Get the free Private company insurance policy renewal application - XL Group

Show details

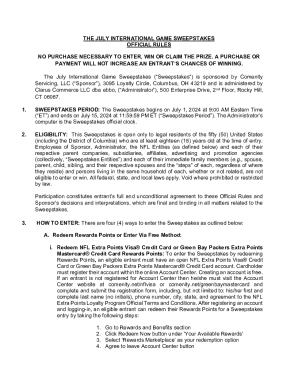

PRIVATE COMPANY INSURANCE POLICY RENEWAL APPLICATION Company Providing Coverage: XL Specialty Insurance Company NOTICE: THE LIABILITY COVERAGE SECTIONS OF THIS POLICY APPLY ONLY TO CLAIMS OR, IF THE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private company insurance policy

Edit your private company insurance policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private company insurance policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private company insurance policy online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit private company insurance policy. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private company insurance policy

How to fill out a private company insurance policy:

01

Gather all necessary information: Before filling out the insurance policy, ensure you have all the required details about your private company. This includes the company's name, address, contact information, business activities, number of employees, and any previous insurance claims or coverage.

02

Determine the coverage you need: Assess your company's specific insurance needs. Consider the type of risks your business may face, such as liability, property damage, or workers' compensation. Consulting with an insurance agent or professional can be helpful in identifying the appropriate coverage for your company.

03

Research insurance providers: Compare different insurance providers that offer private company insurance policies. Look for reputable insurers with experience in providing coverage for businesses in your industry. Take into account factors such as insurance rates, policy features, customer reviews, and the financial stability of the insurance companies.

04

Request quotes: Contact the insurance providers you have shortlisted and request quotes for the coverage you need. Provide them with accurate information to ensure you receive precise quotes tailored to your company's requirements.

05

Review the policy details: Once you have received quotes from insurance providers, carefully review the policy details. Examine the coverage limits, deductibles, exclusions, and any additional benefits or endorsements offered. Pay close attention to the terms and conditions, as well as any obligations or responsibilities required of your company.

06

Consult with legal and financial advisors: Depending on the complexity and size of your company, it may be beneficial to consult with legal and financial advisors before finalizing the insurance policy. They can provide guidance on the terms, conditions, and any potential legal implications that may arise.

07

Complete the application: Fill out the insurance application form accurately and thoroughly. Provide all the necessary information, ensuring there are no omissions or inaccuracies. Be prepared to disclose any previous insurance claims or losses, as this information will likely be requested.

08

Submit the application: Submit the completed insurance application to the insurance provider either electronically or via mail. Ensure that you keep a copy of the application for your records.

Who needs a private company insurance policy:

01

Private companies with physical assets: If your company owns or leases property, such as office space, warehouses, or equipment, having a private company insurance policy can protect you against losses caused by theft, natural disasters, or other unforeseen events.

02

Small to medium-sized businesses: Private companies of all sizes can benefit from insurance coverage. Even small businesses face risks such as liability claims, property damage, or unexpected interruptions to their operations. A private company insurance policy can be tailored to accommodate the specific needs of your business.

03

Companies with employees: If your private company has employees, you may need workers' compensation insurance, which provides coverage for employee injuries and lost wages. Additionally, having general liability insurance can safeguard your company against claims of bodily injury, property damage, or advertising errors.

04

Business owners seeking peace of mind: Insurance policies offer peace of mind and financial protection in the face of unexpected events. By having a private company insurance policy, business owners can focus on running their operations without constantly worrying about potential risks and their financial consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send private company insurance policy to be eSigned by others?

When your private company insurance policy is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute private company insurance policy online?

Completing and signing private company insurance policy online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit private company insurance policy on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit private company insurance policy.

What is private company insurance policy?

Private company insurance policy is a type of insurance coverage that provides protection for businesses from financial losses and liabilities.

Who is required to file private company insurance policy?

Private company owners or managers are required to file private company insurance policy.

How to fill out private company insurance policy?

To fill out private company insurance policy, you need to provide details about your business, assets, and liabilities.

What is the purpose of private company insurance policy?

The purpose of private company insurance policy is to safeguard businesses against potential risks and losses.

What information must be reported on private company insurance policy?

The information that must be reported on private company insurance policy includes business details, coverage limits, and premium amounts.

Fill out your private company insurance policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Company Insurance Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.