Get the free Insurer Payment Denials Survey

Show details

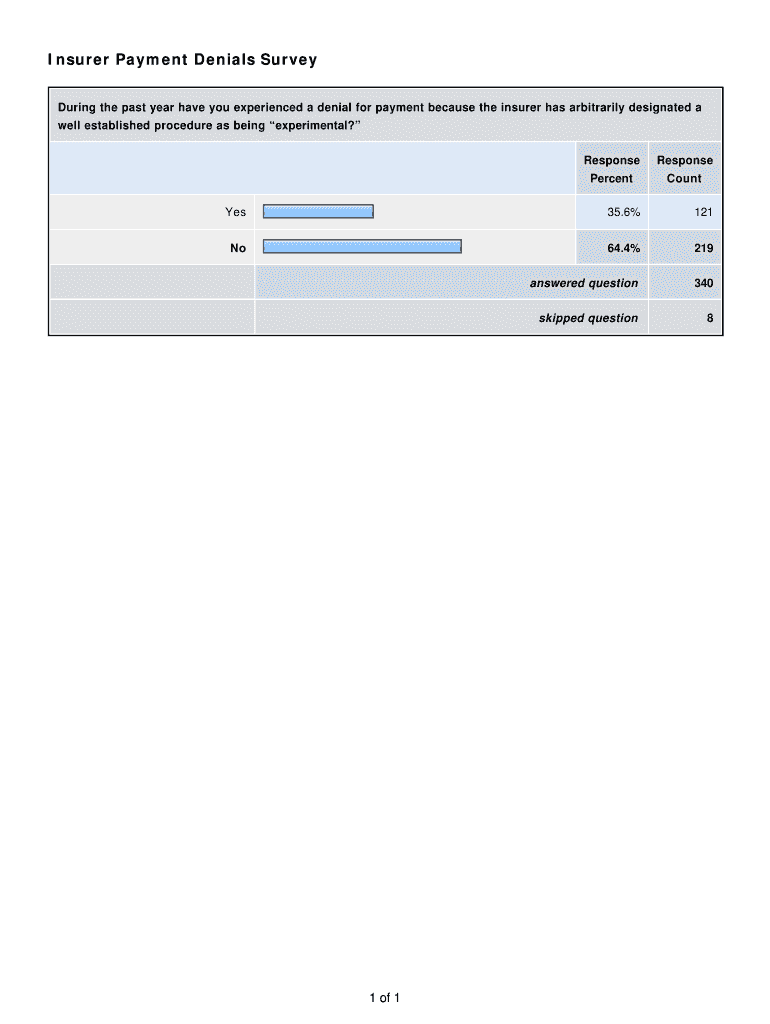

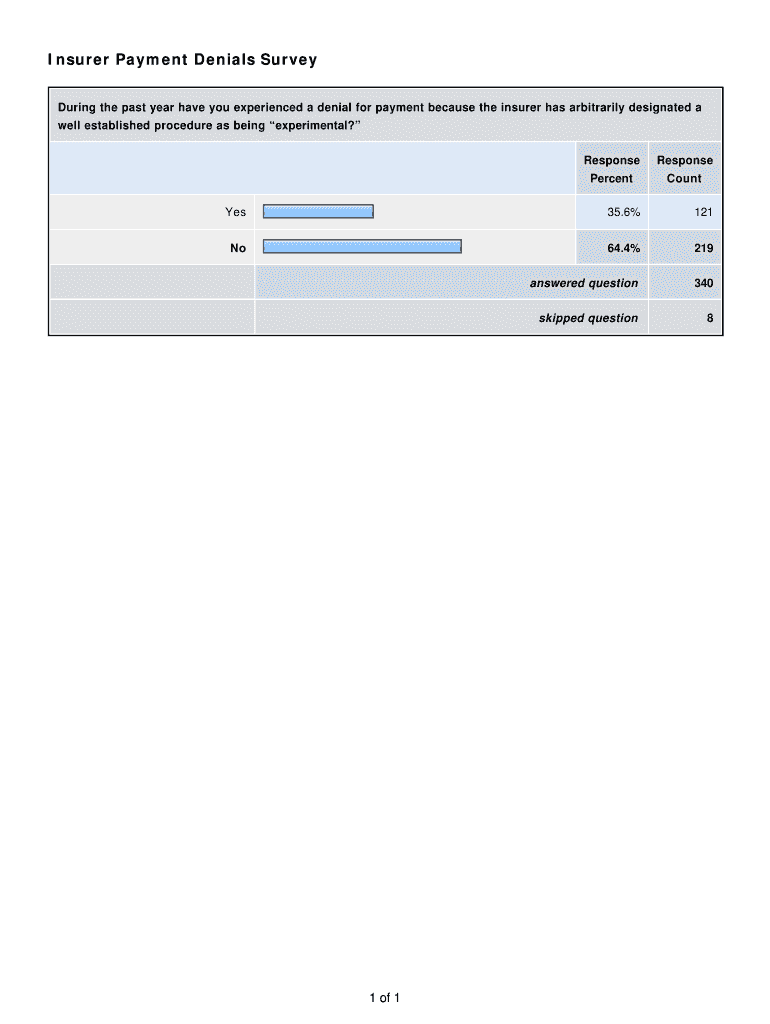

This survey collects data regarding experiences with insurer payment denials, including the frequency of denials, CPT codes involved, insurers responsible for the denials, and appeals processes used

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurer payment denials survey

Edit your insurer payment denials survey form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurer payment denials survey form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurer payment denials survey online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurer payment denials survey. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurer payment denials survey

How to fill out Insurer Payment Denials Survey

01

Step 1: Gather all relevant Policyholder information including name, policy number, and contact details.

02

Step 2: Collect documentation related to the claim being denied, including denial letters and any associated correspondence.

03

Step 3: Review the denial reasons provided by the insurer for clarity and accuracy.

04

Step 4: Complete the survey form, ensuring that each question is answered fully and accurately.

05

Step 5: Provide detailed explanations for each case of payment denial, referencing policy terms and conditions if necessary.

06

Step 6: Include any additional supporting documentation that may bolster your case.

07

Step 7: Submit the completed survey form via the designated platform or email address.

Who needs Insurer Payment Denials Survey?

01

Policyholders who have experienced payment denials from their insurance providers.

02

Insurance agents or brokers seeking to understand and address the trends in insurer payment denials.

03

Regulatory bodies monitoring insurer practices and consumer protection issues.

04

Research organizations studying the impact of insurer payment practices on consumers.

Fill

form

: Try Risk Free

People Also Ask about

How do you respond to an insurance denial?

If an insurance company denies a request or claim for medical treatment, insureds have the right to appeal to the company and also to then ask the Department of Insurance to review the denial. These actions often succeed in obtaining needed medical treatment, so a denial by an insurer is not the final word.

What happens if insurance company can't pay?

Prepare for Litigation. If other avenues don't lead to a satisfactory resolution, your lawyer may recommend filing a lawsuit against the insurance company. Litigation can be a longer process, but it might be necessary to receive fair compensation for your damages.

What to do if insurance doesn't want to pay?

You can file a complaint with your state's Insurance Commissioner, or consult with an attorney to see if you are or the insurance is in the right.

