Get the free For Debt Schemes

Show details

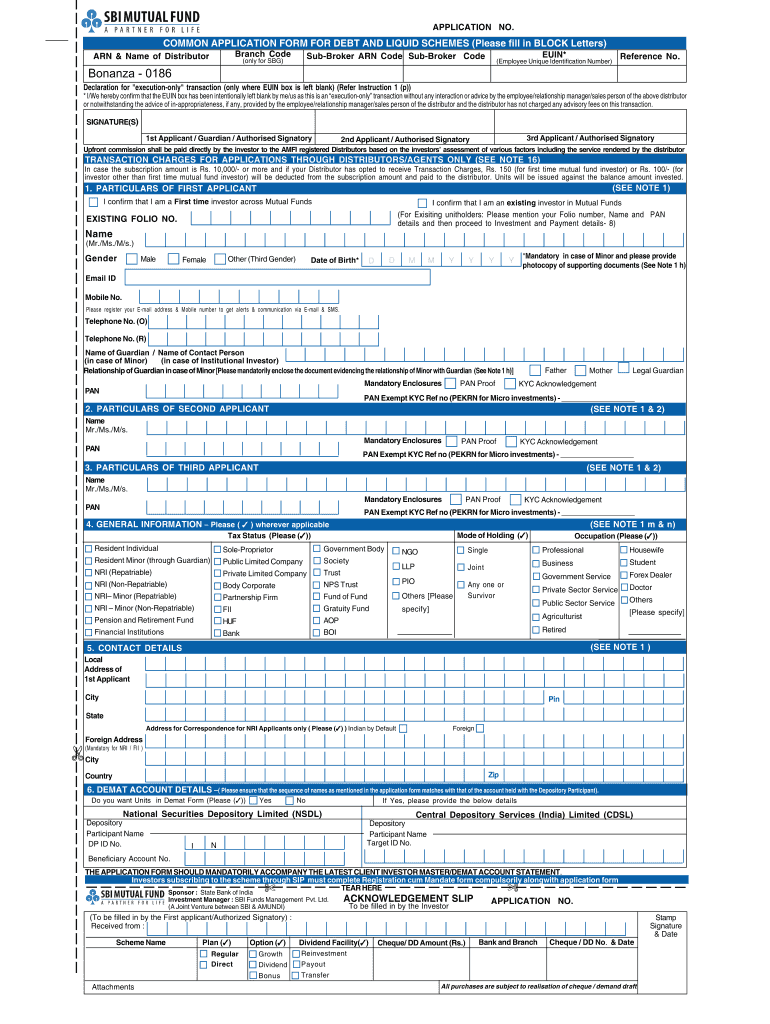

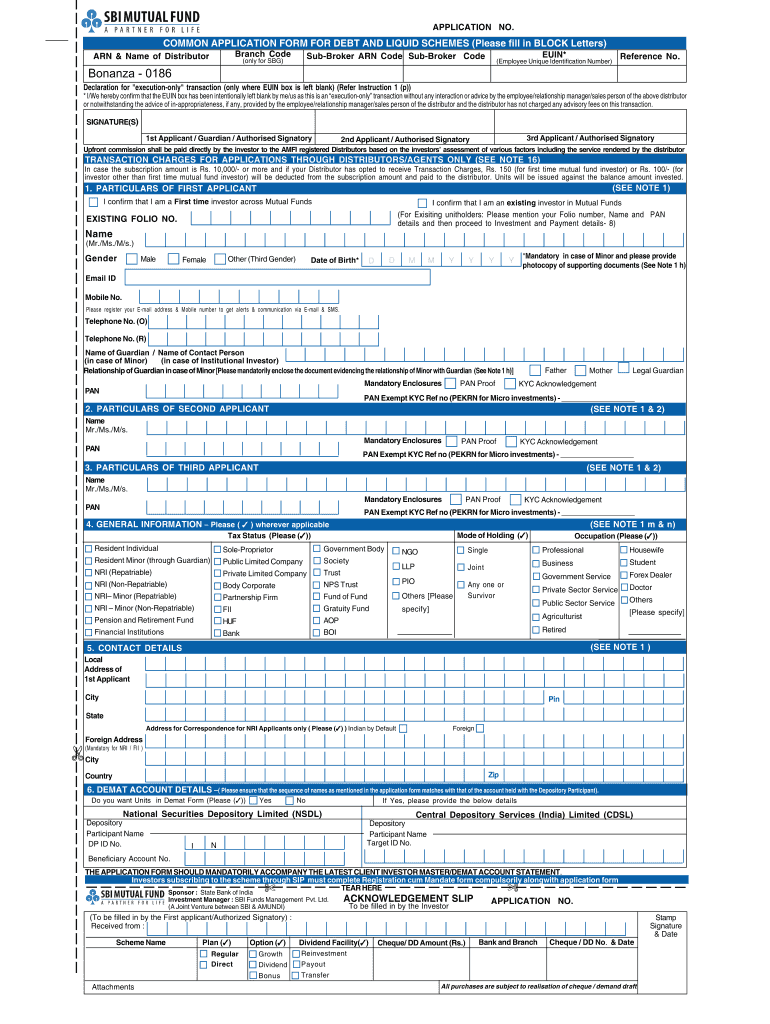

APPLICATION NO. COMMON APPLICATION FORM FOR DEBT AND LIQUID SCHEMES (Please fill in BLOCK Letters) Branch Code ARN & Name of Distributor RUIN* Broker ARN Code Broker Code (only for SBG) Reference

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for debt schemes

Edit your for debt schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for debt schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for debt schemes online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit for debt schemes. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for debt schemes

How to fill out for debt schemes?

01

Understand the purpose: Educate yourself on the different types of debt schemes available and determine which one best suits your financial goals. Take into consideration factors such as interest rates, repayment terms, and eligibility criteria.

02

Gather necessary documents: Prepare the required documents such as identification proof, income proof, bank statements, and any other relevant financial documents. Make sure to arrange them in an organized manner to streamline the application process.

03

Complete the application form: Obtain the application form for the chosen debt scheme from the respective financial institution or online platform. Fill in all the required information accurately and truthfully. Double-check the form for any errors or missing details before submitting it.

04

Attach supporting documents: Ensure that all the necessary documents are correctly attached to the application form. These documents act as evidence of your financial situation and help the lending institution assess your eligibility for the debt scheme.

05

Review and proofread: Before submitting the application, carefully review the entire form and supporting documents to ensure there are no mistakes. This step is crucial to avoid any delays or rejections caused by incorrect or incomplete information.

06

Submit the application: Submit the completed application form along with the supporting documents to the designated authority or financial institution. Follow their specific instructions regarding submission methods, such as online submission, in-person submission, or mailing the documents.

Who needs debt schemes?

01

Individuals with outstanding debts: Debt schemes are beneficial for individuals who have existing debts and are struggling to manage their repayments. These schemes often offer more favorable interest rates or longer repayment periods, providing relief and an opportunity to consolidate debts into a single manageable loan.

02

