Get the free FNMA Mortgage - Title Partners of Florida

Show details

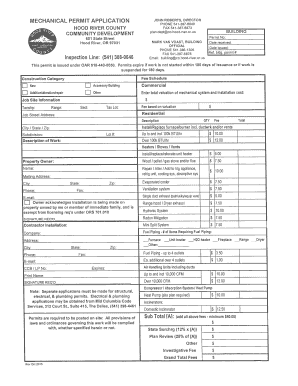

After Recording Return To: Space Above This Line for Recording Data MORTGAGE DEFINITIONS Words used in multiple sections of this document are defined below and other words are defined in Sections

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fnma mortgage - title

Edit your fnma mortgage - title form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fnma mortgage - title form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fnma mortgage - title online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fnma mortgage - title. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fnma mortgage - title

How to Fill Out FNMA Mortgage - Title:

01

Obtain the necessary documents: Gather all the required paperwork, including the FNMA mortgage application form, proof of income, employment history, credit history, and any additional documents requested by the lender or FNMA.

02

Complete the FNMA mortgage application form: Fill in all the required fields accurately and provide all the necessary information. Make sure to double-check everything before submitting the application.

03

Provide proof of income: Include documents such as pay stubs, W-2 forms, or tax returns that demonstrate your income and ability to repay the mortgage.

04

Submit employment history: Present a comprehensive record of your employment to showcase your stability and financial standing. Provide details such as job titles, company names, dates of employment, and salary information.

05

Verify your credit history: Obtain a copy of your credit report and review it for accuracy. If there are any discrepancies, contact the credit bureau to rectify them. Improve your credit score by paying bills on time and reducing outstanding debt.

06

Include additional documents: Depending on the lender or FNMA guidelines, you may need to provide additional documents like bank statements, asset statements, or proof of down payment funds.

Who needs FNMA Mortgage - Title?

01

Homebuyers: Individuals or families interested in purchasing a home can benefit from an FNMA mortgage. FNMA provides affordable mortgage options and promotes homeownership.

02

Lenders: Financial institutions, such as banks and credit unions, partner with FNMA to offer mortgages to borrowers. FNMA guidelines and programs help lenders manage risk and provide competitive loan options.

03

Real estate professionals: Real estate agents, brokers, and other industry professionals work with clients who may require an FNMA mortgage to purchase a property. Understanding the FNMA mortgage process helps them assist clients effectively.

04

Investors: FNMA mortgage-backed securities are attractive to investors seeking stable income with low risk. These securities are backed by a large pool of mortgages that comply with FNMA guidelines.

05

Policy makers and regulators: FNMA, as a government-sponsored enterprise, plays a crucial role in the U.S. housing market. Policy makers and regulators monitor FNMA's activities to ensure its role in providing affordable mortgage options aligns with broader housing goals.

Note: It is essential to consult with a mortgage professional for specific instructions and guidance tailored to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fnma mortgage - title?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the fnma mortgage - title in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete fnma mortgage - title online?

pdfFiller makes it easy to finish and sign fnma mortgage - title online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my fnma mortgage - title in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your fnma mortgage - title and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is fnma mortgage - title?

FNMA Mortgage - Title refers to the title insurance required for loans that are being purchased or guaranteed by the Federal National Mortgage Association (FNMA).

Who is required to file fnma mortgage - title?

Lenders and borrowers are typically required to file FNMA Mortgage - Title. The lender may require the borrower to obtain title insurance to protect their interests in the property.

How to fill out fnma mortgage - title?

To fill out FNMA Mortgage - Title, you will need to work with a title insurance company to provide a title commitment and policy information. This process involves researching the property's title history and ensuring there are no existing liens or claims against the property.

What is the purpose of fnma mortgage - title?

The purpose of FNMA Mortgage - Title is to protect both the lender and the borrower from any potential issues or disputes related to the property's title. It ensures that the property has a clear title, free from any defects.

What information must be reported on fnma mortgage - title?

The information reported on FNMA Mortgage - Title typically includes details about the property's title history, any easements or restrictions, and the title insurance policy details.

Fill out your fnma mortgage - title online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fnma Mortgage - Title is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.