Get the free Corporate Guarantee - Blanket - Aldermore - aldermore co

Show details

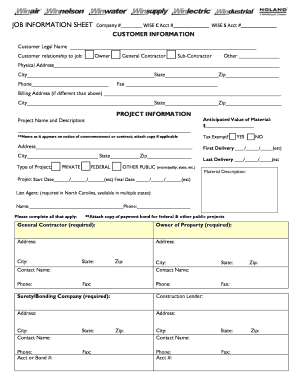

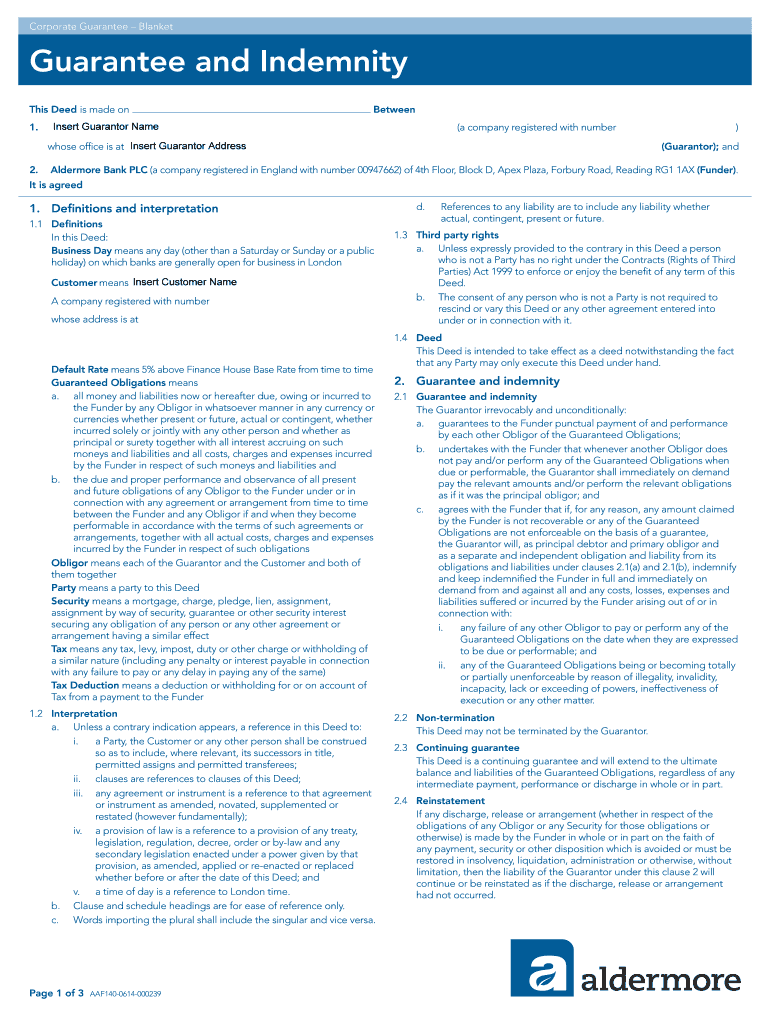

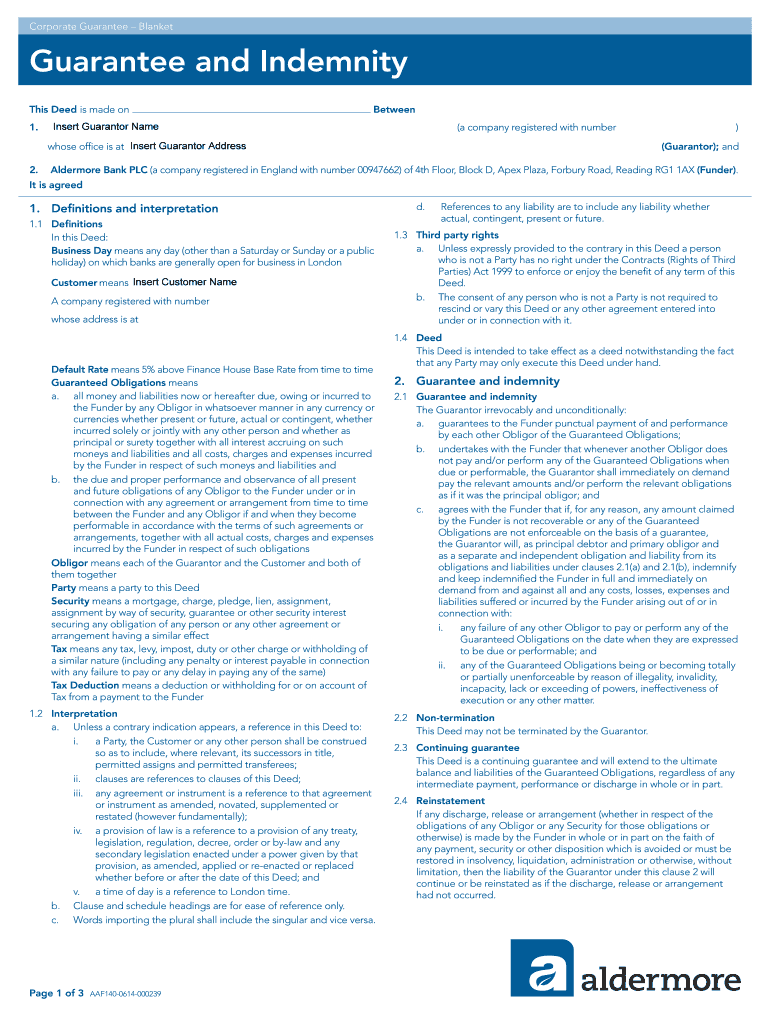

Corporate Guarantee Blanket Guarantee and Indemnity This Deed is made on 1. Between Insert Guarantor Name (a company registered with number whose office is at Insert Guarantor Address) (Guarantor);

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate guarantee - blanket

Edit your corporate guarantee - blanket form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate guarantee - blanket form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate guarantee - blanket online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corporate guarantee - blanket. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate guarantee - blanket

How to Fill Out Corporate Guarantee - Blanket:

01

Gather the necessary information: Before filling out the corporate guarantee - blanket, make sure to gather all the required information. This includes the name of the corporation providing the guarantee, the borrower's information, loan terms, and any other relevant details.

02

Identify the purpose of the guarantee: Determine the specific reason why the corporate guarantee - blanket is being filled out. It could be for a loan, lease agreement, or any other financial transaction where the corporation is guaranteeing payment or performance.

03

Draft the guarantee agreement: Begin by writing a clear and concise introduction stating the purpose of the guarantee and the parties involved. Specify the terms and conditions of the guarantee, such as the amount being guaranteed, the duration, and any limitations or exclusions.

04

Include the corporation's details: Provide the legal name, address, and identification number of the corporation providing the guarantee. It is crucial to ensure accuracy and verify this information.

05

Incorporate the borrower's information: Include the borrower's name, address, and any other relevant details. Note their legal status, whether an individual or an entity, and provide their identification number if applicable.

06

Specify the obligations and responsibilities: Clearly outline the obligations and responsibilities of the corporation providing the guarantee. This may include guaranteeing the full payment of a loan, fulfilling the terms of a lease agreement, or any other agreed-upon commitments.

07

Include any limitations or conditions: If there are any limitations or conditions to the guarantee, such as a cap on liability or specific circumstances under which it becomes void, make sure to clearly state them in the agreement.

08

Outline the consequences of default: State the consequences of default by the borrower and the action that will be taken to remedy the situation. This may include the corporation's responsibility to fulfill the borrower's obligations and any legal remedies available to the lender.

09

