Get the free Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establis...

Show details

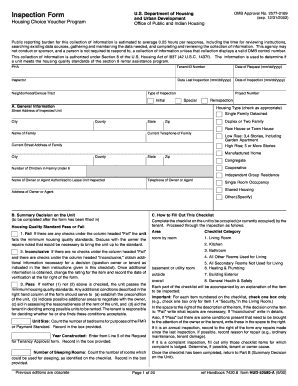

This form is required for Qualified Retail Food Establishments to apply for a Commercial Rehabilitation Exemption. It must be submitted to the local governmental unit along with the application and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial rehabilitation exemption certification

Edit your commercial rehabilitation exemption certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial rehabilitation exemption certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial rehabilitation exemption certification online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit commercial rehabilitation exemption certification. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial rehabilitation exemption certification

How to fill out Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establishments

01

Obtain the Commercial Rehabilitation Exemption Certification form from your local government office or website.

02

Read the instructions carefully to understand the eligibility criteria and required documentation.

03

Fill out the applicant's information section, including the name of the business, address, and contact details.

04

Provide a detailed description of the rehabilitation work being completed on the property.

05

Attach any necessary documentation that supports your claim for the exemption, such as plans, photos, or cost estimates.

06

Include proof of business licensing and other relevant permits that demonstrate your establishment qualifies as a retail food establishment.

07

Sign and date the application to certify that the information provided is accurate.

08

Submit the completed form and any attachments to the appropriate local government authority by the specified deadline.

Who needs Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establishments?

01

Qualified retail food establishments that are undergoing commercial rehabilitation and wish to apply for exemptions from local property taxes.

02

Businesses that meet the criteria outlined by the local government in relation to property improvements and meet eligibility requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is exemption certification?

an official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate. The Revenue should have discretion to grant exemption certificates to building subcontractors where a company has become insolvent for bona fide reasons.

What is commercial rehabilitation?

Commercial rehabilitation means a rehabilitation of a structure other than a single–family, owner–occupied residence.

What qualifies as an exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing the taxable income. Taxpayers may be able to claim two kinds of exemptions: Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

What is an employee exemption certificate?

Exemption from withholding An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

What is considered commercial property in Michigan?

Commercial property shall also include facilities related to a commercial business enterprise under the same ownership at that location, including, but not limited to, office, engineering, research and development, warehousing, parts distribution, retail sales, and other commercial activities.

What is the Rehabilitation Act in Michigan?

AN ACT to provide for educational and other needed services through a vocational rehabilitation program for disabled persons; to authorize an annual appropriation of funds for vocational rehabilitation; to authorize the state board of education to administer such a program; to provide for the proper custody and

What is the Commercial Rehabilitation Act in Michigan?

The Commercial Rehabilitation Act, PA 210 of 2005, as amended, affords a tax incentive for the rehabilitation of commercial property for the primary purpose and use of a commercial business or multi-family residential facility. The property must be located within an established Commercial Rehabilitation District.

What does exemption certificate mean?

A sales tax exemption certificate is an official document that allows a business to make purchases without paying the standard sales tax. This certificate is proof that the purchases are not subject to sales tax due to specific exemptions that apply to the business.

At what age do you stop paying property taxes in Michigan?

Long-term Resident Senior Exemption The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1. Total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establishments?

The Commercial Rehabilitation Exemption Certification for Qualified Retail Food Establishments is a form that allows eligible businesses to apply for tax exemptions during periods of rehabilitation or improvement, aimed at encouraging investment in certain areas.

Who is required to file Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establishments?

Businesses that qualify as retail food establishments and are undergoing significant rehabilitation or improvement projects are required to file this certification to receive the associated tax exemptions.

How to fill out Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establishments?

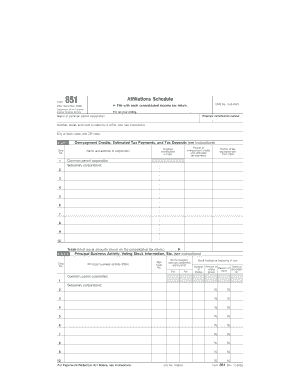

To fill out the certification, applicants typically need to provide details such as the business name, address, description of the rehabilitation project, estimated costs, and relevant tax identification information, ensuring all required fields are completed accurately.

What is the purpose of Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establishments?

The purpose of the certification is to promote economic development by incentivizing retail food establishments to invest in property improvements, thereby enhancing local economies and community development.

What information must be reported on Commercial Rehabilitation Exemption Certification For Qualified Retail Food Establishments?

The certification must report information including the applicant's business details, the nature of the rehabilitation project, its completion timeline, projected economic impacts, and any other details required by the governing tax authority.

Fill out your commercial rehabilitation exemption certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Rehabilitation Exemption Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.