Get the free Companies Form 201 - bApplicationb for REGISTRATION AS AN bb

Show details

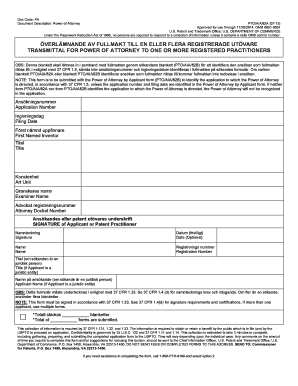

Page 1/3 ASIC registered agent number DAVID ZOHAR for ACTION LIMITED C/ PO Box 3235 256 Adelaide Terrace PERTH state/territory WA postcode 6832 (08) 9225 4815 (08) 9225 6474 lodging party or agent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign companies form 201

Edit your companies form 201 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your companies form 201 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit companies form 201 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit companies form 201. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out companies form 201

How to fill out companies form 201:

01

Start by gathering all the necessary information and documents required to complete form 201. This may include details about the company, such as its name, address, and tax identification number.

02

Begin filling out the form by entering the company's basic information, such as its legal name and registered address. Make sure to provide accurate and up-to-date information.

03

Next, move on to the section that requires you to provide details about the company's shareholders or beneficial owners. Include their names, addresses, and the percentage of ownership they hold in the company.

04

Proceed to fill out the section that pertains to the company's directors or officers. Provide their names, positions, and contact information.

05

If the company has chosen to appoint a representative or agent, provide their details in the relevant section.

06

Fill in the financial information section, which typically includes details about the company's assets, liabilities, income, and expenses. Ensure that all the figures are accurate and supported by relevant documents.

07

Provide any additional information or attachments that may be required according to the instructions provided with the form. This could include supporting documents like financial statements or certificates.

08

Review the completed form thoroughly to ensure all the information provided is accurate and complete. Make any necessary corrections before submitting it.

Who needs companies form 201:

01

Business owners who are required by law to provide detailed information about their company and its ownership structure may need to fill out form 201.

02

Companies that are applying for government contracts or licenses may be required to complete form 201 as part of the application process.

03

Financial institutions or banks may request companies to fill out form 201 when establishing banking relationships or applying for loans.

04

Companies involved in mergers, acquisitions, or corporate restructuring may need to fill out form 201 to provide information about the change in ownership or structure.

05

In some cases, regulatory bodies or government agencies may require companies to submit form 201 as part of their ongoing reporting or compliance obligations.

It is important to note that the requirement of form 201 may vary depending on the jurisdiction and specific regulations applicable to the company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send companies form 201 for eSignature?

When you're ready to share your companies form 201, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my companies form 201 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your companies form 201 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit companies form 201 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign companies form 201 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is companies form 201?

Companies form 201 is a financial disclosure form required by the Securities and Exchange Commission.

Who is required to file companies form 201?

Companies listed on the stock exchange are required to file form 201.

How to fill out companies form 201?

Companies can fill out form 201 online through the SEC's electronic filing system.

What is the purpose of companies form 201?

The purpose of form 201 is to provide investors with important financial information about the company.

What information must be reported on companies form 201?

Companies must report their financial statements, executive compensation, and related party transactions on form 201.

Fill out your companies form 201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Companies Form 201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.