Application for Permission to Organize. This typically includes founding members who are organizing the credit union.

How to fill out Application for Permission to Organize a Credit Union?

To fill out the Application for Permission to Organize, applicants must complete a form provided by the relevant regulatory body, detailing the proposed credit union's name, purpose, membership criteria, business plan, and financial projections.

What is the purpose of Application for Permission to Organize a Credit Union?

The purpose of the Application for Permission to Organize a Credit Union is to assess the feasibility and viability of the proposed credit union, ensuring it meets regulatory requirements and serves a valid community need.

What information must be reported on Application for Permission to Organize a Credit Union?

The Application for Permission to Organize must report details such as the proposed name of the credit union, mission statement, membership eligibility criteria, governance structure, business plan, projected financial statements, and the backgrounds of the organizing committee members.

Fill out your application for permission to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Permission To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.