Get the free Your projected retirement budget worksheet -

Show details

Follow these steps to complete the budget work sheet below: 1. Enter your current annual income from all sources applicable to your situation. 2. Enter your current annual expenses, using the budget

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your projected retirement budget

Edit your your projected retirement budget form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your projected retirement budget form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your projected retirement budget online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit your projected retirement budget. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your projected retirement budget

How to fill out your projected retirement budget:

01

Start by gathering all of your financial documents and statements, including bank statements, investment account statements, and any other documentation related to your income and expenses.

02

Next, calculate your expected monthly income during retirement. This may include sources such as Social Security, pensions, rental income, annuities, and any other sources of income you anticipate receiving during retirement.

03

Determine your expected monthly expenses during retirement. This can include categories such as housing (mortgage or rent), utilities, transportation, healthcare costs, insurance premiums, food, entertainment, and any other regular expenses you foresee having during retirement.

04

Consider any changes or adjustments that may occur during retirement. For example, you may anticipate downsizing your home, reducing transportation expenses, or having lower healthcare costs due to Medicare coverage.

05

Account for inflation. Keep in mind that the cost of living tends to increase over time, so you should factor in inflation when estimating future expenses. This can be done by using an average inflation rate or consulting historical inflation data.

06

Review and revise as necessary. It's important to regularly review and update your projected retirement budget, especially as you get closer to retirement age. Life circumstances and financial situations can change, so it's crucial to ensure your budget reflects the most accurate and up-to-date information.

Who needs your projected retirement budget:

01

Individuals planning for retirement: Creating a projected retirement budget is essential for anyone who wants to effectively plan for their future financial needs. It provides a clear picture of what to expect in terms of income and expenses during retirement.

02

Financial advisors: Retirement budget information is crucial for financial advisors who assist clients in making informed decisions about retirement planning, investment strategies, and wealth management. It helps them understand their clients' financial goals and customize plans accordingly.

03

Estate planners: Projected retirement budgets play a role in estate planning, allowing estate planners to assess the potential financial implications and ensure the appropriate distribution of assets according to clients' wishes during retirement and beyond.

In conclusion, creating a projected retirement budget requires careful consideration of income, expenses, potential changes, and inflation. It is essential for individuals planning for retirement, as well as professionals in the financial and estate planning sectors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is your projected retirement budget?

My projected retirement budget is the amount of money I estimate I will need to cover my expenses after I retire.

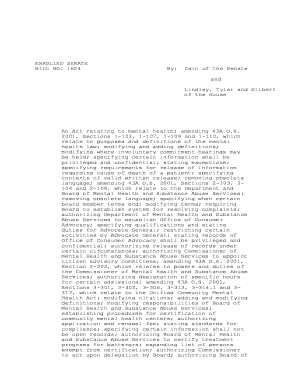

Who is required to file your projected retirement budget?

I am required to file my projected retirement budget.

How to fill out your projected retirement budget?

I can fill out my projected retirement budget by listing all my expected expenses and sources of retirement income.

What is the purpose of your projected retirement budget?

The purpose of my projected retirement budget is to help me plan and ensure that I have enough money to support myself during retirement.

What information must be reported on your projected retirement budget?

I must report my estimated expenses, income from retirement accounts, social security benefits, and any other sources of income.

How do I edit your projected retirement budget in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing your projected retirement budget and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit your projected retirement budget on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign your projected retirement budget on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit your projected retirement budget on an Android device?

You can edit, sign, and distribute your projected retirement budget on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your your projected retirement budget online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Projected Retirement Budget is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.