Get the free Lexington insurance company - Risk Alternatives amp Management

Show details

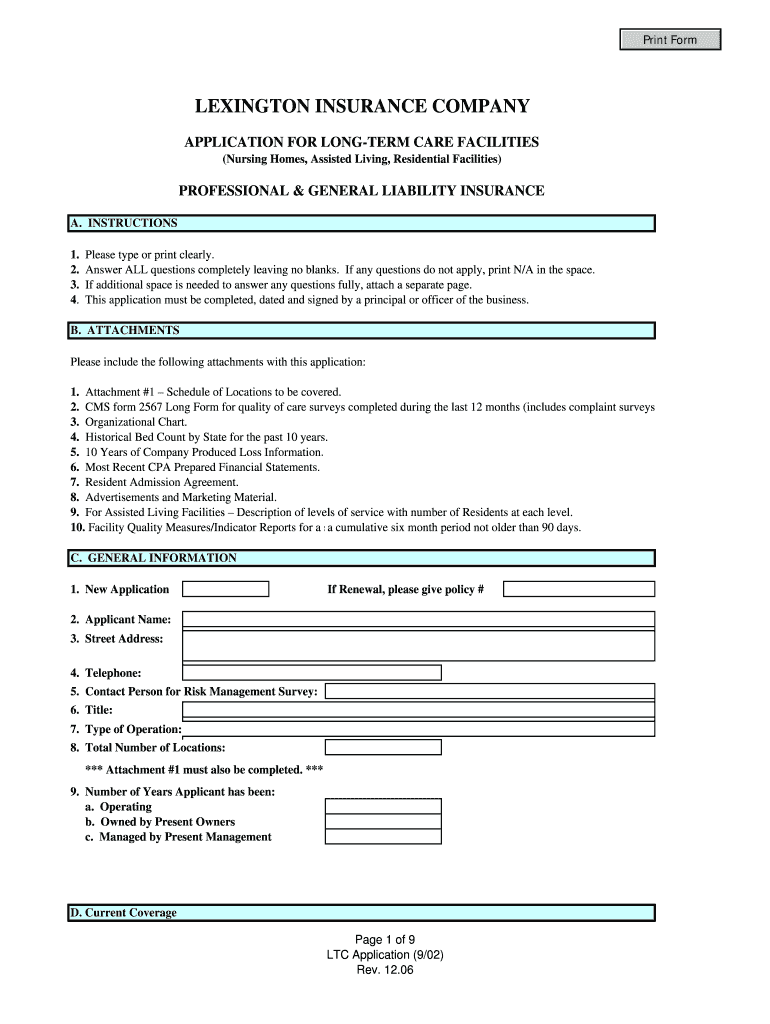

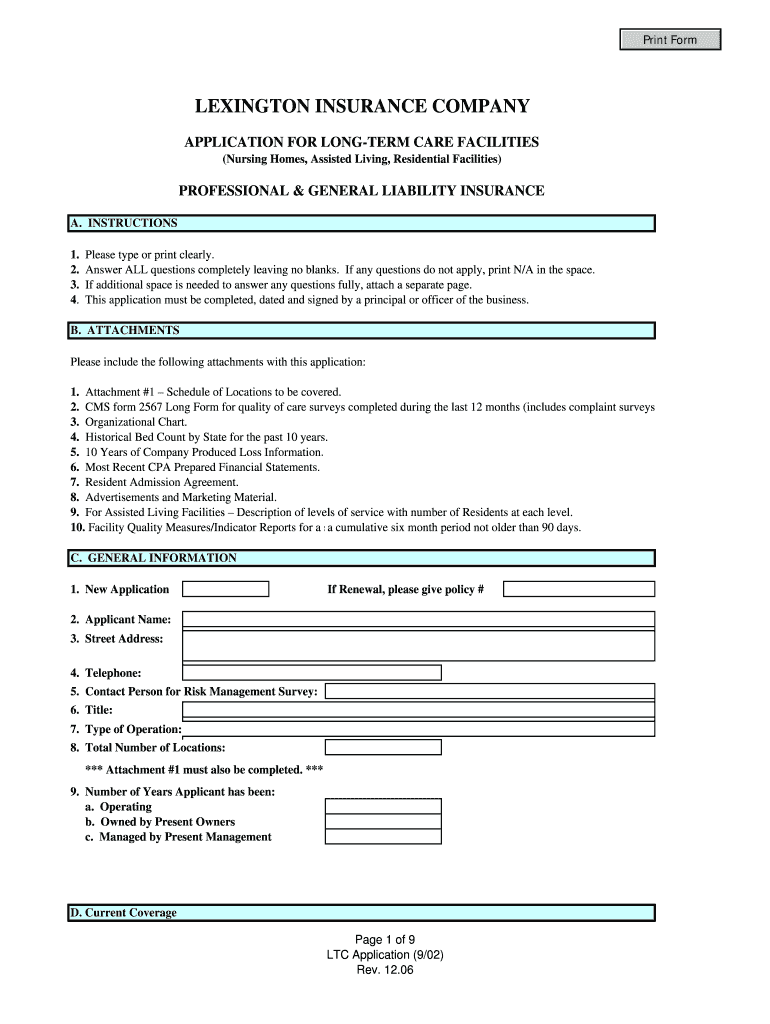

Print Form LEXINGTON INSURANCE COMPANY APPLICATION FOR LONGER CARE FACILITIES (Nursing Homes, Assisted Living, Residential Facilities) PROFESSIONAL & GENERAL LIABILITY INSURANCE A. INSTRUCTIONS 1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lexington insurance company

Edit your lexington insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lexington insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lexington insurance company online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lexington insurance company. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lexington insurance company

How to fill out Lexington Insurance Company:

01

Start by gathering all necessary information and documents. This may include personal identification, insurance policy details, and any relevant proof of claims or incidents.

02

Visit the official website of Lexington Insurance Company or contact their customer service for assistance in filling out the required forms. They will provide guidance on which forms are needed for your specific situation.

03

Carefully review the instructions provided with the forms to understand the required information and any supporting documents.

04

Fill out the forms accurately and completely. Double-check all information before submitting to avoid any errors or delays in processing.

05

If you have any questions or uncertainties, don't hesitate to reach out to Lexington Insurance Company for clarification. They have dedicated representatives who can assist you with any concerns you may have.

06

Once you have completed filling out the forms, make copies of all documents for your records.

07

Submit the filled-out forms and any necessary supporting documentation to Lexington Insurance Company as per their instructions. This could be through mailing, fax, or online submission, depending on their preferred method.

08

Keep track of your submission by maintaining a record of the date sent and any tracking numbers or confirmation email received.

09

Follow up with Lexington Insurance Company after submitting the forms to ensure they have received your documents and to inquire about any further steps or information required.

10

Continuously monitor any updates or communication from Lexington Insurance Company regarding your claim or policy status.

Who needs Lexington Insurance Company:

01

Businesses: Lexington Insurance Company primarily caters to the needs of businesses across various industries, providing them with specialized insurance solutions. This could include both small and large businesses seeking coverage for property damage, liability, professional services, and more.

02

