Get the free Payment ACH Authorization Agreement - gemc

Show details

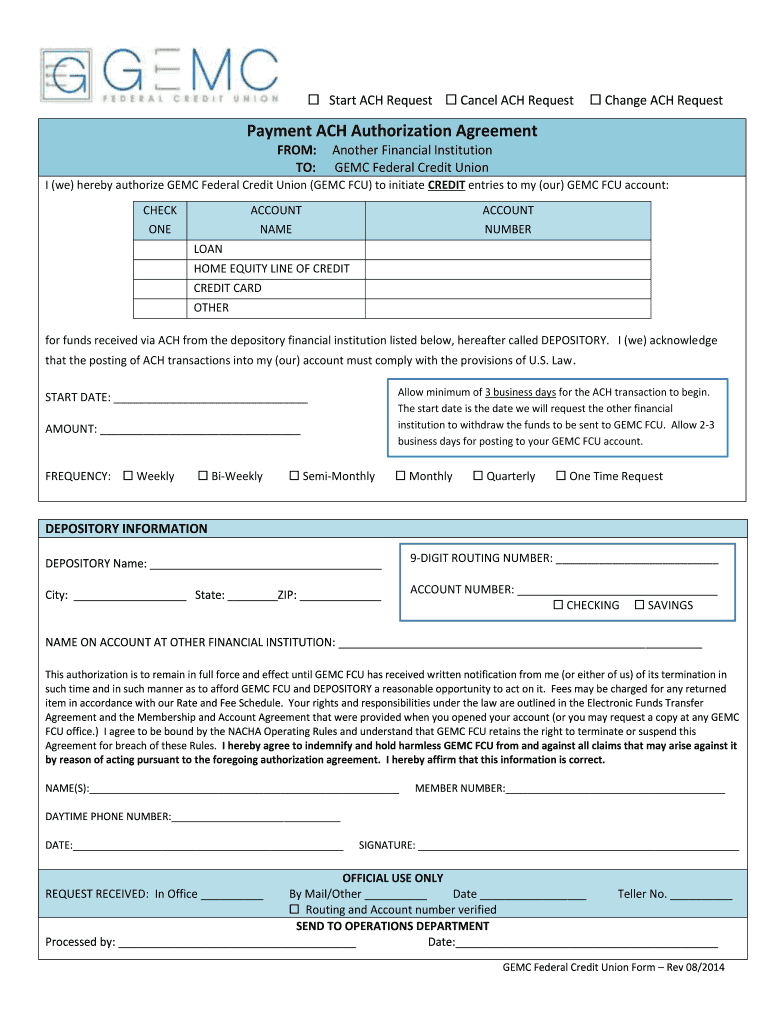

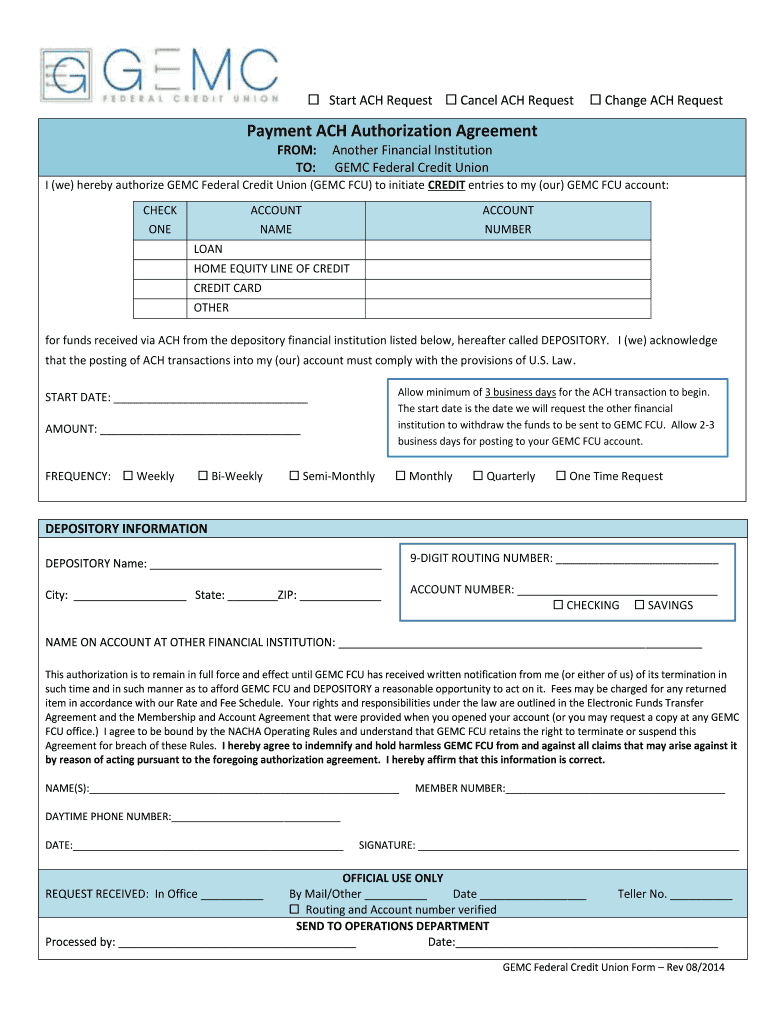

Start ACH Request Cancel ACH Request Change ACH Request Payment ACH Authorization Agreement FROM: TO: Another Financial Institution GEM Federal Credit Union I (we) hereby authorize GEM Federal Credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment ach authorization agreement

Edit your payment ach authorization agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment ach authorization agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment ach authorization agreement online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payment ach authorization agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment ach authorization agreement

How to Fill Out Payment ACH Authorization Agreement:

01

Begin by obtaining the payment ACH authorization agreement form from the appropriate source, whether it is your bank, a financial institution, or an online platform.

02

Carefully read through the entire agreement to understand the terms and conditions, as well as the purpose of the authorization. Pay attention to any specific instructions provided.

03

Fill in your personal information accurately. This typically includes your full name, mailing address, contact information, and any other required identification details.

04

Provide the necessary banking information, such as your bank account number, routing number, and the name of the financial institution. Double-check this information for accuracy to avoid any potential issues.

05

Indicate the type of authorization you are granting by checking the appropriate box. This could include authorizing one-time payments, recurring payments, or a specific duration for the authorization.

06

If there are any fees associated with the agreement, make sure to review and understand them. Some agreements may require you to initial or sign specific sections related to fees.

07

If applicable, provide information regarding any specific limitations or restrictions on the authorization. This could include maximum payment amounts or certain types of transactions that are excluded.

08

Sign and date the agreement at the designated spots. Make sure your signature matches the name provided at the beginning of the form. If necessary, check if a witness or notary is required to validate the agreement.

09

Keep a copy of the completed and signed agreement for your records. It's always a good idea to have a copy as proof of your authorization.

Who Needs Payment ACH Authorization Agreement?

01

Individuals who wish to make electronic payments or have funds electronically withdrawn from their bank accounts may require a payment ACH authorization agreement. This could include individuals paying bills or making recurring payments to service providers such as utility companies, lenders, or subscription services.