Review and sign the document: Once the corporate guarantee - blanket is drafted, review it carefully to ensure accuracy and clarity. Seek legal advice if necessary. Then, both the corporation and the borrower should sign the document to make it legally binding.

Who Needs Corporate Guarantee - Blanket:

01

Companies giving loans: Financial institutions and lenders often require a corporate guarantee - blanket to mitigate the risk of non-payment. They may request such guarantees from corporations before approving loans or lines of credit.

02

Landlords leasing to corporations: Property owners and landlords may request a corporate guarantee - blanket from corporations to ensure rent payments and adherence to lease agreements. This provides landlords with additional security and a guarantee of performance.

03

Suppliers and vendors: Suppliers or vendors working with corporations, especially for larger transactions or ongoing business relationships, may request a corporate guarantee - blanket. This ensures payment for goods or services rendered and reduces the risk of non-payment.

Remember, it is essential to consult legal professionals and tailor the language of the corporate guarantee - blanket to the specific situation and applicable laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is corporate guarantee - blanket?

A corporate guarantee - blanket is a type of guarantee provided by a corporation to secure a loan or other financial obligation.

Who is required to file corporate guarantee - blanket?

Corporations or entities that are seeking to secure a loan or financial obligation may be required to file a corporate guarantee - blanket.

How to fill out corporate guarantee - blanket?

To fill out a corporate guarantee - blanket, the corporation must provide detailed information about the financial obligation being secured and the terms of the guarantee.

What is the purpose of corporate guarantee - blanket?

The purpose of a corporate guarantee - blanket is to provide assurance to the lender that the financial obligation will be met in the event that the corporation is unable to fulfill its obligations.

What information must be reported on corporate guarantee - blanket?

Information required on a corporate guarantee - blanket may include details about the corporation, the financial obligation being secured, and the terms of the guarantee.

How can I edit corporate guarantee - blanket from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your corporate guarantee - blanket into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit corporate guarantee - blanket on an iOS device?

Create, modify, and share corporate guarantee - blanket using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit corporate guarantee - blanket on an Android device?

You can edit, sign, and distribute corporate guarantee - blanket on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your corporate guarantee - blanket online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Guarantee - Blanket is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.