Startups and entrepreneurs: Debt schemes can be advantageous for startups and entrepreneurs looking for financial support to kickstart or expand their business ventures. Such schemes offer access to necessary funds while allowing for structured repayment options that align with the business's cash flow.

03

Students seeking educational funding: Debt schemes specifically tailored for educational purposes are also available. These schemes assist students in financing their educational expenses, such as tuition fees, books, accommodation, and other related costs. They provide students with an opportunity to pursue their desired education without immediate financial burden.

04

Individuals planning major expenses: If you are planning a significant expense such as home renovations, purchasing a vehicle, or organizing a wedding, debt schemes can provide the required funds. These schemes allow you to borrow money and repay it over time, making it easier to manage the financial burden of these large expenses.

It is important to note that the suitability of a debt scheme varies depending on individual financial circumstances. It is always advisable to consult with a financial advisor or professional to assess your specific needs and make an informed decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is for debt schemes?

Debt schemes are investment schemes that primarily invest in fixed income securities issued by corporations or governments.

Who is required to file for debt schemes?

Fund houses or asset management companies are required to file for debt schemes.

How to fill out for debt schemes?

To fill out for debt schemes, the fund houses need to provide detailed information about the portfolio composition, risk factors, and past performance of the debt schemes.

What is the purpose of for debt schemes?

The purpose of debt schemes is to provide investors with an opportunity to invest in fixed income securities and earn a regular income.

What information must be reported on for debt schemes?

Information such as the portfolio composition, credit rating of the securities, maturity profile, and historical returns must be reported on for debt schemes.

How do I edit for debt schemes straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing for debt schemes.

How do I fill out for debt schemes using my mobile device?

Use the pdfFiller mobile app to fill out and sign for debt schemes. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit for debt schemes on an Android device?

With the pdfFiller Android app, you can edit, sign, and share for debt schemes on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your for debt schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Debt Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.