02

Businesses that want to accept electronic payments from their customers or clients may also need a payment ACH authorization agreement in order to process these transactions. This allows businesses to streamline their payment processes and offer more convenient payment options to their customers.

03

Non-profit organizations or charitable institutions may require a payment ACH authorization agreement to facilitate recurring donations or contributions from their supporters. This ensures a reliable and efficient means of receiving funds regularly.

In summary, filling out a payment ACH authorization agreement involves accurately providing personal and banking information, understanding and agreeing to the terms and conditions, and signing the agreement as required. This allows individuals, businesses, and non-profit organizations to facilitate electronic payments or withdrawals in a secure and convenient manner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payment ach authorization agreement?

The payment ach authorization agreement is a legally binding document that authorizes a third party to initiate automated clearing house (ACH) payments from a payer's bank account.

Who is required to file payment ach authorization agreement?

Both the payer and the payee are required to file a payment ach authorization agreement in order to authorize ACH payments.

How to fill out payment ach authorization agreement?

To fill out a payment ach authorization agreement, both parties need to provide their contact information, bank account details, and sign the agreement to authorize ACH payments.

What is the purpose of payment ach authorization agreement?

The purpose of a payment ach authorization agreement is to establish the terms and conditions for initiating ACH payments between a payer and a payee.

What information must be reported on payment ach authorization agreement?

The payment ach authorization agreement must include the names and contact information of both parties, bank account details, authorization for ACH payments, and any terms and conditions agreed upon.

How can I edit payment ach authorization agreement from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like payment ach authorization agreement, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in payment ach authorization agreement?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your payment ach authorization agreement to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit payment ach authorization agreement on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share payment ach authorization agreement on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your payment ach authorization agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Ach Authorization Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.