Professionals: Individuals who provide professional services, such as lawyers, accountants, architects, and consultants, often require insurance coverage to protect against claims or lawsuits arising from their professional advice or services.

03

Organizations in high-risk industries: Companies operating in industries that are prone to higher risks, such as construction, manufacturing, healthcare, or technology, may turn to Lexington Insurance Company for specific coverage tailored to their industry's unique needs.

04

Individuals with unique insurance requirements: Lexington Insurance Company also offers personal insurance products such as high-value homeowners, earthquake, and excess liability insurance for individuals with specialized or high-risk needs.

05

Wholesalers and retailers: Businesses involved in wholesale or retail operations may require insurance coverage for their inventory, liability protection, and other specific risks associated with their industry.

Remember, it is always recommended to consult with an insurance professional or Lexington Insurance Company directly to determine the specific insurance coverage needed for your individual or business requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lexington insurance company?

Lexington Insurance Company is a professional risk management firm that offers insurance coverage for various industries and businesses.

Who is required to file lexington insurance company?

Any company or individual seeking insurance coverage for their business or personal assets may be required to file with Lexington Insurance Company.

How to fill out lexington insurance company?

To fill out forms for Lexington Insurance Company, individuals can visit their website or contact their customer service for assistance.

What is the purpose of lexington insurance company?

The purpose of Lexington Insurance Company is to provide comprehensive insurance coverage for businesses and individuals to protect against unforeseen risks.

What information must be reported on lexington insurance company?

Applicants may need to report details about their business operations, assets, liabilities, and other relevant information to apply for insurance coverage with Lexington Insurance Company.

Can I create an electronic signature for signing my lexington insurance company in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your lexington insurance company and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit lexington insurance company on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign lexington insurance company right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit lexington insurance company on an Android device?

With the pdfFiller Android app, you can edit, sign, and share lexington insurance company on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your lexington insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lexington Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.