When insurance companies refuse to pay?

Keep in mind the appeal process can be time-consuming, so working with an attorney can be most efficient. Even if your appeal is denied, you and your attorney can contact a state regulator or your state ombudsman to resolve the conflict. You can also file a complaint against your insurer.

What is the most common source of insurance denials?

The claim has missing or incorrect information. Whether by accident or intentionally, medical billing and coding errors are common reasons that claims are rejected or denied. Information may be incorrect, incomplete or missing. You will need to check your billing statement and EOB very carefully.

What is the 80% rule in insurance?

The 80% rule dictates that homeowners must have replacement cost coverage worth at least 80% of their home's total replacement cost to receive full coverage from their insurance company.

What percentage of insurance appeals are successful?

In the medical industry, over 50% of appeals for coverage or reimbursement denials have a positive outcome. For homeowners, it may take litigation to achieve a fair settlement.

What is it called when an insurance company refuses to pay?

Insurance bad faith is when an insurance company refuses to pay a claim without good reason or doesn't investigate the claim in a reasonable amount of time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Insurer Payment Denials Survey?

The Insurer Payment Denials Survey is a tool used to collect data regarding instances where insurance claims have been denied by insurers, analyzing the reasons and trends behind these denials.

Who is required to file Insurer Payment Denials Survey?

Entities such as healthcare providers, professionals, and facilities that submit claims to insurance companies are typically required to file the Insurer Payment Denials Survey.

How to fill out Insurer Payment Denials Survey?

To fill out the Insurer Payment Denials Survey, organizations need to gather data on claim denials, specify the reasons for each denial, and submit the information through the designated reporting platform or form provided by the regulatory body.

What is the purpose of Insurer Payment Denials Survey?

The purpose of the Insurer Payment Denials Survey is to identify patterns of claim denial, improve the claims process, and enable policymakers to address issues related to insurance reimbursement practices.

What information must be reported on Insurer Payment Denials Survey?

Information that must be reported on the Insurer Payment Denials Survey includes the number of denied claims, the reasons for denials, the types of services rendered, and details about the insurance providers involved.

Fill out your insurer payment denials survey online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurer Payment Denials Survey is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.