Get the free Transfer your super to PSSap Transfer your super to PSSap

Show details

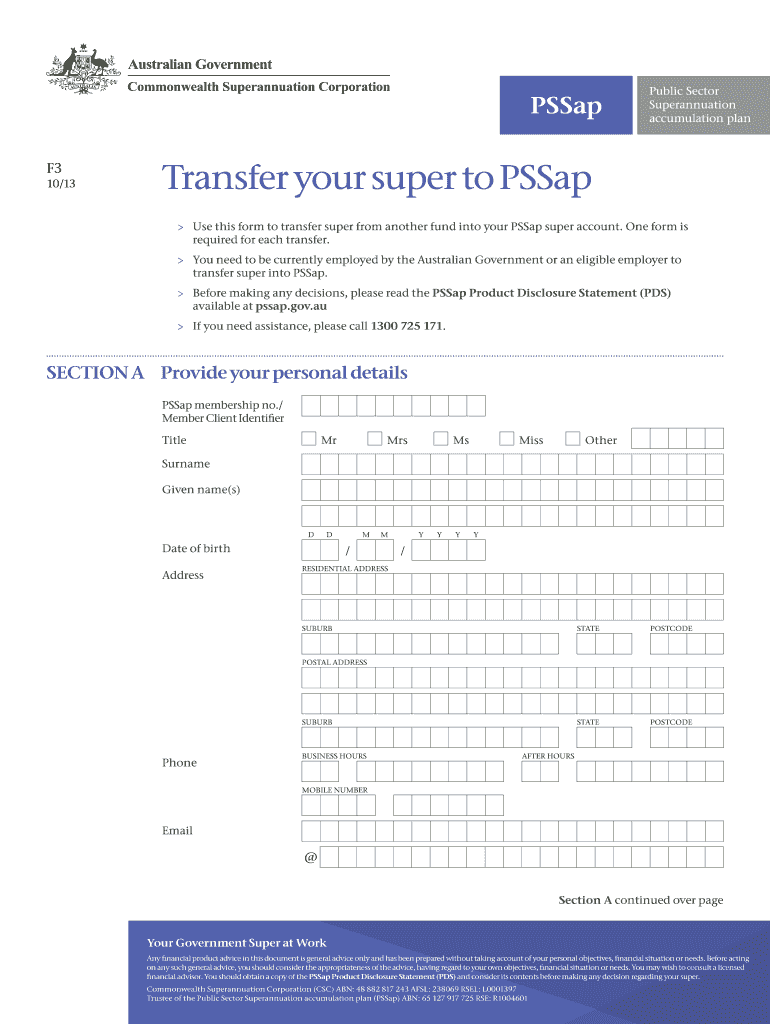

F3 10/13 Transfer your super to SSAP Use this form to transfer super from another fund into your SSAP super account. One form is required for each transfer. You need to be currently employed by the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer your super to

Edit your transfer your super to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer your super to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer your super to online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit transfer your super to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer your super to

How to fill out a transfer your super to:

01

Gather necessary information: Before starting the transfer process, make sure you have all the required information, such as your current superannuation fund details, including the account number and fund name, and the details of the fund you wish to transfer to.

02

Contact your current superannuation fund: Get in touch with your current superannuation fund and inform them about your intention to transfer your super to another fund. They will provide you with the necessary forms and instructions for the transfer.

03

Complete the transfer forms: Fill out the transfer forms accurately, ensuring that you provide all the requested information. This typically includes your personal details, the details of your existing fund, and the details of the new fund you wish to transfer to.

04

Review and double-check the forms: Take the time to review the completed transfer forms thoroughly. Make sure all the information is accurate, and there are no mistakes or missing details. If any doubts or uncertainties arise, contact your current superannuation fund for clarification.

05

Submit the transfer forms: Once you are confident that the forms are correctly filled out, submit them to your current superannuation fund. Follow any specific instructions provided regarding submission methods, such as mailing or online submission.

06

Confirmation and tracking: After submitting the transfer forms, your current superannuation fund will process the transfer request. They will provide you with a confirmation or receipt to acknowledge the receipt of your transfer request. It is recommended to keep this confirmation for your records.

07

Monitoring the transfer progress: While the transfer is being processed, you can regularly check the progress by contacting both your current superannuation fund and the new fund. They will be able to provide updates on the status of your transfer and the expected timeline for completion.

Who needs to transfer their super to:

01

Individuals switching jobs: Changing employers often leads to employees transferring their superannuation to a new fund to consolidate their retirement savings and simplify their finances.

02

People looking for better returns or benefits: Some individuals may choose to transfer their super to a different fund that offers higher investment returns or additional benefits, such as lower fees or better insurance options.

03

Combining multiple super accounts: If you have multiple superannuation accounts, consolidating them into one fund can help manage your super more effectively, reduce fees, and make it easier to keep track of your retirement savings.

04

Changing super fund providers: Sometimes, individuals may decide to transfer their super to a different fund due to dissatisfaction with their current fund's performance, customer service, or other factors.

05

Early retirement or transition to pension phase: When nearing retirement or transitioning into the pension phase, individuals may choose to transfer their super to a fund that offers suitable retirement products and benefits.

Remember, it's important to consider your personal circumstances and seek professional advice before making any decisions regarding the transfer of your superannuation funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is transfer your super to?

Transfer your super to allows individuals to move their retirement savings from one superannuation fund to another.

Who is required to file transfer your super to?

Individuals who wish to transfer their superannuation balance from one fund to another are required to file transfer your super to.

How to fill out transfer your super to?

To fill out transfer your super to, individuals must contact their current and intended superannuation fund to initiate the transfer process.

What is the purpose of transfer your super to?

The purpose of transfer your super to is to consolidate or switch superannuation funds for better investment returns or lower fees.

What information must be reported on transfer your super to?

Information such as account details, fund names, and transfer amounts must be reported on transfer your super to.

How do I edit transfer your super to straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit transfer your super to.

How do I fill out the transfer your super to form on my smartphone?

Use the pdfFiller mobile app to fill out and sign transfer your super to on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit transfer your super to on an iOS device?

Create, modify, and share transfer your super to using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your transfer your super to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Your Super To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.